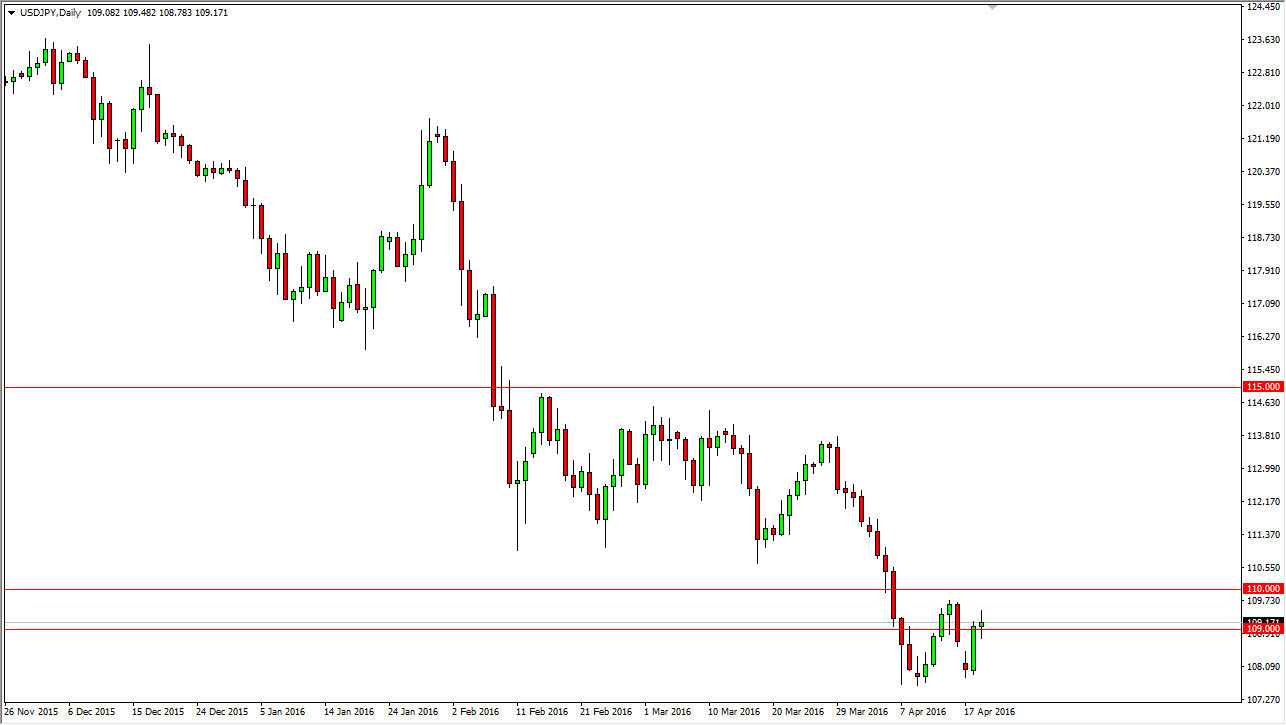

USD/JPY

The USD/JPY pair went back and forth during the course of the session on Tuesday, as we continue to find the 109 level interesting. This is an area that begins quite a bit of resistance that extends all the way to the 110 level. Exhaustive candle of course is a reason to start selling again, so if I start selling, it will only be We break the bottom of the range for the day on Tuesday. At that point, I would anticipate that the market should go back to the 108 level, if not the 107.50 area. I’m no interest in buying this market at the moment, I believe that there are massive amounts of resistance just above and of course far too much uncertainty to abandon the Japanese yen at the moment.

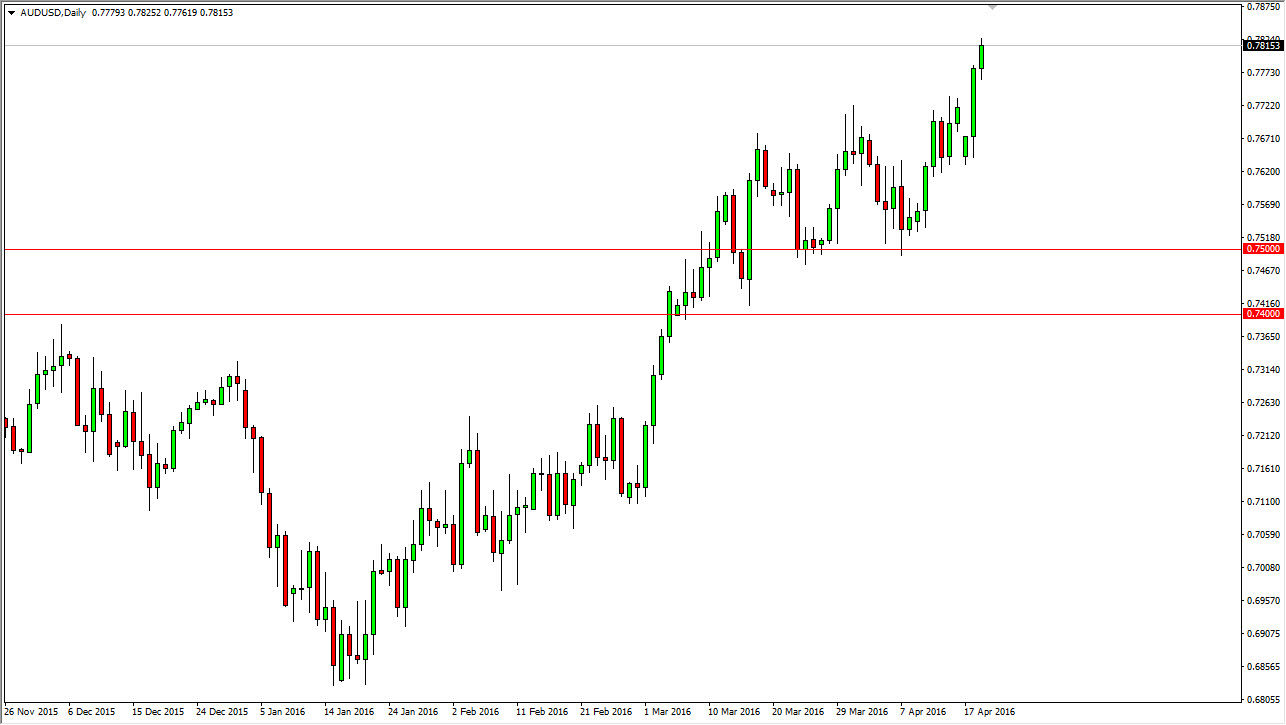

AUD/USD

The AUD/USD pair broke out to the upside during the day on Tuesday, as we cleared the 0.78 level. This is a market that has been an uptrend for some time, and with that being the case if we pullback I believe that there should be enough support below to turn back into this market and start buying as supportive candles being an opportunity to take advantage of “value.” Also, the gold markets will have an influence on the Australian dollar as it typically does, and with that being the case I think that if gold rallies which of course it has been doing, the Australian dollar should continue to the same direction.

The 0.75 level below is massively supportive, and as a result I believe that any pullback at this point in time will continue to find buyers may supply in that floor. In fact, I believe that the first real supportive level is to be found at the 0.77 level, which was so massively resistive until just a couple of sessions ago. I have no interest whatsoever in selling this market.