The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 3rd April 2016

Last week I highlighted long AUD/USD and short GBP/USD as good trades for this week, although I qualified that by suggesting that risk sentiment would affect which one was superior. In any case the week saw AUD/USD rise by 2.28% and GBP/USD also rise by 0.68%. Therefore even if both trades were taken, the result still would have been nicely profitable.

This week I see long AUD/USD as the best possible trade, as it is trending upwards quite strongly, helped by a perception that the Federal Reserve is in no mood to be raising rates quickly, and of a strengthening Australian economy.

Fundamental Analysis & Market Sentiment

Fundamental analysis is becoming more useful in Forex markets at the moment.

The feature that really stands out this week is the weakness of the U.S. Dollar. This currency is usually the key to the Forex market, and when it is the big mover, it tends to make the market really jump. The market is now quite convinced following the FOMC statement that rate rises any going to happen later rather than sooner. Although Friday’s NFP numbers were slightly stronger than was anticipated, the FOMC statement is a much more important factor in influencing perceptions.

Turning to Australia, the economic data looks quite strong, but it seems that there is not likely to be any further rate cut, therefore the Australian Dollar is quite well-positioned for a rise. It has been the leading currency against a weakening USD, although the Euro also rose strongly against the USD this week.

Technical Analysis

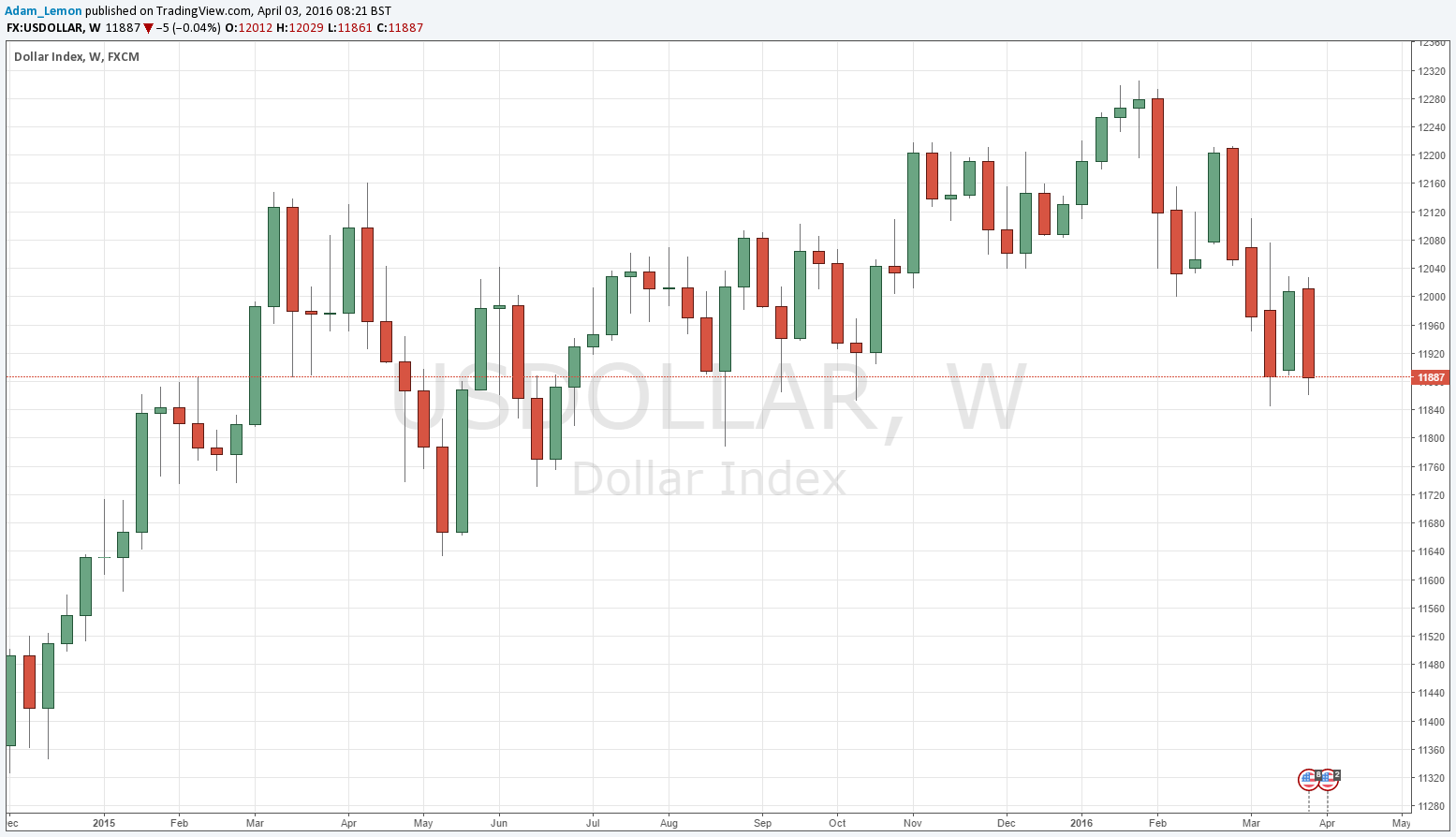

USDX

The U.S. Dollar Index fell fairly strongly last week, closing at a price lower than the prices from both three months and six months ago, suggesting the greenback is in a downwards trend. This suggests that the best trend trades are likely to be against the U.S. Dollar in the near future. However the Index still really needs to break below recent support from about 11800 to 11600 before the fall would start to look very strong.

