Gold settled slightly higher at the end of a volatile session yesterday. Gold prices hit their highest level since March 17 but the market reversed earlier gains after comments from European Central Bank President Mario Draghi and better-than-expected U.S. data led to a strong bounce in the dollar. Draghi indicated the central bank was ready to take fresh action if needed and could cut interest rates further. The U.S. Labor Department reported that the number of first-time applicants for jobless benefits fell by 6K to 247K.

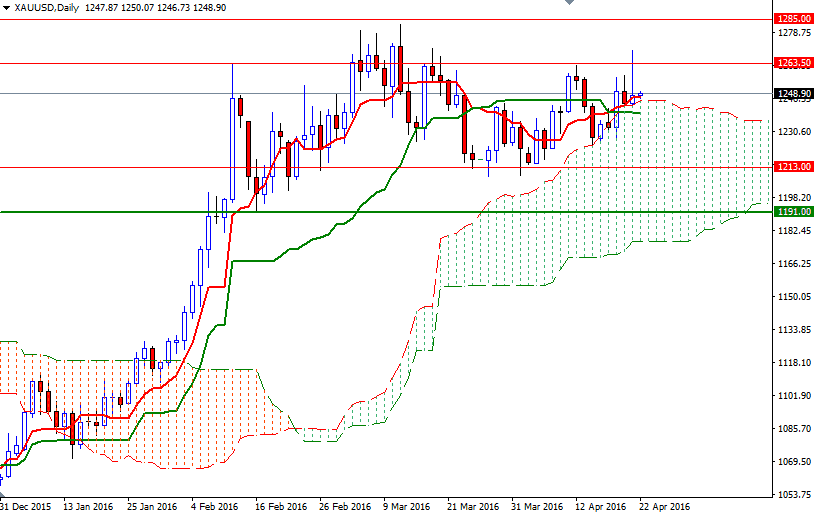

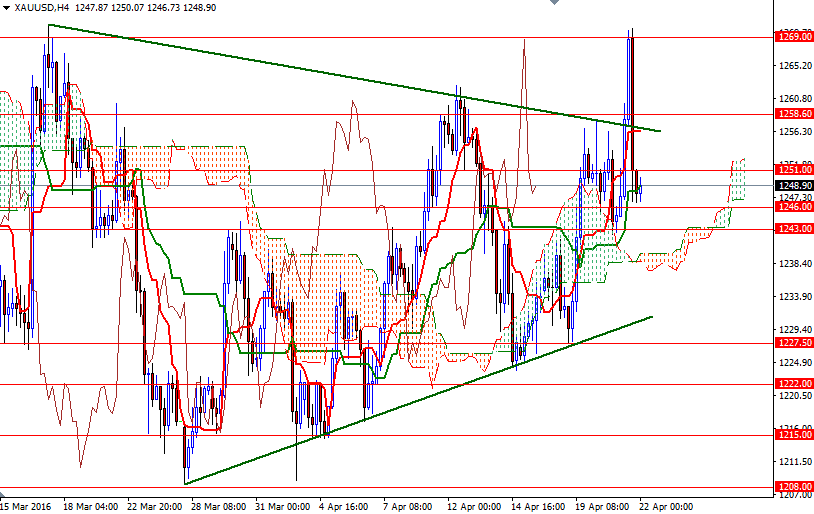

The XAU/USD is currently trading at $1248.34 an ounce as the market is being supported by the daily Ichimoku cloud. The 1246/3 region has been supportive in the past so it may be troublesome for the bears. If prices can break through the 1253/1 resistance, then the 1258.60-1256.50 area could be the next port of call. Since a bearish trend line, a horizontal resistance and the 4-hourly Tenkan-sen (nine-period moving average, red line) converge in this particular zone, it would not surprise me if prices stall. Beyond that, sellers will be waiting at around 1263.

To the downside, keep an eye on the 1246/3 support. If the market drops through 1243, it is likely that XAU/USD will head back to the 1239.40-1236 zone occupied mostly by the 4-hourly cloud. A break below 1236 could see a fall to the bullish trend line. The bears have to invalidate this supportive trend line if they intend to test the 1227.50 level.