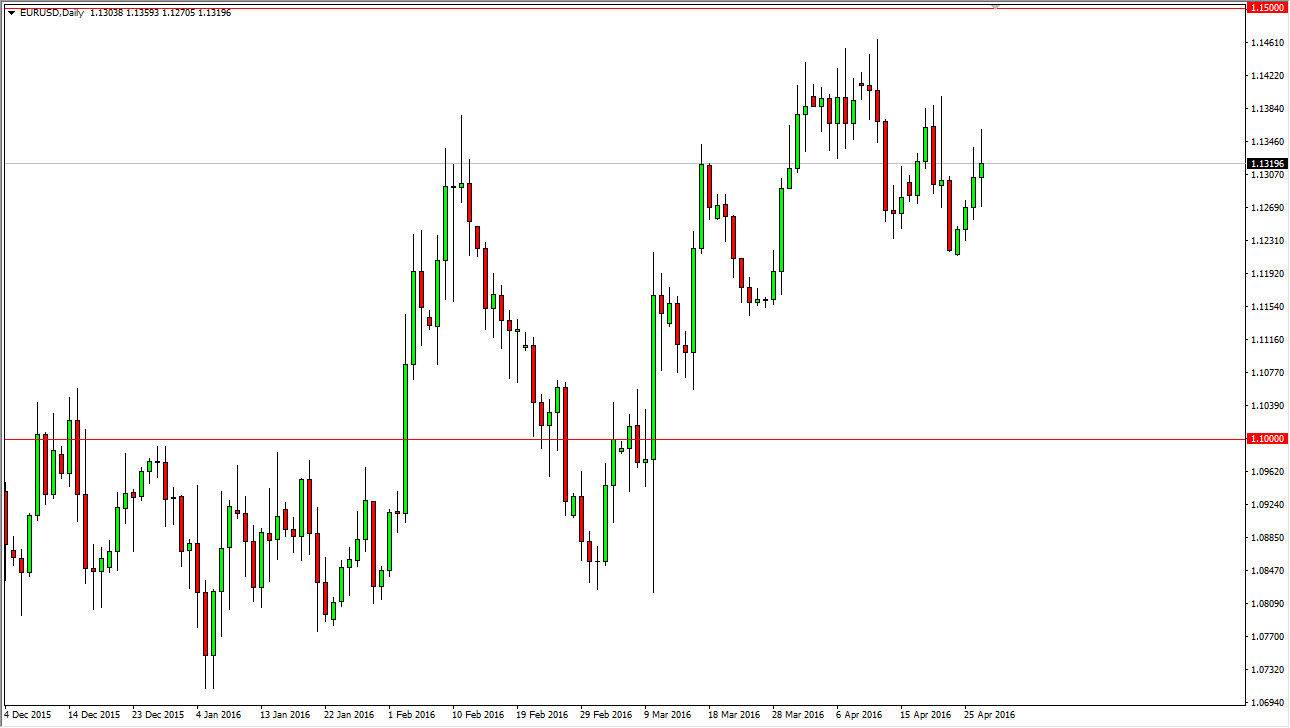

EUR/USD

The EUR/USD pair had a very volatile day during the session on Wednesday, as the FOMC Statement following the interest-rate decision of course caused quite a bit of volatility in the markets overall. Ultimately, as the daily candle shaped up, it suggested a continuation of the bullish pressure that we have seen in this market. However, I don’t necessarily think that this is going to be an easy market to trade for any real length of time, and currently I feel that short-term pullbacks offer short-term buying opportunities that you can take advantage of. I recognize that we are still stuck between 1.12 and the 1.14 level above.

GBP/USD

The GBP/USD pair initially fell during the day on Wednesday, but found enough support at the 1.45 level to turn things around and form a bit of a hammer like candle. That of course is a very bullish sign and as a result I feel that the market will probably continue to go higher. I think there’s also quite a bit of support all the way down to the 1.44 level and as a result I believe that the buyers are going to return and continue to push this market higher. I recognize that there is a significant amount of resistance just above, but quite frankly we should continue to see the upward pressure take over and eventually send this market to the 1.50 handle above.

It’s not until we break down below the 1.44 level that I would even remotely consider selling this market, as it has been very bullish of the last couple of weeks. I think that concerns of the Federal Reserve stepping away from interest-rate hikes could potentially push this market higher, just as the mere suggestion of the United Kingdom possibly leaving the European Union could push this market lower.