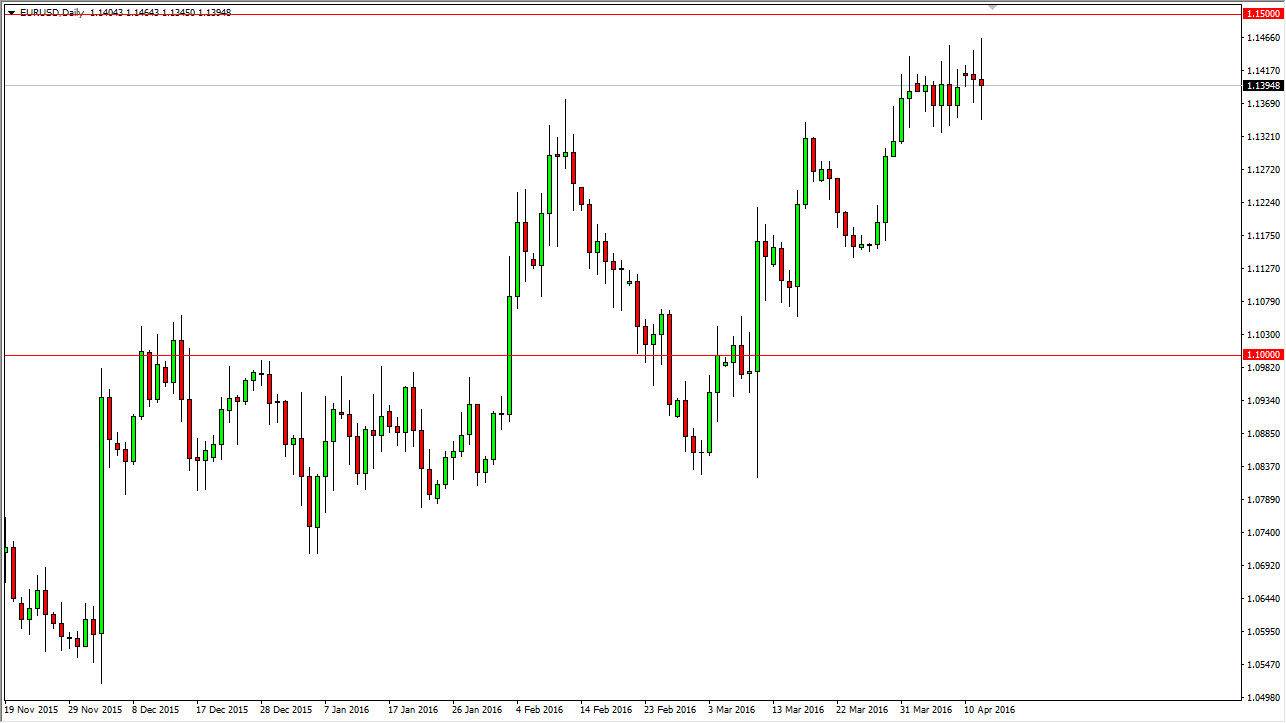

EUR/USD

The EUR/USD pair went back and forth during the course of the session on Tuesday, as we continue to see quite a bit of volatility. With this being the case, the market continues to be very difficult to be involved in, and I believe that the 1.14 level continues offer a significant amount of resistance, and I believe that the resistance should reach towards the 1.15 level. Ultimately, this market breaking above that level would be a significant breakout for the longer term, and with that the market should then become more or less a “buy-and-hold” type of situation.

At this point, if we pullback in this market I feel that it will only be thought of as value when it comes to the Euro, especially considering that the Federal Reserve looks quite a bit more dovish than it once did. With this, the US dollar is probably overpriced when it comes in relation to the Euro. I believe that we are simply trying to build up enough momentum to break out to the upside.

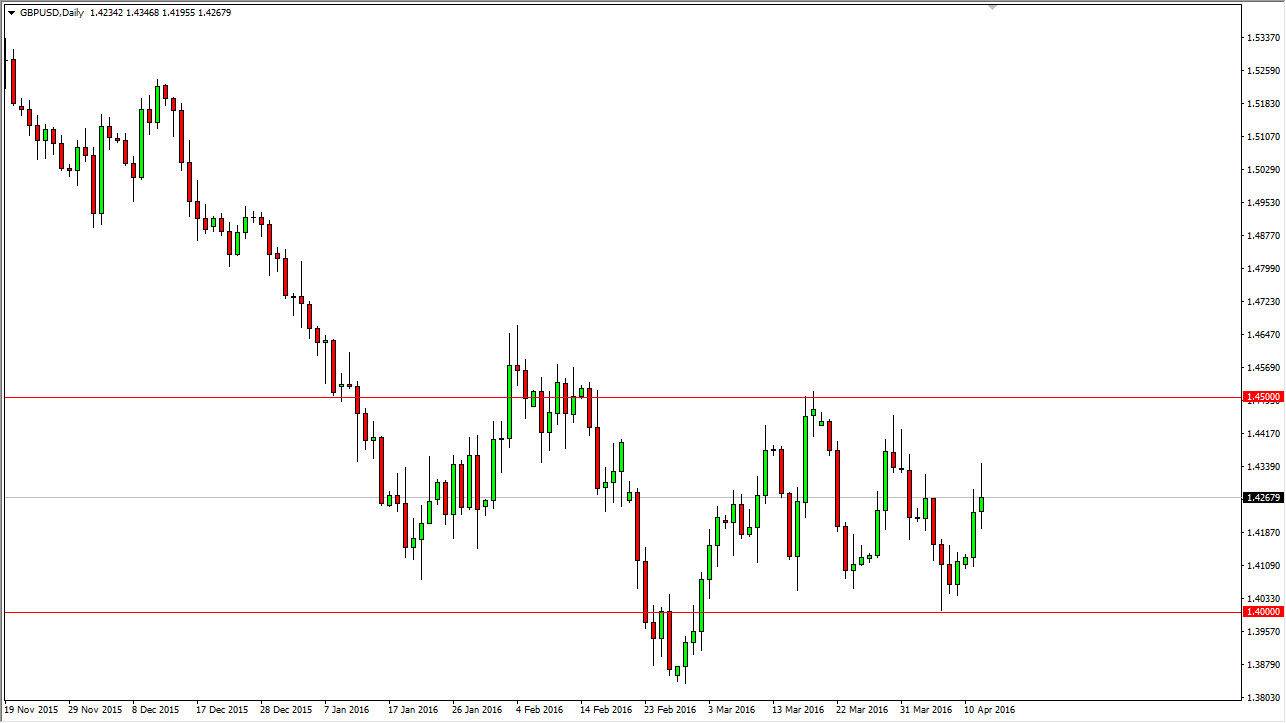

GBP/USD

The GBP/USD pair initially rallied during the course of the day on Tuesday, but found enough resistance near the 1.4350 level to turn things back around and form a shooting star. The shooting star of course is a negative sign, and as a result it’s very likely that the sellers are about to return. When you look at this chart, you can see that we are starting to make “lower high”, which of course suggests that the selling pressure is increasing. With that being said, I believe that it’s only a matter time before breaking down below the bottom of the candle should send more sellers into this market as we reach towards the 1.40 level.

If we broke above the top of the shooting star, I think that there is a significant amount of resistance of the 1.45 handle, and with that being the case, I feel that the market should find more than enough selling pressure in that area to keep this market from breaking a longer-term. Ultimately, I feel that there is a lot of volatility in this market due to the fact that the 2 central banks are both looking rather dovish.