Gold rose slightly on Wednesday, following a Federal Reserve statement that signaled it was not in a hurry to tighten monetary policy. The U.S. central bank left short-term interest rates unchanged but kept the door open to a hike in June. "The committee continues to closely monitor inflation indicators and global economic and financial developments," the Fed said at the conclusion of a two-day meeting yesterday.

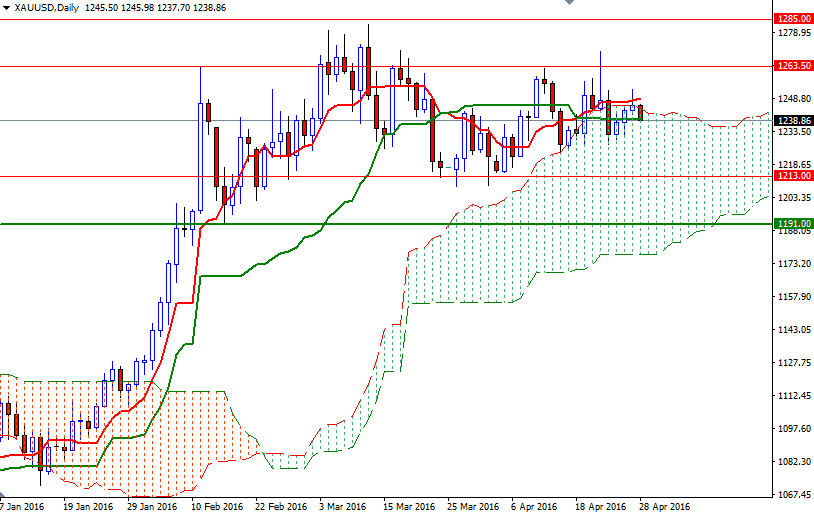

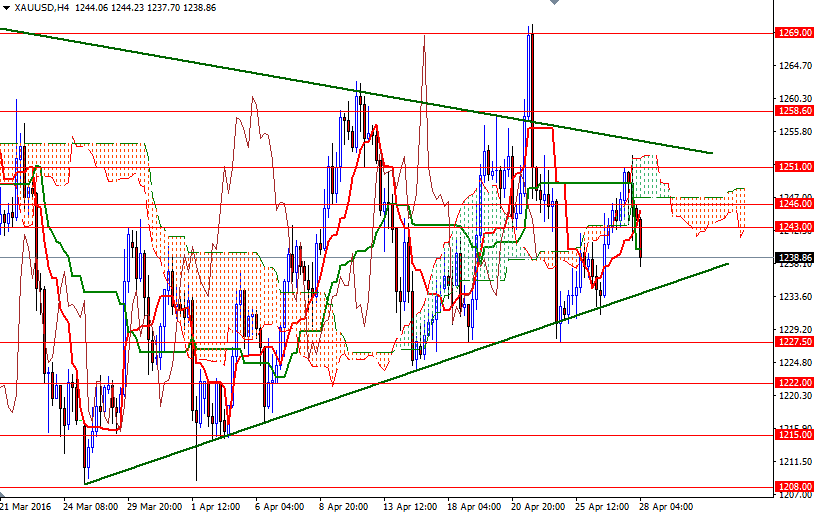

The daily Ichimoku cloud continues to act as a support but prices are still below the cloud on the 4-hour time frame. With the Fed's announcement failing to trigger any strong reaction, it is likely the ranging conditions will continue. In other words, the triangle (marked on the 4-hour chart) will prevail and contain the market.

The first hurdle gold needs to jump is located in the 1255.50-1251 region where the upper line of the triangle and top of the 4-hourly cloud converge. If prices can break through, then the bulls may find a chance to test nearby resistances at 1258.60 and 1263.50. To the downside, the initial support stands in the 1234-1233.70 area. A breakout below the lower line would open up the risk of a move towards 1227. As pointed out earlier this week, breaching this support is essential for a bearish continuation. In that case, the market will be aiming for 1222.