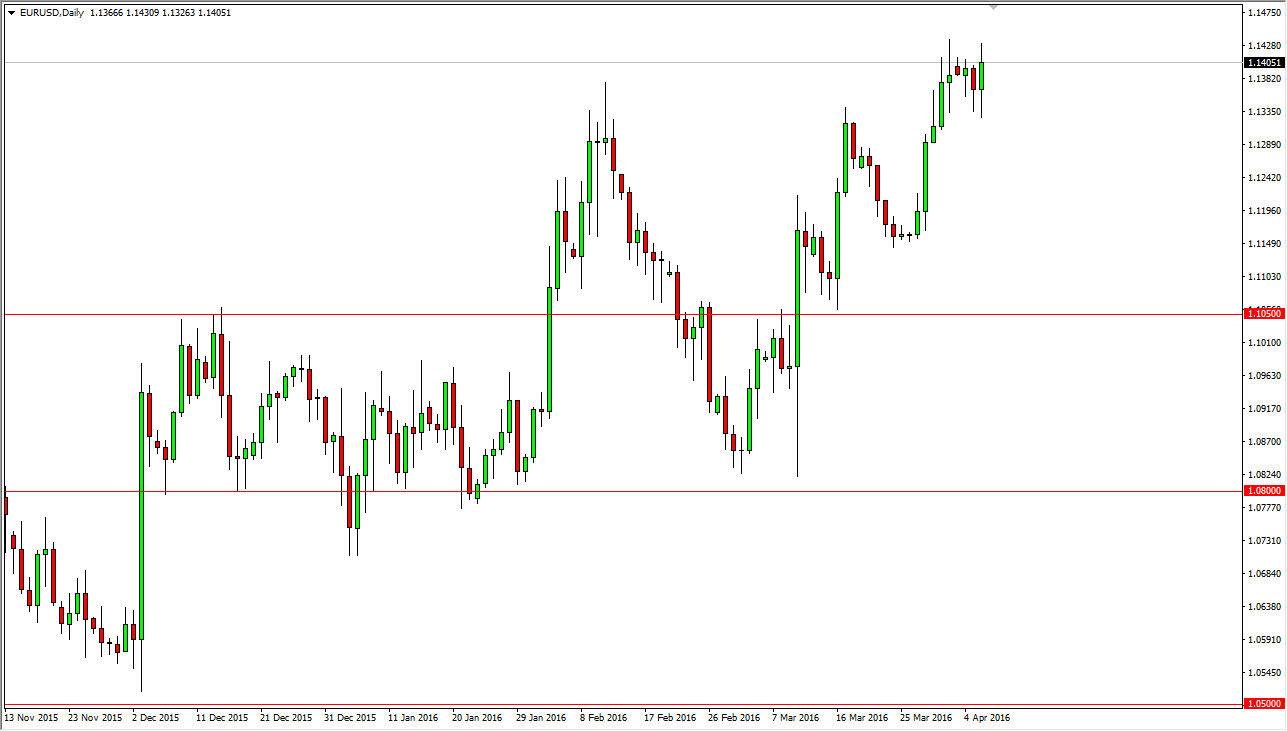

EUR/USD

The Euro initially fell during the day on Wednesday, but we turned back around and formed a fairly positive candle. Ultimately, looks as if the Federal Reserve is going to remain fairly dovish, and that should continue to put money in favor of the Euro overall. I believe that this market is trying to break out to the upside, perhaps reaching towards the 1.15 level given enough time. Pullbacks at this point in time should be thought of as potential buying opportunities on signs of support as well, and I don’t really have a scenario in which I am willing to sell this market. I believe that the market continues to find buyers every time we pullback as we have seen since the middle of February. If we can get above the 1.15 level, this market should continue to go much like before.

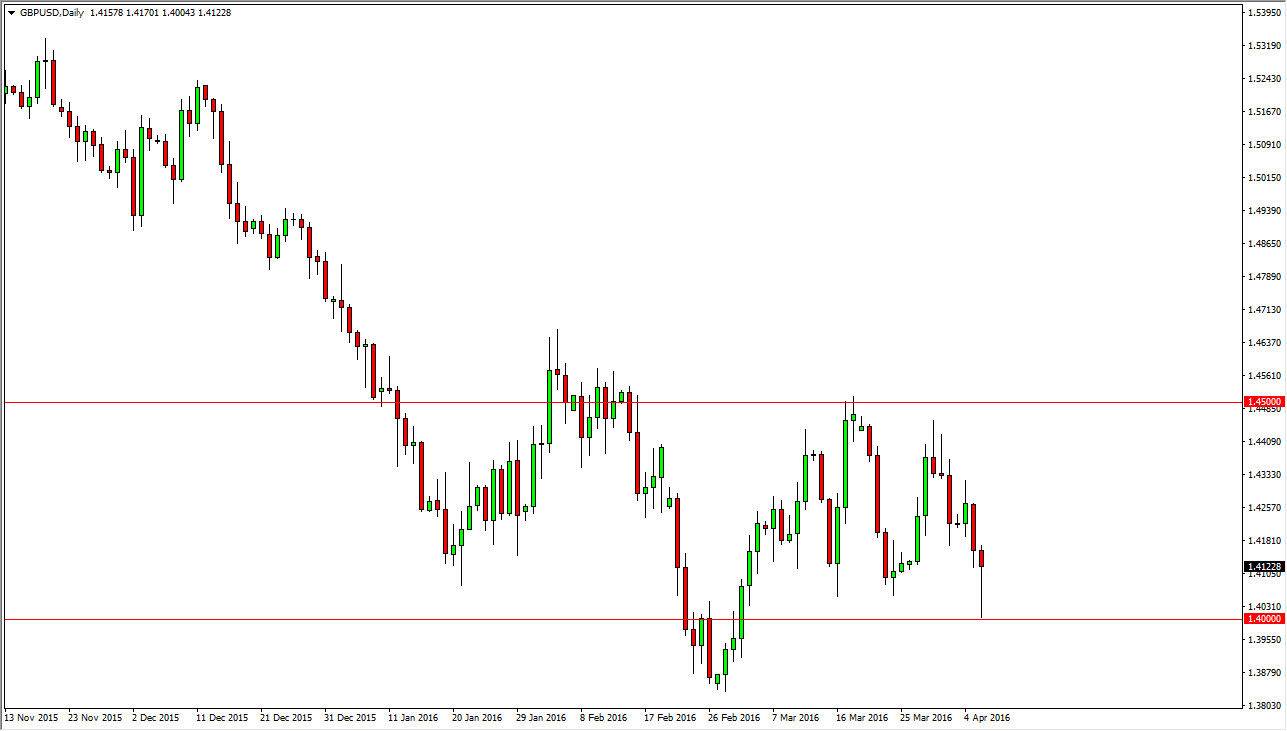

GBP/USD

The GBP/USD pair initially fell during the course of the day on Wednesday, but found enough support at the 1.40 level to turn things back around and form a bit of a hammer. The hammer of course is a very bullish sign so therefore I believe that we are going to continue to see quite a bit of back and forth action between the 1.40 level on the bottom, and the 1.45 level on the top. With the Federal Reserve stepping away from at least a few interest-rate hikes, it’s going to be very bearish for the US dollar. However, we also have the concerns about the British leaving the European Union, and that of course is going to be bearish for the British pound itself. Because of that, I think there is too much in the way of uncertainty to expect this market to make any significant moves and therefore we should continue to see back-and-forth type of trading on short-term charts in this general range going forward.