AUD/USD

This pair rose quite strongly this week following the downwards movement over the previous week. At one stage the price reached above 0.7700 which had not been seen since June 2015. Friday’s bounce following a pullback from 0.7600 was a confluence of a round number and the 50% retracement level from the recent upwards leg.

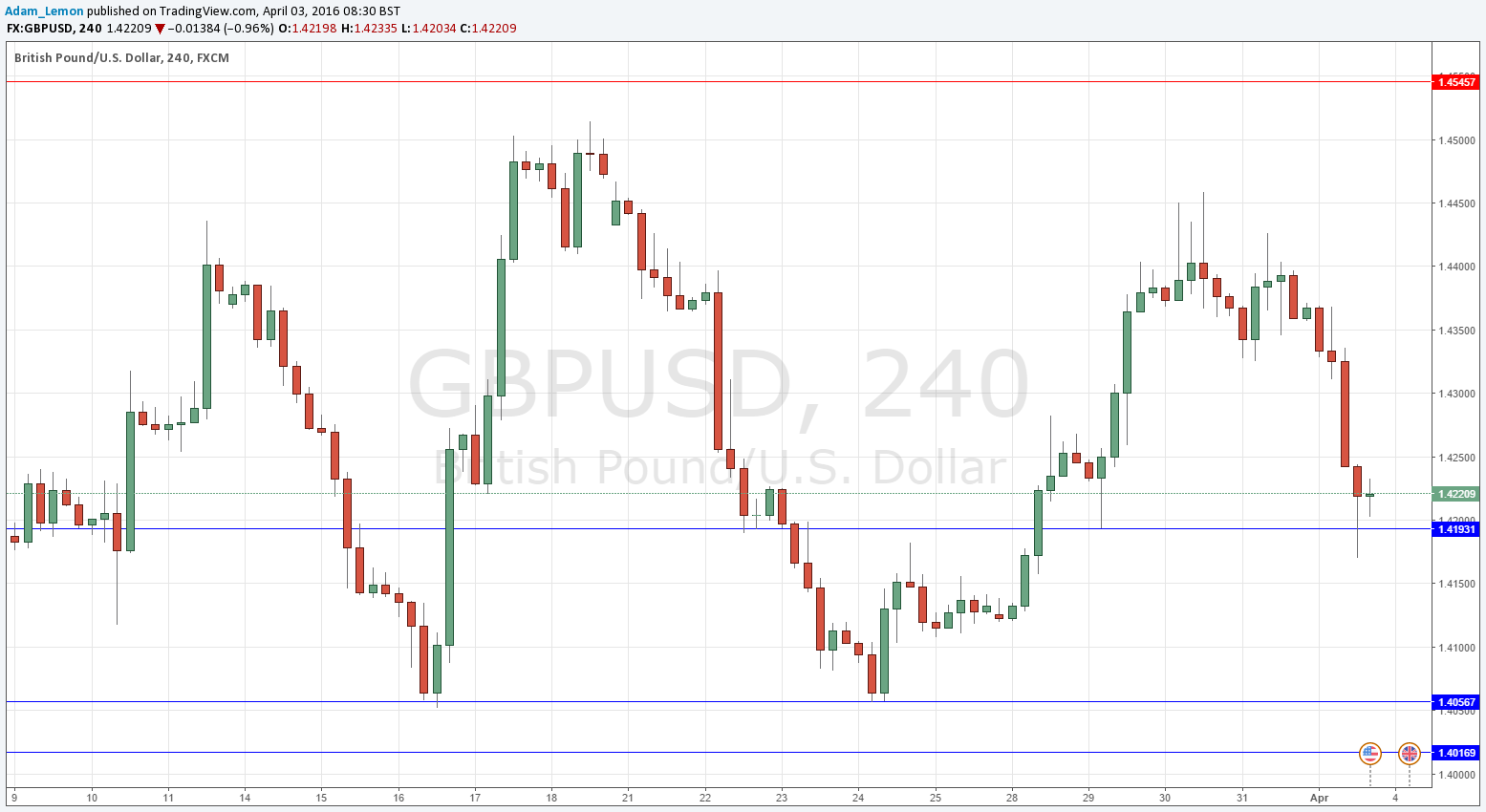

GBP/USD

Although technically still in a downwards trend, both currencies are weak, and this pair is really just ranging with considerable volatility, so its movements are very difficult to predict.

USD/JPY

We saw a resumption of the bearish trend following a rejection of the broken triangle trend lines at last week’s high of 113.80. There could be another good shorting opportunity next week if the price pulls back to 112.21 or above.

The safest trade of the week is probably going to be long AUD/USD.