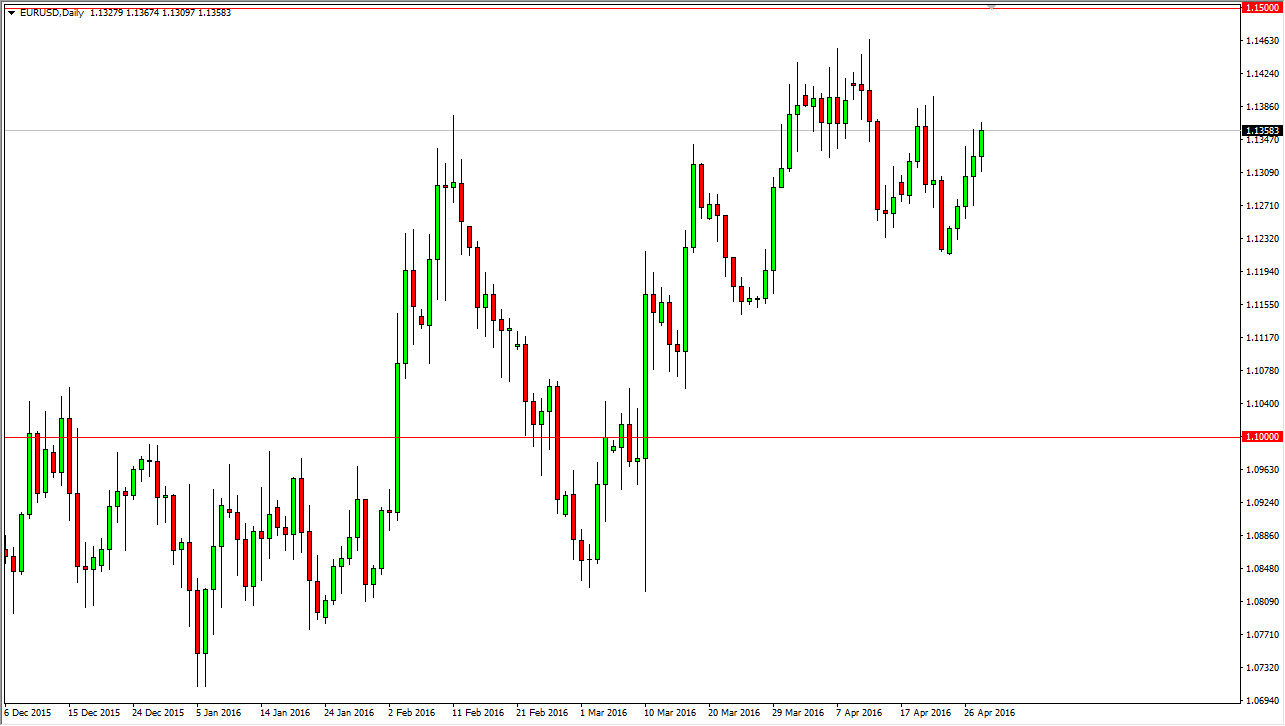

EUR/USD

The EUR/USD pair initially fell during the day on Thursday but turned back around to form a bullish candle, and that being the case the market looks as if it is going to try to grind towards the 1.14 level above. There is a significant amount of resistance from there to the 1.15 handle, and as a result it is going to be very bumpy on the way up. I believe that pullbacks will represent value though, and that traders will continue to reenter the market again and again as it looks as if the Federal Reserve is likely to increase interest rates a lot less aggressively than previously thought. On top of that, there are several things moving around the world that continue to add quite a bit of volatility. At this point, I believe that we will more than likely she buyers return.

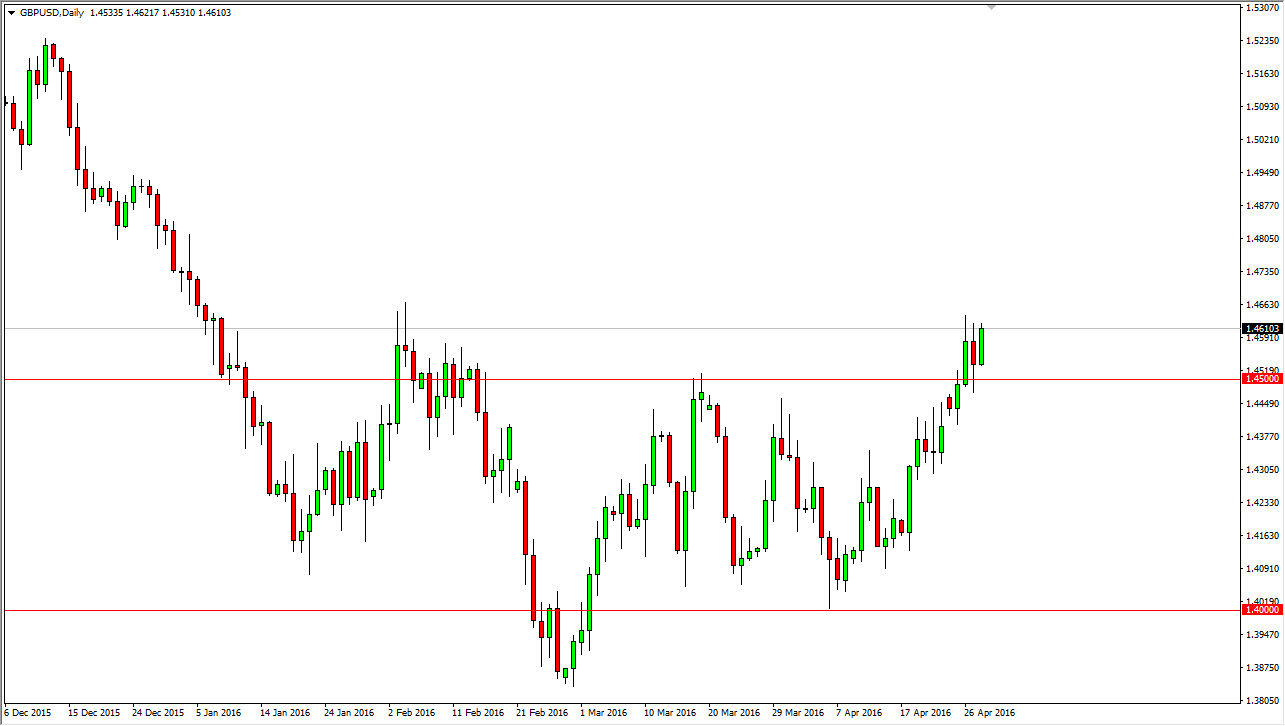

GBP/USD

The GBP/USD pair rose during the course of the session on Thursday, as the 1.45 level continues offer support. This is a market that looks as if it’s ready to continue going higher, and a break above the 1.46 level should be the gateway to higher pricing. At that point in time, I would anticipate that the British pound should go to the 1.50 level eventually. I think that there will be a lot of volatility though, so it is going to be difficult to hang onto the trade for the longer term. With this being the case, I believe that short-term traders will return again and again as this market shows quite a bit of upward momentum.

There is so much in the way of noise that we should continue to see choppiness, but ultimately we should continue to see buyers win out over the longer term. With this, I look at this as a positive market that will eventually show more clearly of the buyers taking over.