S&P 500

The S&P 500 rose during the course of the session on Tuesday, breaking above the 2100 level. That being the case, the market looks as if we could continue to go higher, but short-term pullbacks will more than likely offer enough value for traders to get involved in. The 2080 handle below is supportive, and most certainly the 2060 level. At this point in time, it looks very likely that we will try to break out to a fresh, new high which is the 2120 handle. The Federal Reserve continues to look less and less likely to make as many of the interest-rate hikes that the market expected, and that of course should continue to have people looking to buy stock markets going forward.

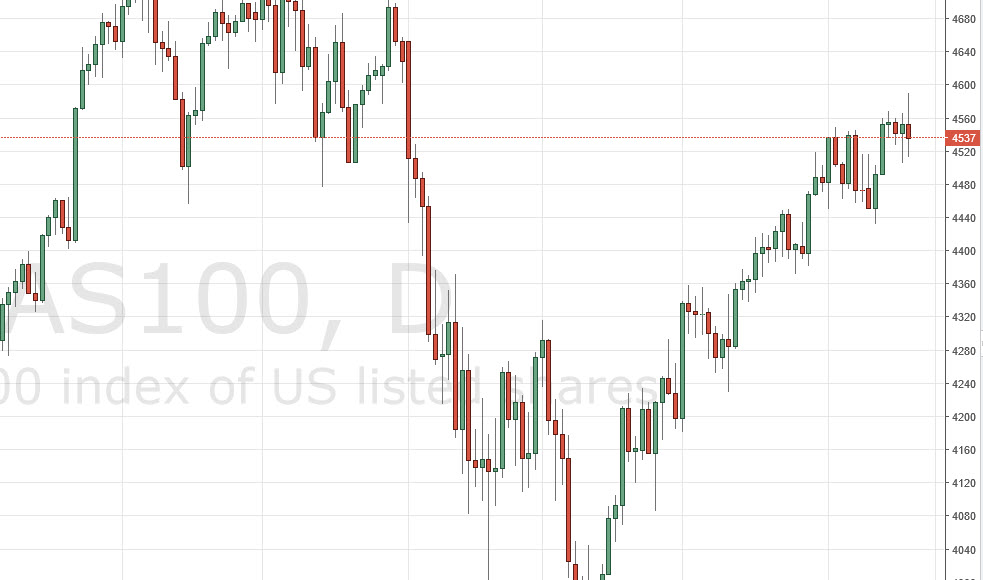

NASDAQ 100

The NASDAQ 100 went back and forth during the course of the session on Tuesday, showing a very volatile candle and going as high as just below the 4600 level. Ultimately, this ended up forming a slightly negative candle but at the end of the day it looks as if we are still very much well supported just below, especially at the 4500 level. The market has quite a bit of support below, and as a result it’s only a matter of time before we bounce every time we pullback. A break above the top of the range should send this market looking for the 4725 level, but there is so much noise between here and there, you have to believe that you will have to get involved via pullbacks.

I have no interest in selling this market, I believe that it is not until we break well below current levels that we can consider selling. For me, that’s the 4400 level below, and with that I feel it’s very unlikely that I will be selling anytime soon.