NZD/USD Signal Update

Last Monday’s signals were not triggered as the action was not bullish enough to trigger a long trade at 0.6790.

Today’s NZD/USD Signals

Risk 0.50%

Trades may only be taken from 8am New York time until 5pm Tokyo time.

Protect any open trades at least half an hour before the FOMC release.

Short Trades

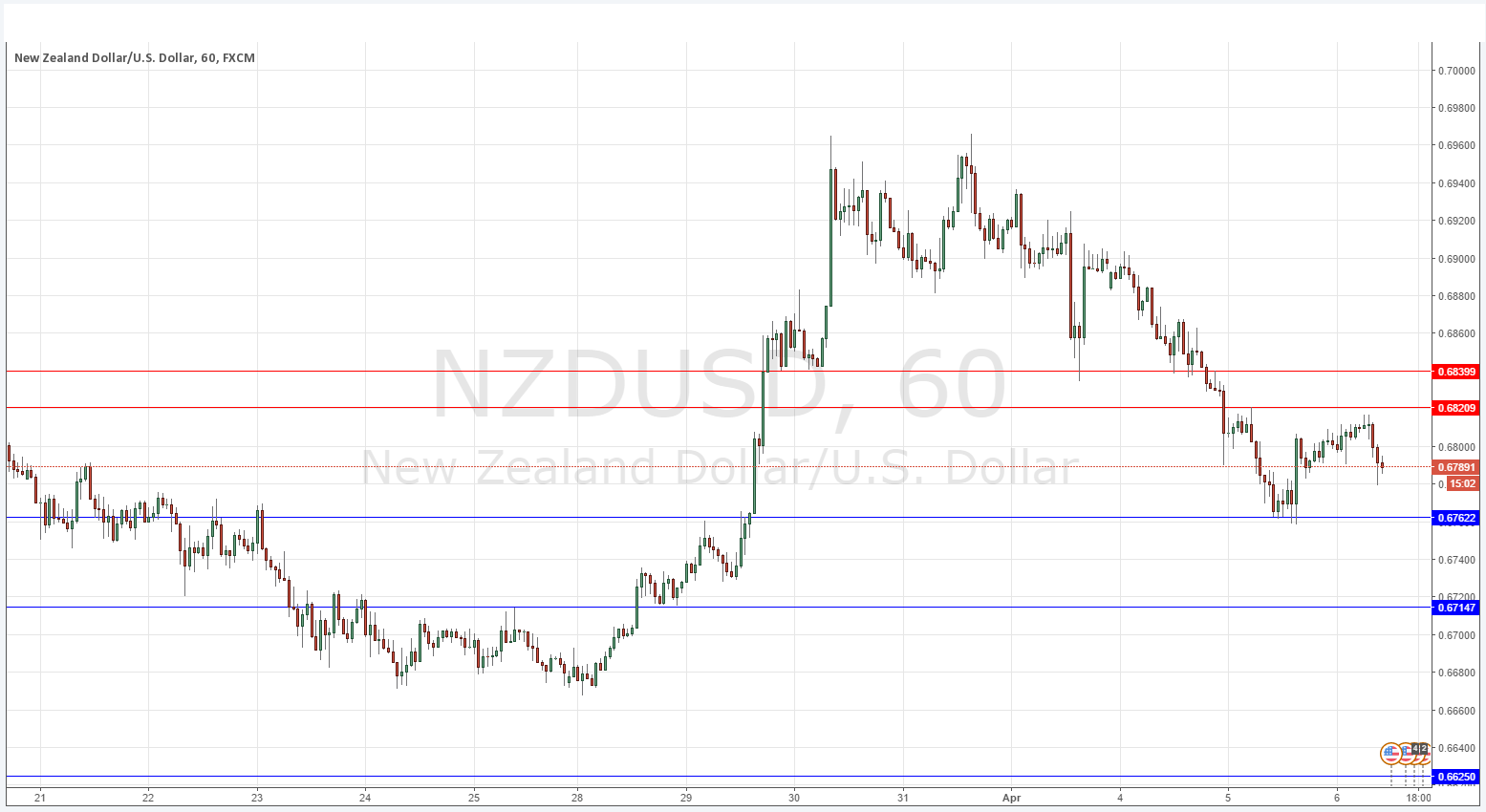

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6821 or 0.6840.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trades

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6762, 0.6716 or 0.6620.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

NZD/USD Analysis

The NZD was the strongest mover against the USD, but as the USD has recovered over the past few days, this pair has dropped right back into its range, although it has to be said there is still a bullish tilt. This means that it should be possible to get some trades set-up with conservative profit targets in either direction, and there are key levels nearby both above and below the current price as at the time of writing.

There is nothing due today concerning the NZD. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time, followed by the FOMC Meeting Minutes at 7pm.