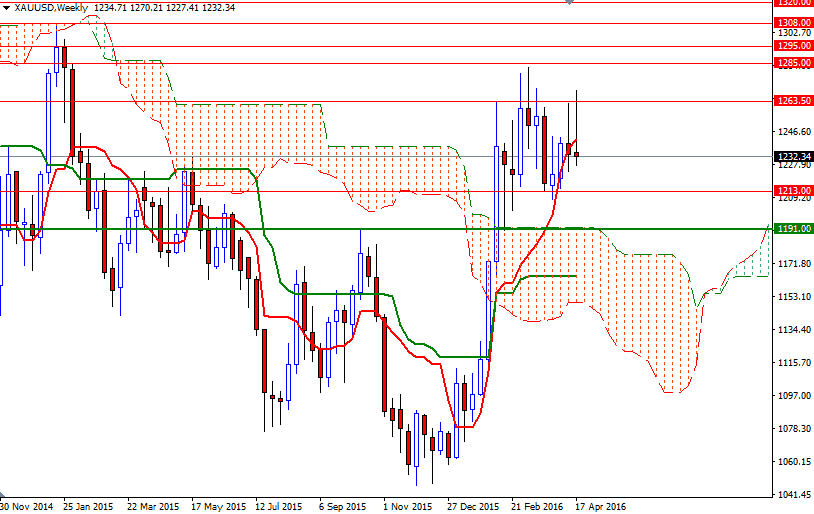

Gold prices settled at $1232.34 an ounce on Friday, suffering a loss of $2.37 on the week, as a sharp drop in the Euro following hints of more monetary stimulus from the European Central Bank buoyed the dollar and added to pressure on gold. The XAU/USD traded as high as $1270.03 after the lower line of the triangle provided a bullish bounce but encountered significant amount of resistance and reversed its course. As a result, the precious metal erased gains and returned to the same trend line, leaving a tall shadow to the top of the weekly candle.

Last week, I had mentioned that we were going to spend some more time consolidating and this second consecutive tall upper shadow supports the fact that the market is rejecting higher prices. The main event for the markets this week is likely to be the two-day Federal Open Market Committee meeting beginning on Tuesday. The majority of market players expect that the Federal Reserve will leave short-term interest rates unchanged but hint at rate hike in June. From a technical perspective, I think XAU/USD will suffer from the short-term bearish outlook.

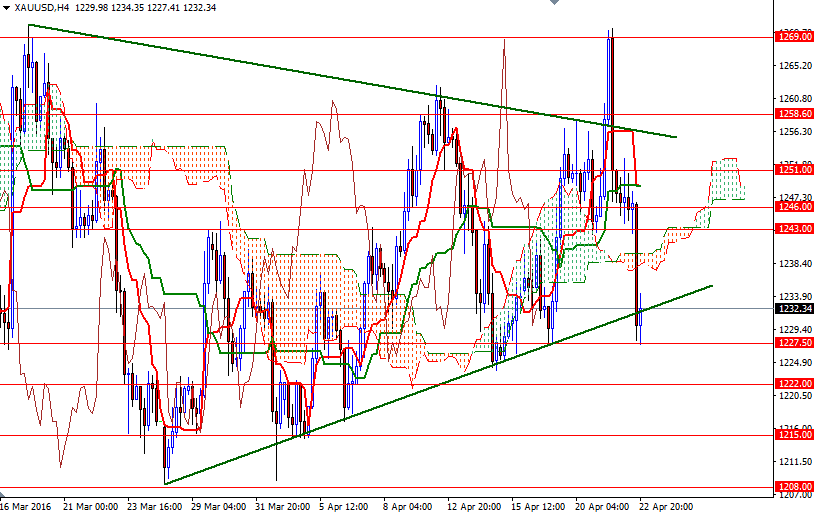

In order to confirm this bearishness will remain dominant, prices will have to break down below the 1227.50 support level. If this support is broken convincingly, then 1222 and 1215/3 will become the bears' next possible targets. Closing below 1213 would imply that the market is ready to head towards the 1208/5 area. Below that, the 1199/7 zone stands out and the bears will have to demolish this strategic support so that they can test the 1191 level which happens to be the top of the weekly Ichimoku cloud. However, if the 1227.50 remains intact, expect a rebound toward the 1243.25-1239.60 area before prices start falling. The bulls have to push prices back above the 1251/46 zone where a horizontal resistance, the top of the daily Ichimoku cloud and Tenkan-sen (nine-period moving average, red line) converge if they want to regain the control and test the 1258.60-1256.50 and 1263.50 barriers.