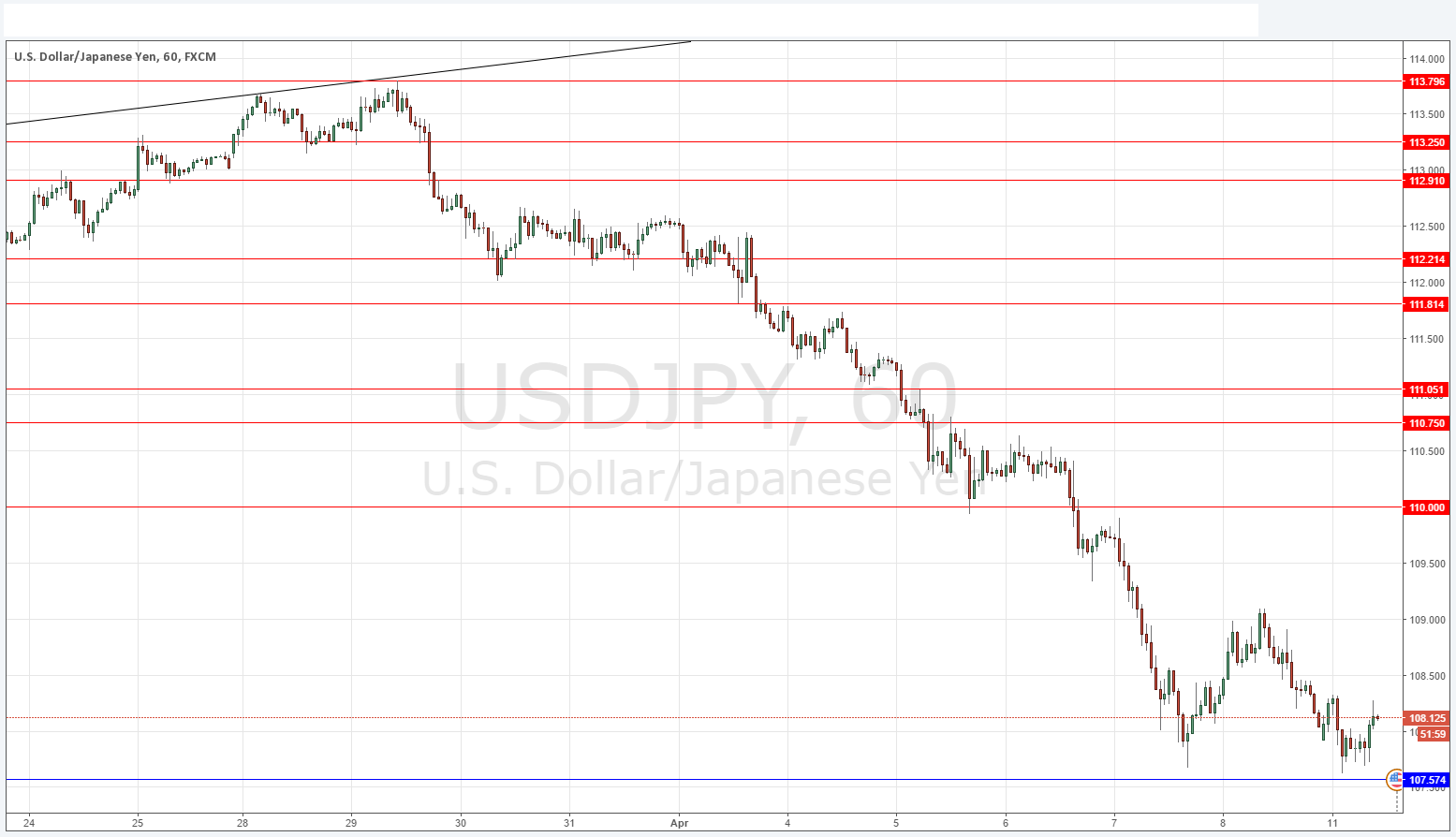

USD/JPY Signal Update

Last Thursday’s signals were not triggered.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be entered between 8am New York time and 5pm Tokyo time only.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 110.00.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 107.57.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

There are finally some signs of this pair bottoming out as the price got very close to the anticipated support level of 107.57 which was a key price area about 18 months ago when this pair was on its way up. However there are still signs of strong bearishness so it is too early to call a change.

There may be minor resistance at 108.25, 108.50 and 109.00 so if you really want to try short trades there could be minor pullbacks that will take us to these levels. If the price rises strongly past them, it would be a bullish sign.

Regarding the USD, there will be an announcement by the Federal Reserve at some time today concerning discount rates. There is nothing due concerning the JPY.