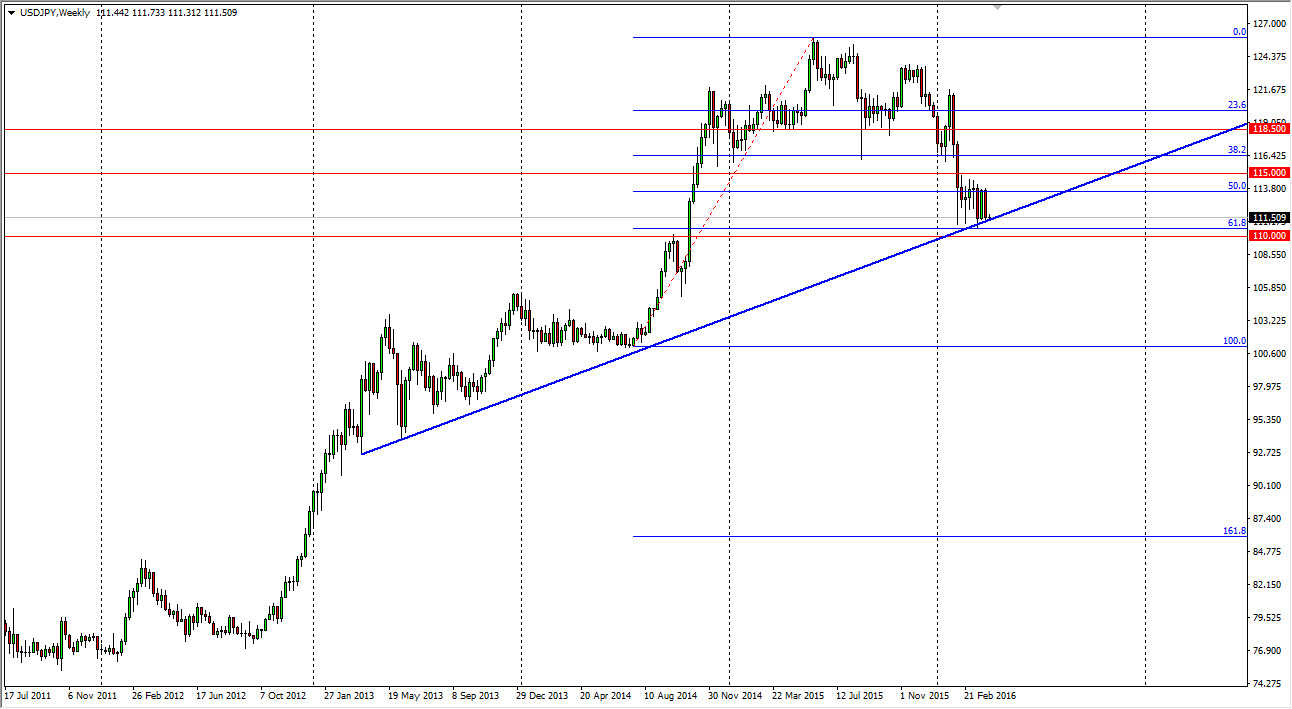

The USD/JPY pair has fallen quite a bit during the first part of the year, but quite frankly we are starting to reach fairly significant areas of support. I can make an argument for several different supporting factors. For example, we have the 110 level just below which of course is a large, round, psychologically significant number, and was an area of resistance in August 2014. We also have an uptrend line that we are approaching at the moment, which has been fairly reliable. A bounce from there would not be surprising at all.

Finally, I can make an argument for the 61.8% Fibonacci retracement level being just below the uptrend line and just above the 110 level. This was from the latest surge higher, and because of this I have to believe that there are several technical traders out there looking at this general vicinity.

Risk appetite

Keep in mind that this pair tends to be fairly sensitive to risk appetite, and we will have to pay attention to the various stock markets around the world to determine whether or not it’s likely that the USD/JPY pair continues to rise. However, there’s nothing on this chart at the moment that suggests that it won’t continue to do so. Because of this, I feel that the pair is going to be slightly bullish this particular month. This will be even more so if the Federal Reserve suggests that they are going to move forward with the rate hikes.

On top of that, you can never forget about the Bank of Japan. The Japanese central bank is one of the most dovish in the world, and will continue to drive down the value of the Yen if they get a chance. They rely heavily on exports, and a cheaper currency helps fuel those sales that are so desperately needed. With this, I am mildly optimistic for the month of April when it comes to the USD/JPY pair.