NZD/USD Signal Update

Yesterday’s signals were not triggered as the price action at the first touch of the anticipated resistance level at 0.6840 was not sufficiently bearish.

Today’s NZD/USD Signals

Risk 0.75%

Trades must be entered between 8am New York time and 5pm Tokyo time only.

Long Trades

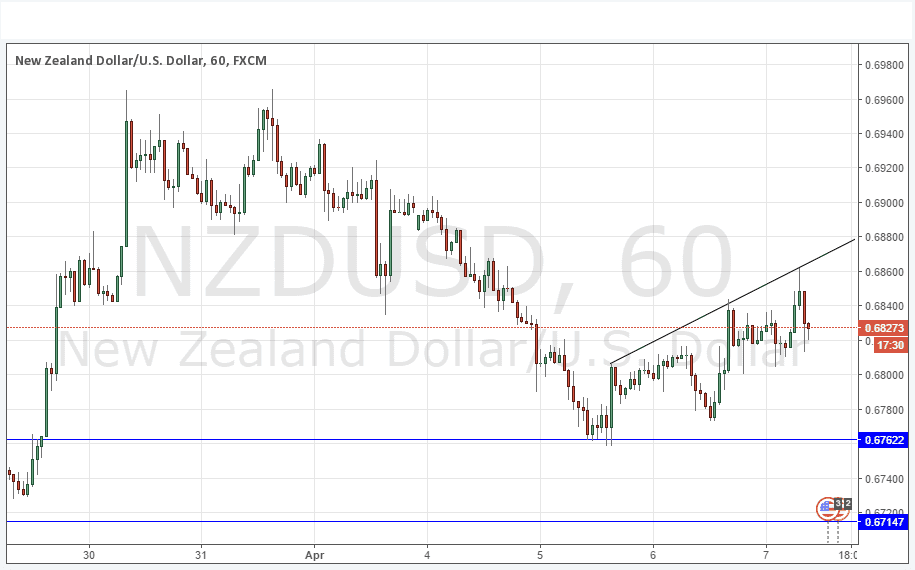

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6762 or 0.6716.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

NZD/USD Analysis

This pair has been relatively calm and orderly compared to many other major pairs in the Forex market over the pre and post FOMC Meeting Minutes release period.

Overall there is a slight bullish bias, as there has been for a while. This can be determined by the way that yesterday’s resistance levels were rubbed out, also with the way that the lows of recent candles are stacking on the highs of previous candles: the exact level is too sloppy to use with precision, but you can see this stair-step in the chart below at around 0.6815 which can act as minor support and possibly provide some long scalps.

There are no major levels until 0.6762 so today there are probably going to be better opportunities elsewhere.

Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time. There is nothing due today concerning the NZD.