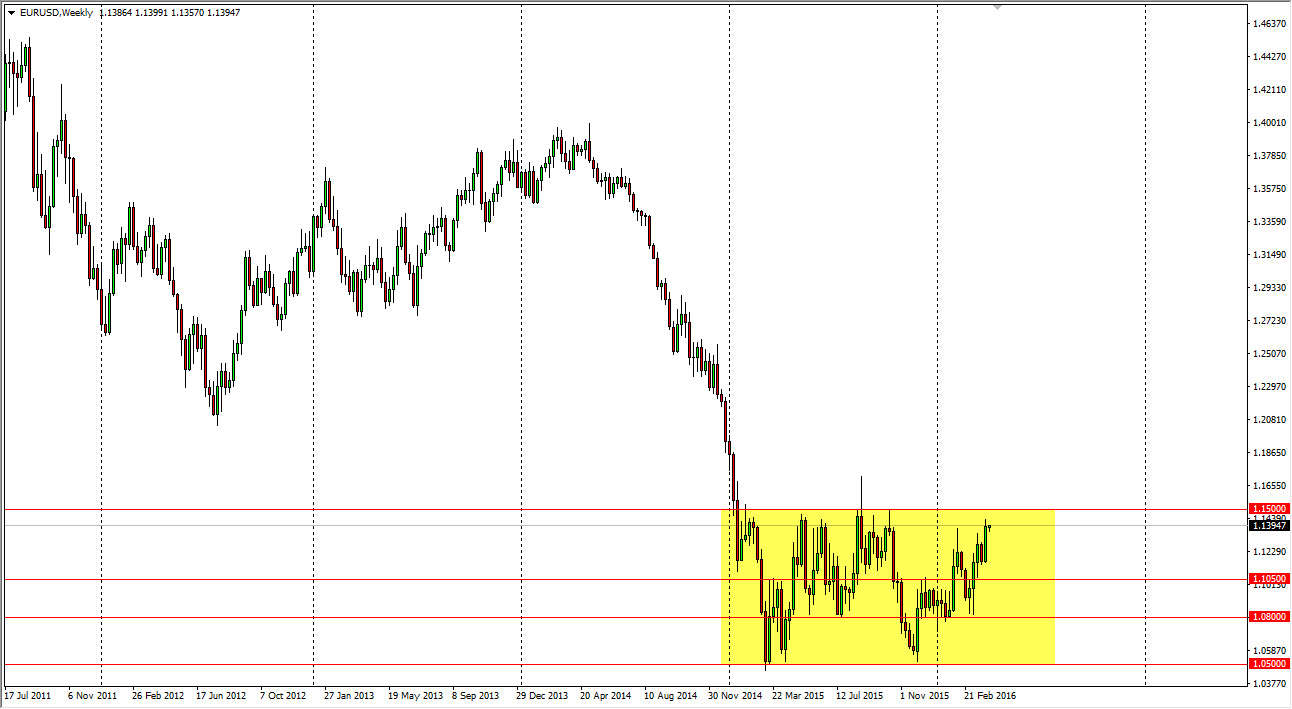

The EUR/USD pair has been rising during the majority of 2016, but has not broken out of the consolidation area that we have been in since the end of 2014. It’s a huge area, but we have been consolidating between 1.05 on the bottom, and 1.15 on the top. This may be due to the stance by both central banks, which of course is dovish. The Federal Reserve has recently suggested that it was willing to step away from a couple of interest-rate hikes, while the European Central Bank has suggested that they are willing to do more quantitative easing if needed. However, we are approaching a fairly interesting area that we will have to pay attention to.

I believe that there is a massive amount of resistance between the 1.14 and the 1.15 level, so if we can break above the 1.15 level I think that is a very strong and bullish signal. On the other hand, it wouldn’t surprise me at all to see this market turn right back around at that level as it has so many times. The one time we did break through during the year and 2015, we turn right back around almost immediately.

Volatility

I believe that volatility will continue to be the mainstay of this market, and I would not be willing to take a trade it until I get at least a daily close in confirmation. In other words, if we close on a daily candle above the 1.15 level, at that point in time I began to buy. On the other side of that trade would be an exhaustive candle somewhere just above, and on a daily close. Then I would be willing to sell this market expecting a return to lower levels as the consolidation would continue.

The one thing that you can count on though is going to be the choppiness that we’ve seen recently continuing. If we do break out to the upside though, those pullbacks should end up being value that you can pick up.