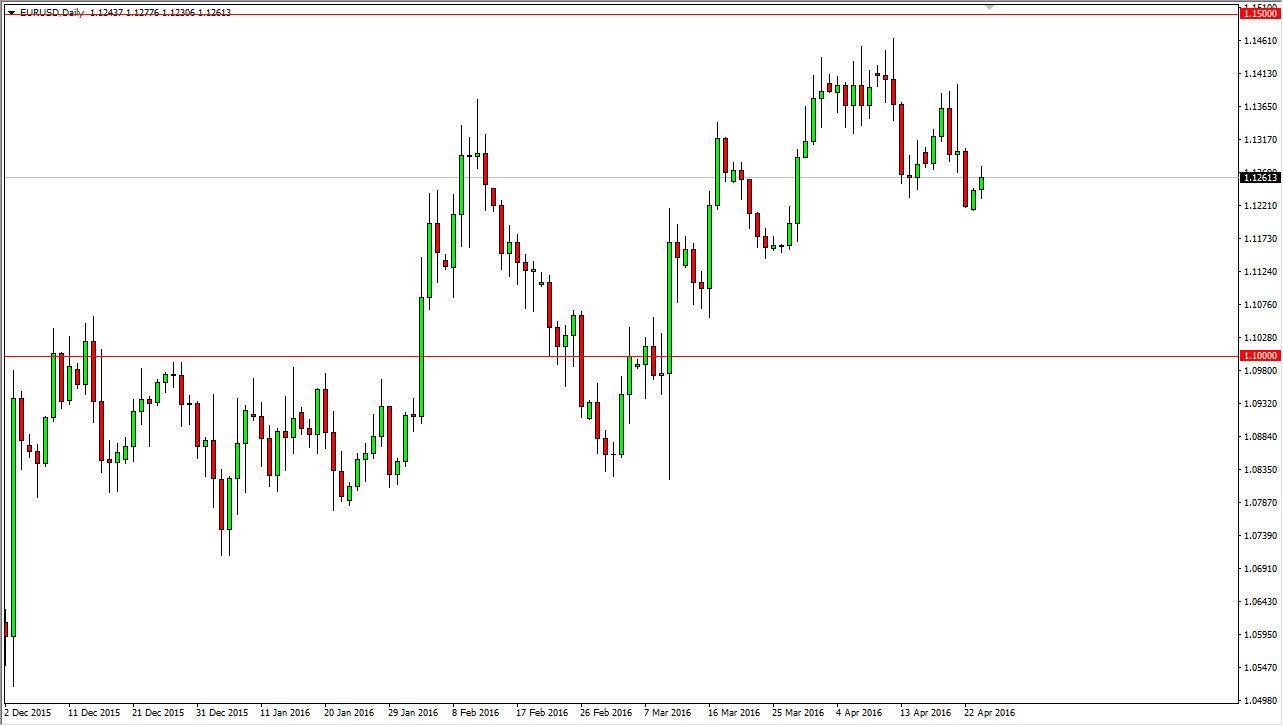

EUR/USD

The EUR/USD pair bounced during the day on Monday, as the 1.12 level has offered enough support to form a green candle. Ultimately, it looks as if we are continuing to try to go higher, perhaps reaching towards the 1.14 level, an area that is significant resistance, and extends all the way to the 1.15 handle. If we can break above that level, then it becomes a “buy-and-hold” type of market, but until then I think that you’re going to have to essentially play what is known as “small ball”, and other words play small moves on the markets instead of trying to form some type of longer-term position.

This is a market that should continue to find quite a bit of volatility, but at the end of the day I am not really that interested in selling, at least until we get below the 1.12 level, and then I would only be willing to sell from a short-term type of perspective.

GBP/USD

The GBP/USD pair broke higher during the course of the session on Monday, clearing the 1.45 level at one point. However, we turned right back around to form a bit of a shooting star. Ultimately, if we can break down below the bottom of the shooting star like candle, the market should continue to drop down to the 1.41 handle. The 1.41 handle is supported all the way down to the 1.40 level, meaning that it is probably going to continue to find quite a bit of consolidation overall.

On the other hand, if we can break above the top of the shooting star for the session on Monday, that would be a very bullish sign and I believe at that point in time the British pound could break out to the upside for a longer-term move. It’s not going to be easy, but it is a potential move that we have to keep in mind.