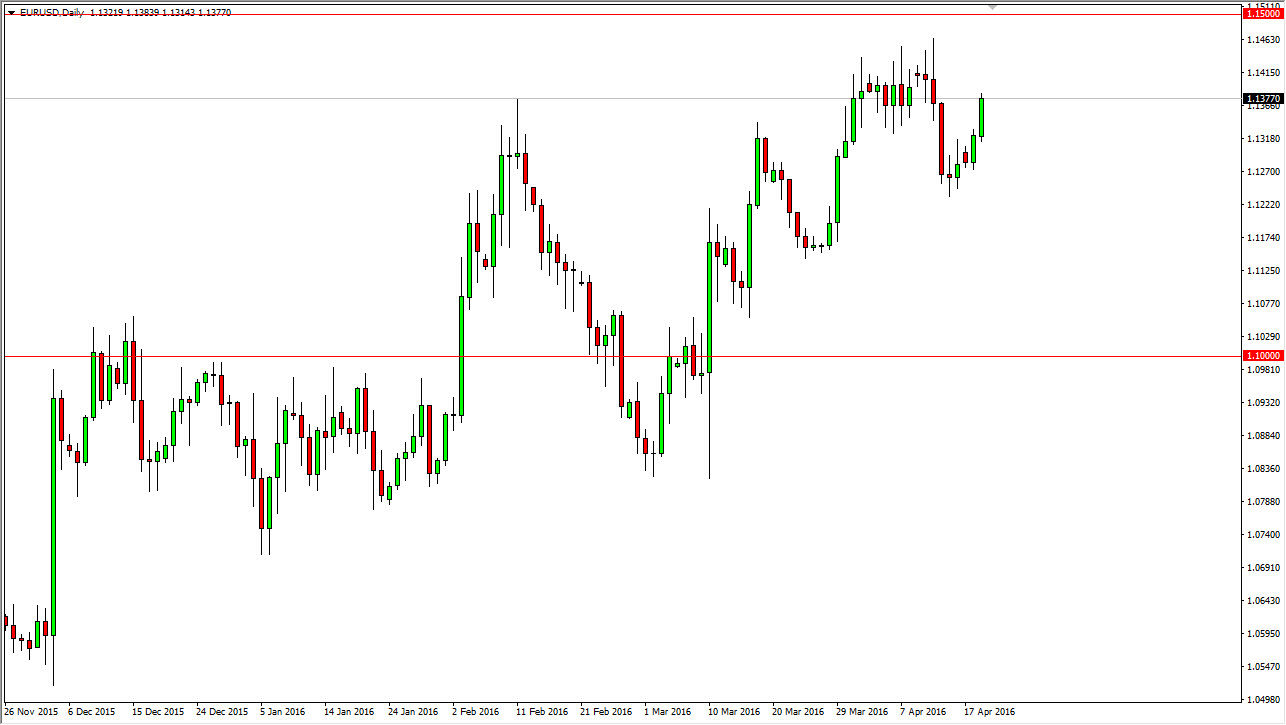

EUR/USD

The EUR/USD pair rose significantly during the course of the day on Tuesday, testing the 1.14 region. This is an area where we had been consolidating around recently, and as a result it is attractive to the marketplace, and should continue to be so. However, it’s probably only a matter of time before we break above there and reach towards the 1.15 level, which has been my target for some time. The recent pullback has been significant, but not enough to change the trend, or change my mind over the longer term. I believe that pullbacks still represent value, and will be continuing reasons to go long as the trend is most certainly favoring the upside. If we can break above the 1.15 level, this should send the market much higher. I have no interest in shorting.

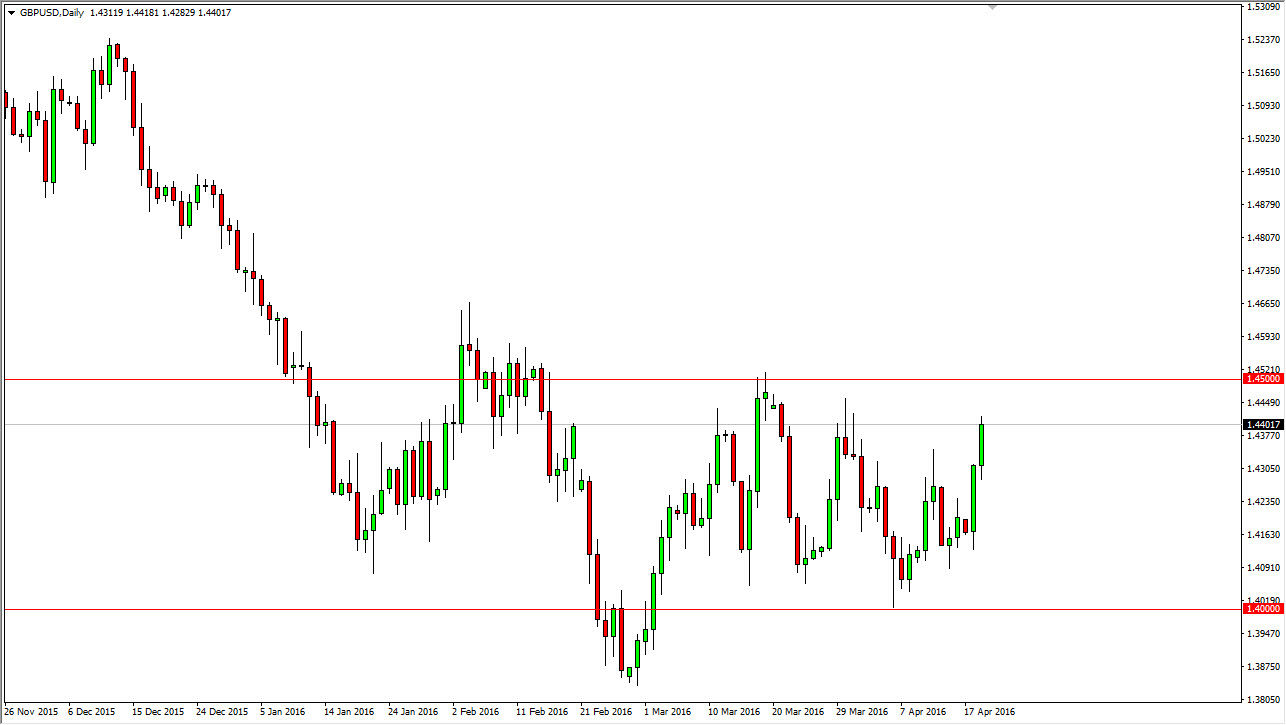

GBP/USD

The GBP/USD pair initially fell during the course of the day on Tuesday but found bullish pressure yet again, and as a result it looks as if the market should continue to favor the British pound, at least in the short-term. I believe that the 1.45 level above will be resistive again though, mainly because of the fact that it is the top of the longer-term consolidation that the market has been dealing with for some time.

On the other hand, I do think it’s a perfect place to see some type of turn around. If we get an exhaustive candle, especially near the 1.45 level, I will not hesitate to start shorting this market as we have been stuck in this consolidation for about 2 months now. On the other hand, a daily close above the 1.4550 level would be enough to convince me that the buyers are taking over and we are going higher for the longer-term move. At this point in time though, I’m going to wait until we get a daily close telling me which way to go before putting any money to work.