The USD/MXN pair has recently been selling off, just as we have seen happen against the US dollar against several other currencies. Granted, many of you may or may not trade the Mexican peso, but it is one of the more important currencies when it comes to other markets. The Mexican peso is used as a proxy for most of Latin America, and of course has an oil related component to it. A large portion of the oil rigs in the Gulf of Mexico and in the Caribbean are owned by Mexican companies. Because of this, it is a bit of a petrocurrency.

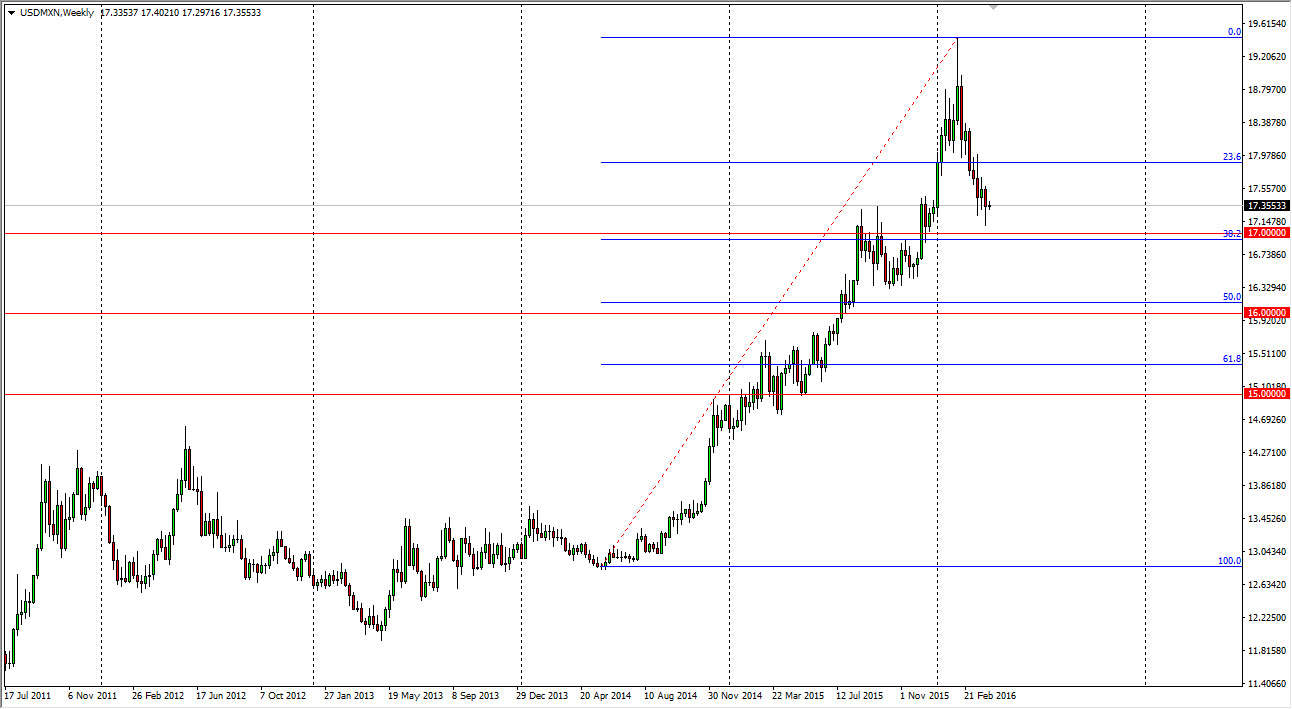

With this being said, I cannot help but notice that we are approaching an interesting technical level. The 17 and oh of course is a large, round, psychologically significant number, but it also represents the 38.2% Fibonacci ratio from the rally that started in the middle of 2014. With oil markets rallying so much lately, but starting to struggle again, this could be a sign that the US dollar will continue to rise, not only against the Mexican peso but against several of the other commodity currencies such as the Norwegian krone, Canadian dollar, and the like.

Oil

Pay attention to oil markets, they seem to be struggling with the $42 level. That’s an area that is vital in the WTI Crude Oil markets, which can be used as a tertiary indicator when it comes to the USD/MXN pair. If you don’t have the ability to buy this particular currency pair, the USD/CAD pair can also work as it is in very similar shape.

Keep in mind that the spread is kind of high for this particular pair, and it tends to be one that you need to trade for the long-term move. However, keep in mind also that the pip value in the Mexican peso is much smaller than other currencies, so don’t let the spread dissuade you from trading.