The EUR/GBP pair has been on an absolute tear to the upside recently, and I think that’s part of what’s going to work against this pair during the month of April. It’s not that I don’t think we can continue higher, but I recognize that we are most certainly overextended by just about any metric that you measure it by.

Keep in mind that this pair tends to grind more than move in an impulsive manner. The fact that we have picked up over 500 pips in just a couple of months is a bit surprising, especially considering that it is a countertrend move. However, as many of you will be aware there are a lot of different things pushing the pair at the moment.

Brexit

One of the things that the market will be focusing on is whether or not the United Kingdom is ready to leave the European Union. That has driven this pair quite a bit higher recently, but quite frankly it is probably overreacting as usual. Even if the British do leave the European Union, the British pound holds quite a bit of value in the banking sector, and still will continue to be one of the premier currencies in the world. With that, it’s difficult to imagine that it will suddenly lose massive amounts of value. In fact, even if the British do choose to leave, quite often the sellers will get out of the market after that announcement. Remember, markets are trying to anticipate what happens.

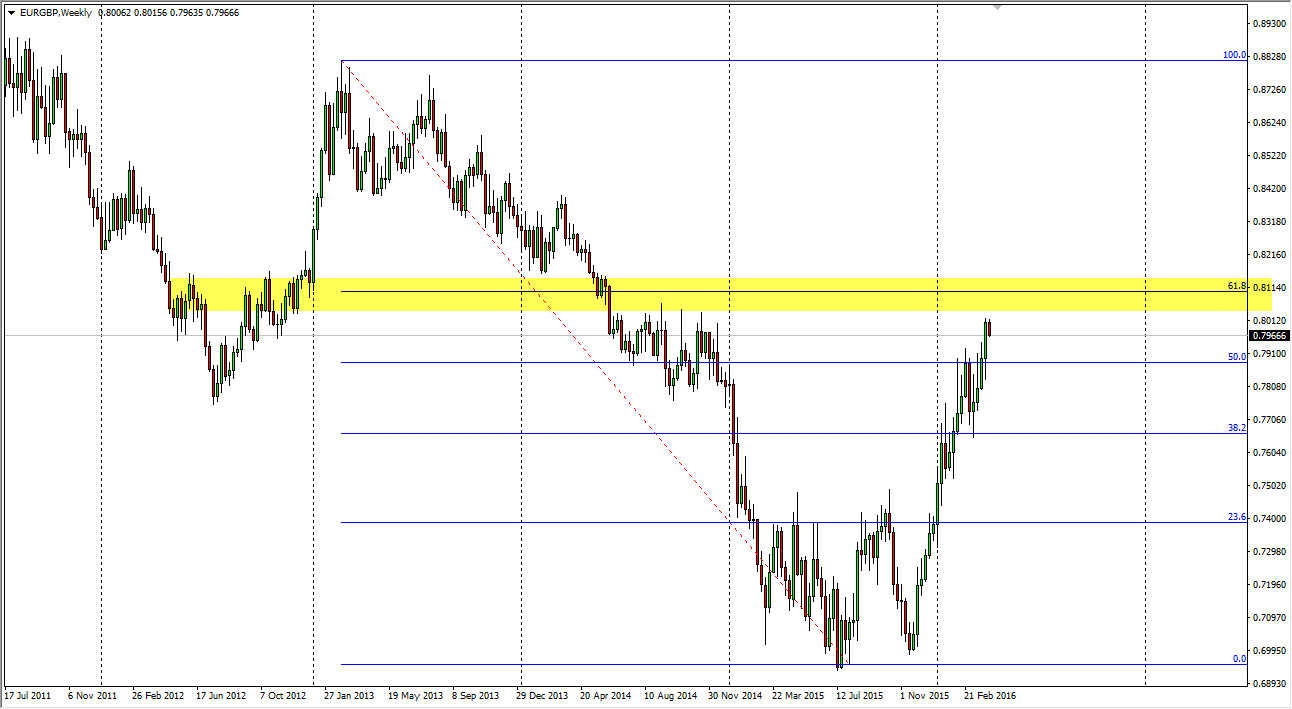

On the other hand, there is the possibility that they stay and that most certainly would make this a market that is massively overvalued suddenly. That doesn’t happen until June, so at this point in time I think it’s a fair assessment to suggest that perhaps a pullback is due. On the chart, you can see I have a yellow box at the 61.8% Fibonacci retracement level just above, which also looks quite a bit like resistance to me as well. It is because of this area I think we need to fall in order to try to find buyers.