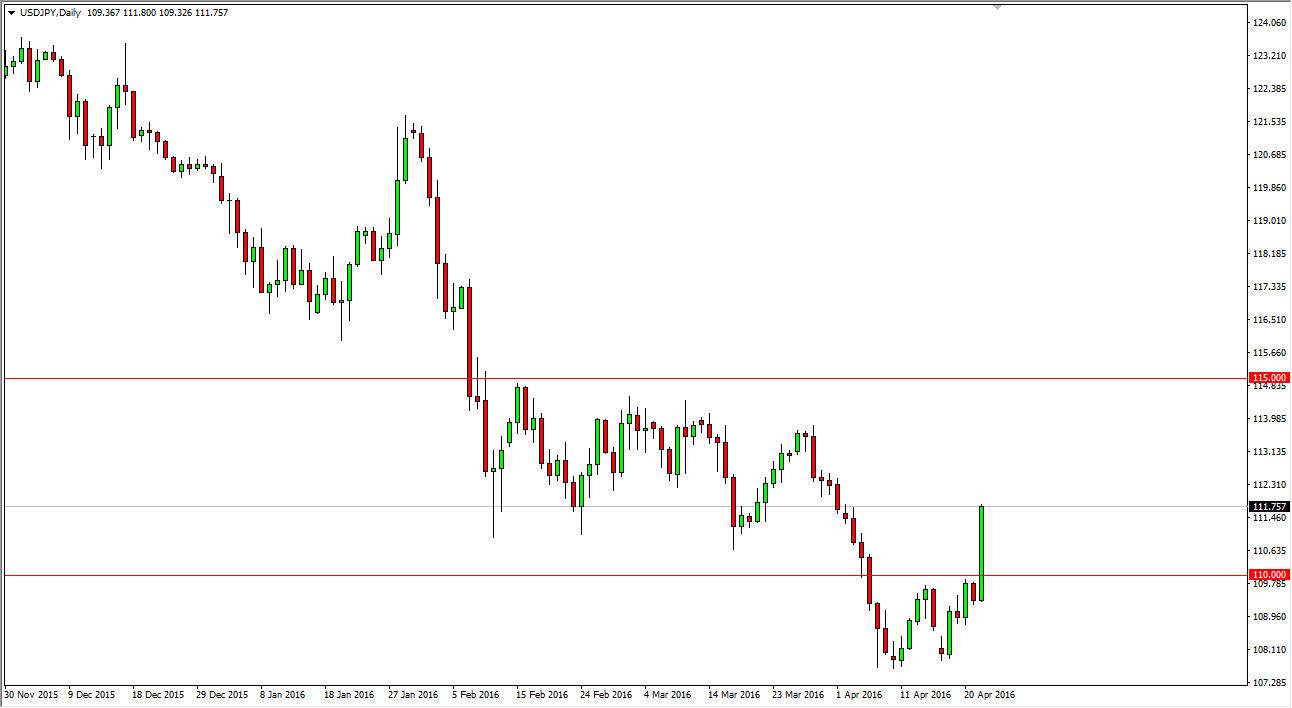

USD/JPY

The USD/JPY broke out during the course of the day on Friday, clearing the 110 level with significant strength. On top of that, we even broke above the 111 level, which had been the top of resistance for me. Ultimately, it looks as if the market is probably going to try to break to the 114 handle given enough time. Ultimately, I believe that the resistance extends all the way to the 115 level, and above there becomes a longer-term “buy-and-hold” type of situation.

However, the strength shown by the massive candle that formed on Friday suggests that we will have more momentum to the upside. You would think that pullbacks will continue to offer value that traders will wish to buy, mainly because a lot of people would have missed this obvious move.

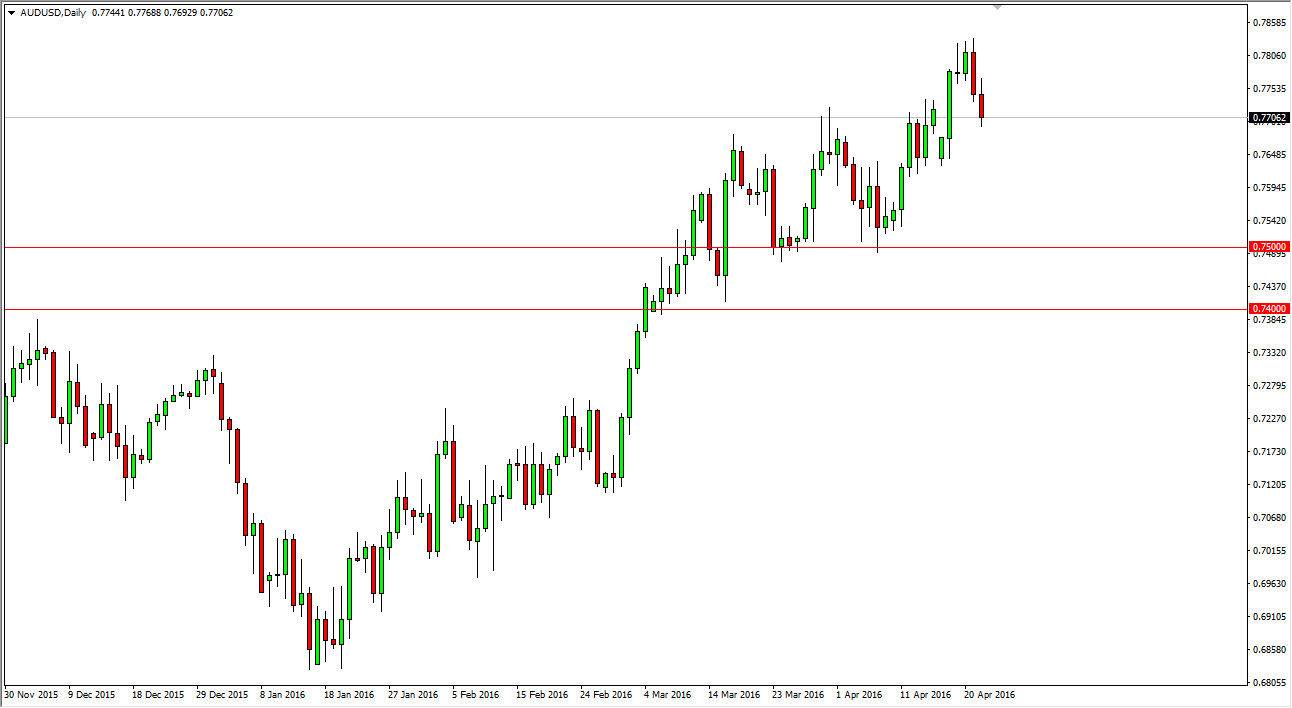

AUD/USD

The AUD/USD pair initially tried to rally during the day on Friday, but then turned right back around to form a slightly negative candle. We tested the .77 handle, which is the previous resistance, so now I would assume that we should rally from here. An exhaustive negative candle, perhaps a hammer something like that, would be reason enough to start going long. With that, I would anticipate that the market should then go to the 0.7850 level, and then eventually the 0.80 level after that which of course has been my longer-term target for some time.

Pay attention to the gold markets, they certainly have a massive effect on the Australian dollar and how it behaves, and with that being the case you have to pay attention to both markets at the same time, as if the gold markets rally, you have to think that the Australian dollar will move right along with it. At this point in time though, I have to say that the market does look as if it has broken out recently, and now looks as if it will more than likely continue to go higher over the longer term.