EUR/USD

The EUR/USD pair initially rallied during the day on Thursday, but turned back around to form a massive shooting star. This was in reaction to dovish statement coming out of the European Central Bank, and as a result it appears that the market will continue to show quite a bit of volatility, and as a result the 1.1250 level below will be tested in my opinion. I think that area could hold as support though, but essentially we will simply bang around in this general vicinity. I don’t really have too much in the way of interest when it comes to trading this market, it seems to be simply rudderless at this point.

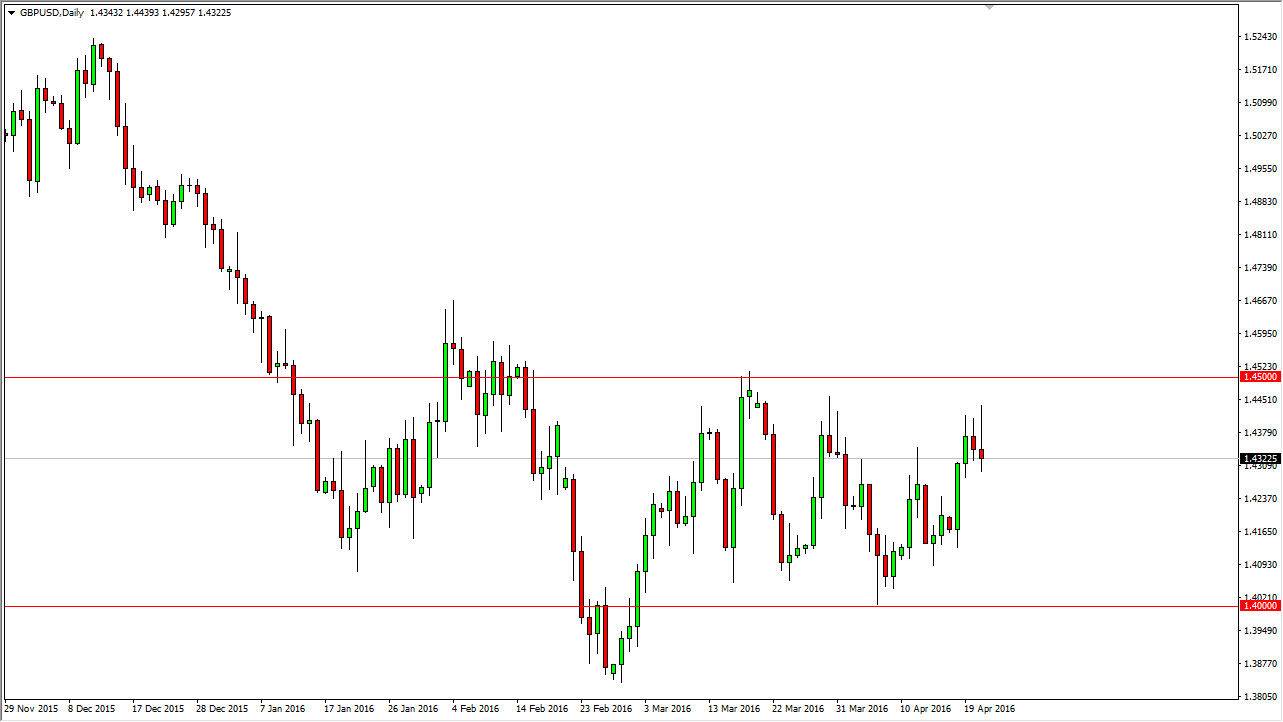

GBP/USD

The GBP/USD pair initially tried to rally during the course of the day, but turned right back around to form a shooting star on the Thursday trading session. With this, it looks as if we are going to drop from here, and if we break down below the bottom of the shooting star, I would be more than willing to start selling. I believe that this market will probably try to find the 1.41 level at that point in time as it is the beginning of serious support when it comes to the longer-term consolidation area. The market seems to be bouncing around between the 1.40 and the 1.45 levels, so I think that this pullback is to be expected.

Keep in mind that both central banks of course are in focus, and they both look very soft at this point in time. The Federal Reserve is more than likely not going to raise rates as rapid as we once thought, and of course the British are in a unique situation as they are going to vote in June as to whether or not they want to remain in the European Union, and that tends to be very negative for the British pound until we get some clarity.