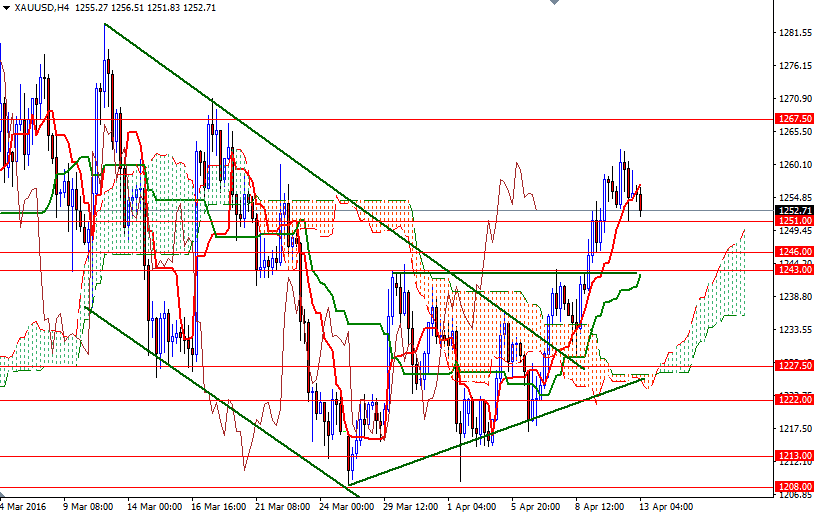

Gold prices settled slightly lower on Tuesday after shuffling between gains and losses as a rally in equities sapped the metal's safe-haven appeal. The XAU/USD pair initially tried to break out to the upside but the expected resistance at around 1258.60 kicked in and capped the market, dragging it back towards the previous resistance now flipped to support at 1250. A rebound in the dollar also weighed on the precious metal.

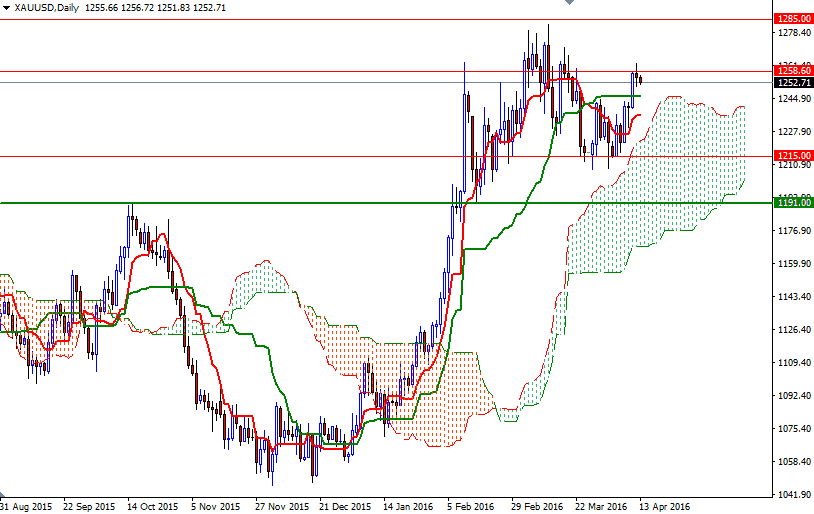

Investors are awaiting retail sales report to gauge the strength of the American consumer. The gold market is sensitive to the U.S. data. The medium-term outlook is bullish with prices residing above the weekly and daily Ichimoku clouds. Positive Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) crosses on the weekly and 4-hourly charts supports this view.

However, the short-term charts suggest that a retest of 1246/3 is likely if the market drops through the 1251/0 support. The bears will have to eliminate this support so that they can find a chance to make an assault on the 1236/4 area. To the upside, there are hurdles such as 1258.60 and 1263.50. If prices recover and anchors somewhere above 1263.50, then I suspect XAU/USD will reach the next barrier in the 1272-1267.50 region.