Gold prices advanced for a fourth straight session on Thursday as weakness in the dollar and Bank of Japan's decision to stand pat on policy bolstered demand for the precious metal. BoJ officials held off on expanding monetary stimulus, saying that they want to wait and see how the introduction of negative rates in January affects the economy. Soft U.S. economic data also helped the market. The Commerce Department reported that gross domestic product rose at a 0.5% annualized rate in the first quarter.

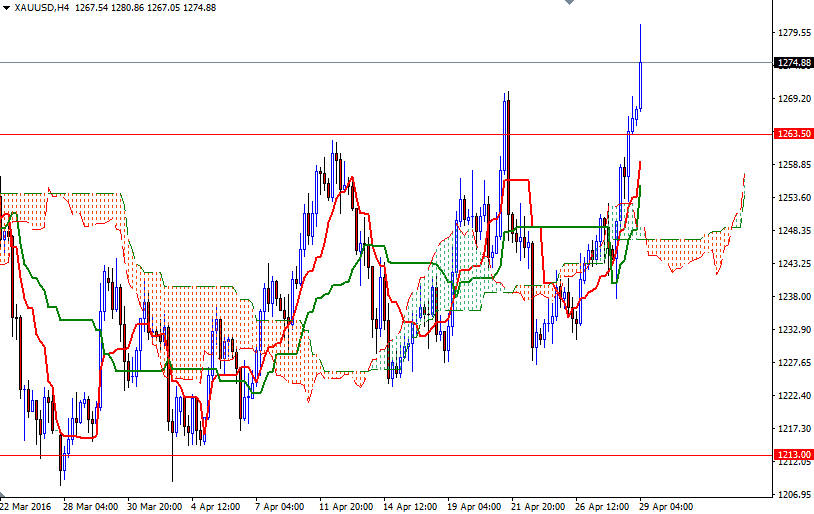

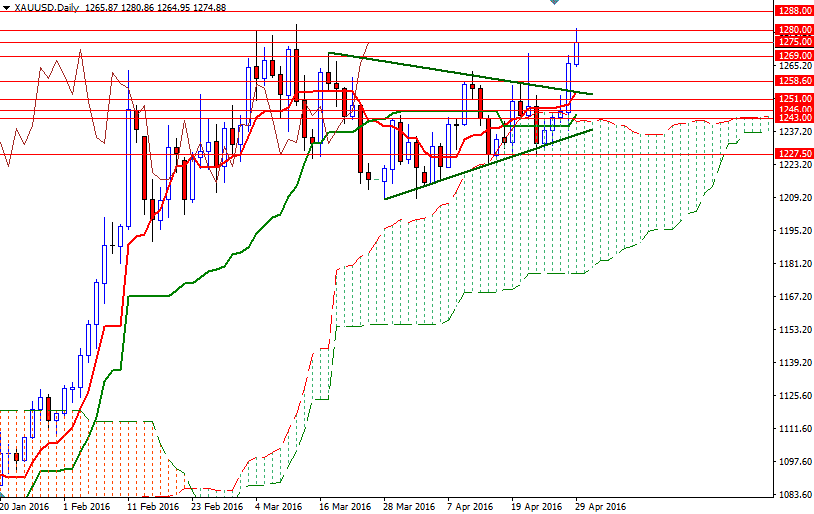

The XAU/USD pair finally broke strongly above the upper limit of the triangle - this also marked a departure from the consolidation zone that we had been watching since mid-April. As a result, gold prices rose to the highest level in almost 8 weeks during the Asian session today. Yesterday's rally pushed prices back above the 4-hourly Ichimoku cloud and caused short-term charts to realign with longer-term bullish inclinations. However, the area between the 1275 and 1280 levels has been troublesome in March so it would not surprise me if prices stall there ahead of the weekend.

If that is the case, prices may return to 1263-1258.60 area to test the broken resistance as a support. But of course, in order to reach there, the bears will have to drag prices below 1269 first. Falling through 1258.60 would suggest that we are heading towards 1251. On the other hand, If the bulls are able to maintain control and penetrate the 1280/75 area, it is likely that XAU/USD will test 1285/88 afterwards. Beyond that, the bulls will be targeting the 1295 level.