USD/JPY Signal Update

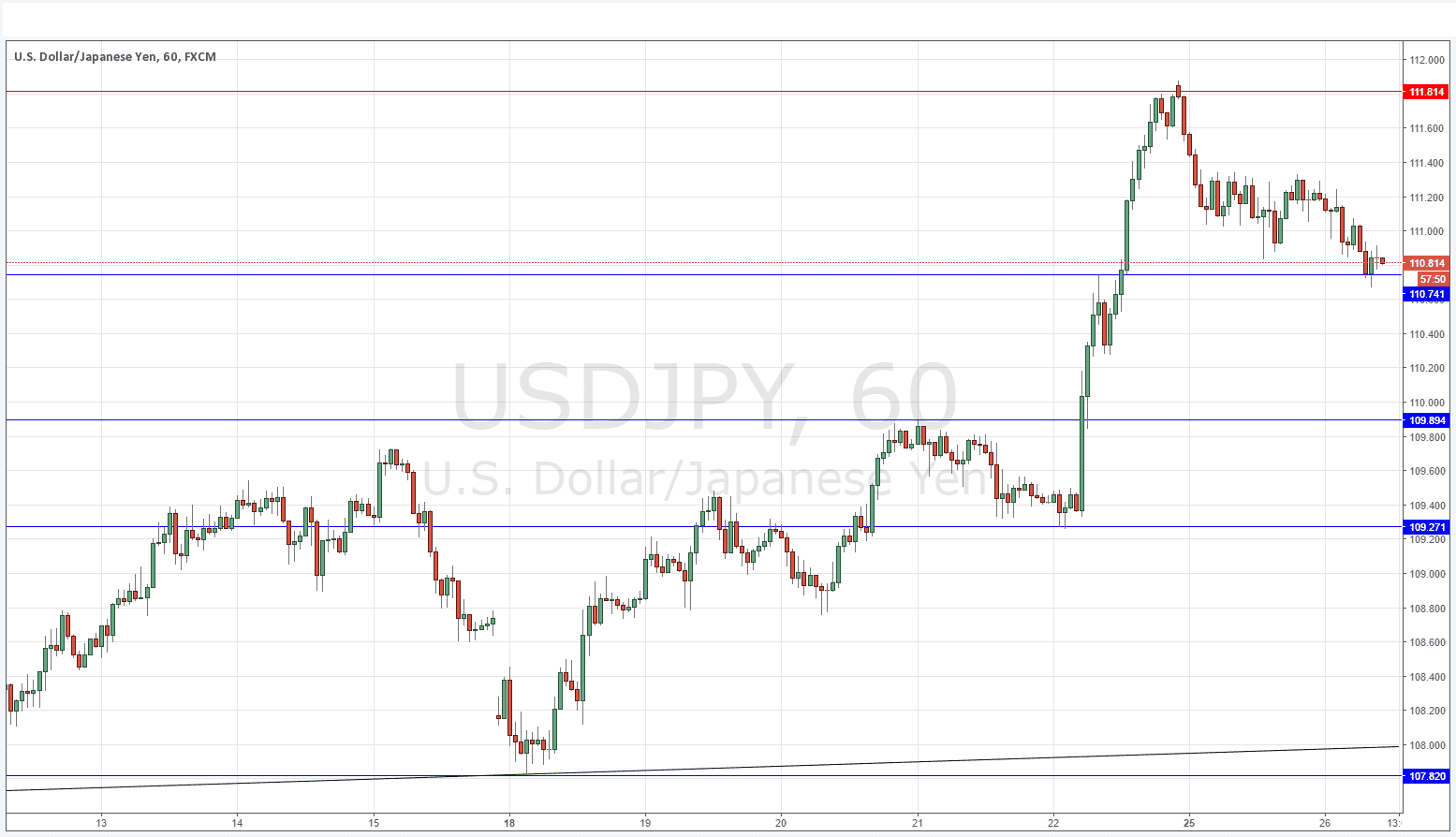

Yesterday’s signals were not triggered as the price did not reach 110.74 during the Tokyo session.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be taken between 8am New York time and 5pm Tokyo time.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 111.81 or 112.21.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trades

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 109.48 or 109.27.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

After last week’s strongly bullish move following a perception that the Bank of Japan would begin to extend negative interest rates, the Yen has rallied somewhat and this pair has fallen back to the closest support level, where it now sits at the time of writing. It is hard to forecast what is most likely to happen next ahead of the FOMC Statement due tomorrow. However it can be said looking at the chart that the primary movement still seems to be bullish, even though the pair is within a long-term bearish trend.

Regarding the USD, there will be a release of Core Durable Goods Orders data at 1:30pm London time, followed later by CB Consumer Confidence data at 3pm. There is nothing due concerning the JPY.