USD/JPY Signal Update

Yesterday’s signals were not triggered.

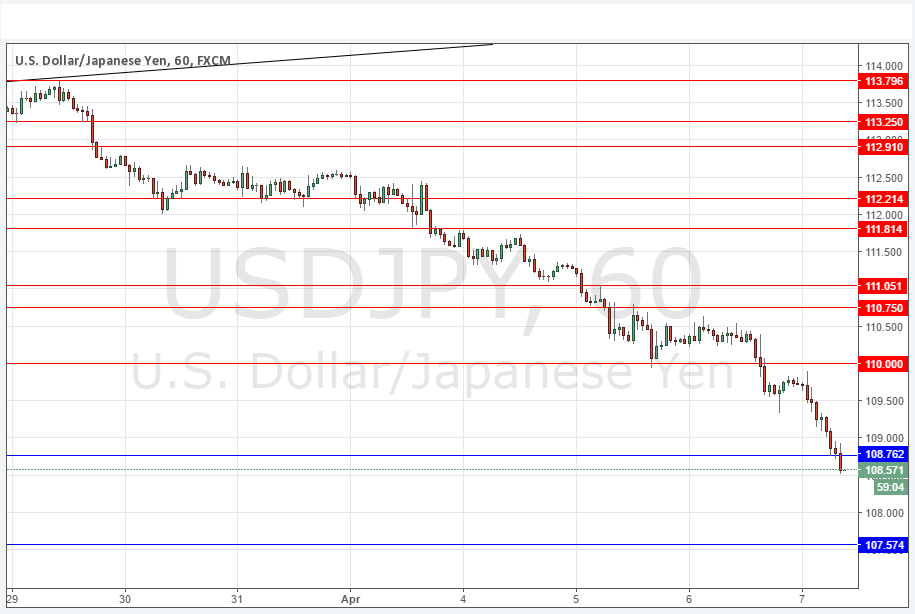

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be taken from 8am New York time to 5pm Tokyo time.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 110.00.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 107.57.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

All that can really be said is that this pair is wildly bearish. The price just keeps falling, slicing through levels of anticipated support, and has just cut through 108.76 by more than 20 pips as at the time of writing. It looks as if there is no key level that might hold the fall until 107.57, which would be quite confluent with a key psychological number at 107.50.

However things are so bearish you can make money just by selling any short-term bullish pullback, but that can be dangerous. It might be worth the risk provided you only try it once and do not get greedy.

Technically, it is worth noting that when you have an area where the price moves very quickly, when the price finally reverses back through that same area, it often also does so with great speed. This certainly applies to the kind of price range we are in now, which 18 months ago was the subject of a meteoric rise, so it is not so surprising that the price is falling here extremely quickly and strongly.

Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time. There is nothing due today concerning the JPY.