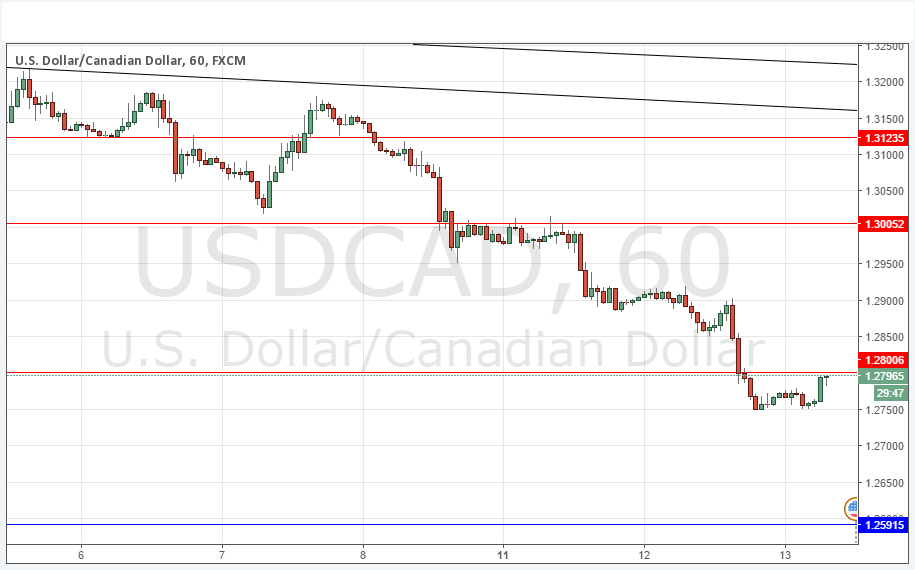

USD/CAD Signal Update

Yesterday’s signals were not triggered as there was no bullish price action at 1.2800.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be taken between 9am and 5pm New York times today.

Long Trade 1

Go long after bullish price action on the H1 time frame immediately following the next touch of 1.2591.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trades

Go short after bearish price action on the H1 time frame following the next touch of 1.2800 or 1.3005 or 1.3124.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CAD Analysis

The price has continued to fall very strongly as the price of crude oil rallies strongly. It might be that 1.2800 will now act as resistance over the short term, but there are high-impact news releases due today for both currencies within this pair so there is likely to be a great deal of volatility later which will make any trade before the news releases very dangerous.

Overall, there is a very strong, long-term bearish trend.

Concerning the USD, there will be releases of Retail Sales, Core Retail Sales and PPI data at 1:30pm London time, followed by Crude Oil Inventories at 3:30pm. Regarding the CAD, at 3pm there will be releases of the Bank of Canada’s Monetary Policy Report, Rate Statement and Overnight Rate, followed by a Press Conference at 4:15pm.