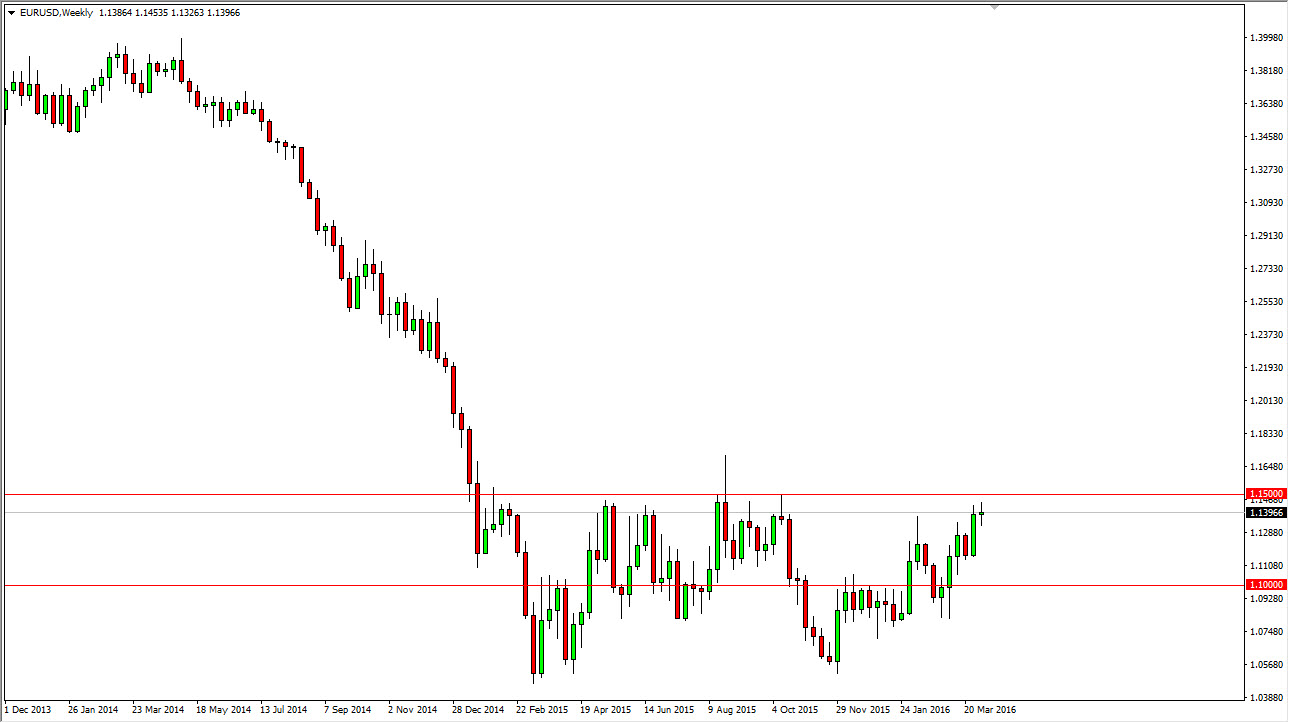

EUR/USD

The EUR/USD pair went back and forth during the course of the week, as we continue to bounce around the 1.14 level. Ultimately, the 1.15 level above should continue to be resistive, and as a result I think that we will continue to struggle to get above that level. Pullbacks should be thought of as value though, so I’m willing to buy those.

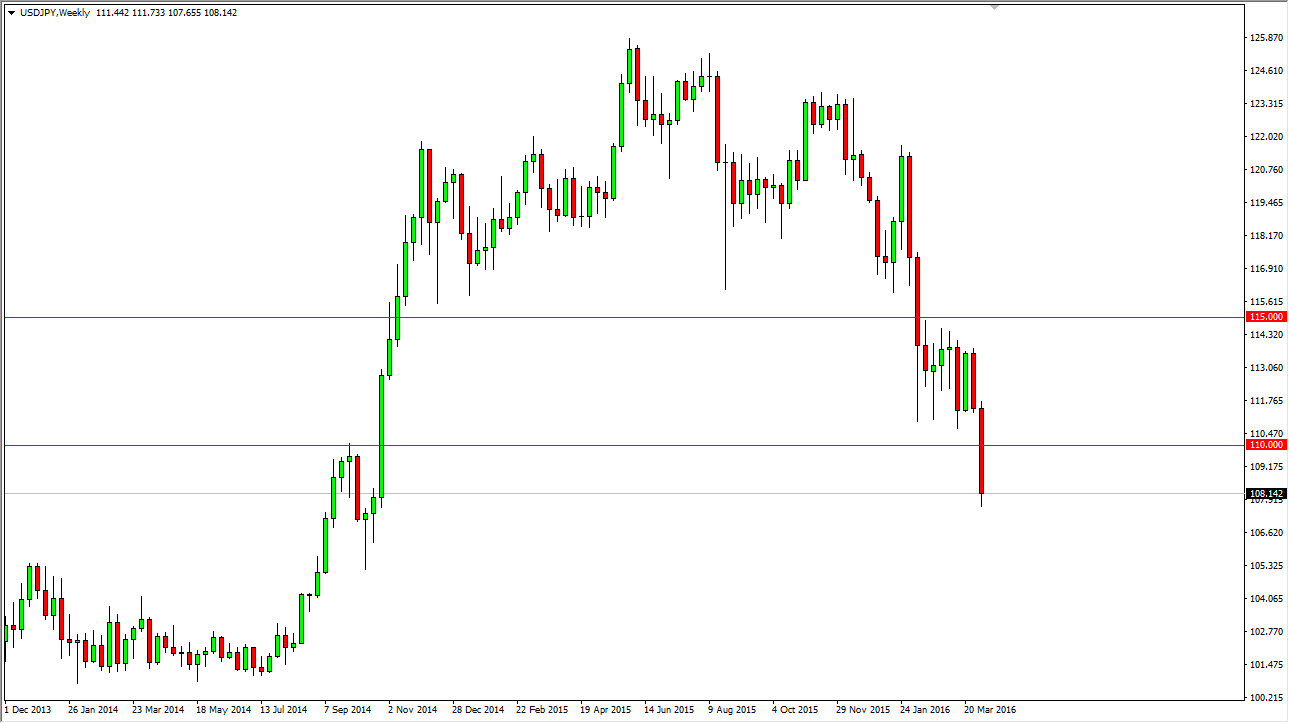

USD/JPY

The USD/JPY pair broke down during the course of the week, slicing through the 110 level. With this, it looks like we will probably go down to the 105 handle, so at this point in time I am willing to sell short-term rallies that show signs of exhaustion. It’s not until we break above the 110 level that I am willing to start buying this pair again. And I believe that the 105 level below will be supportive though, so having said that it’s only a matter of time before buyers reenter the market.

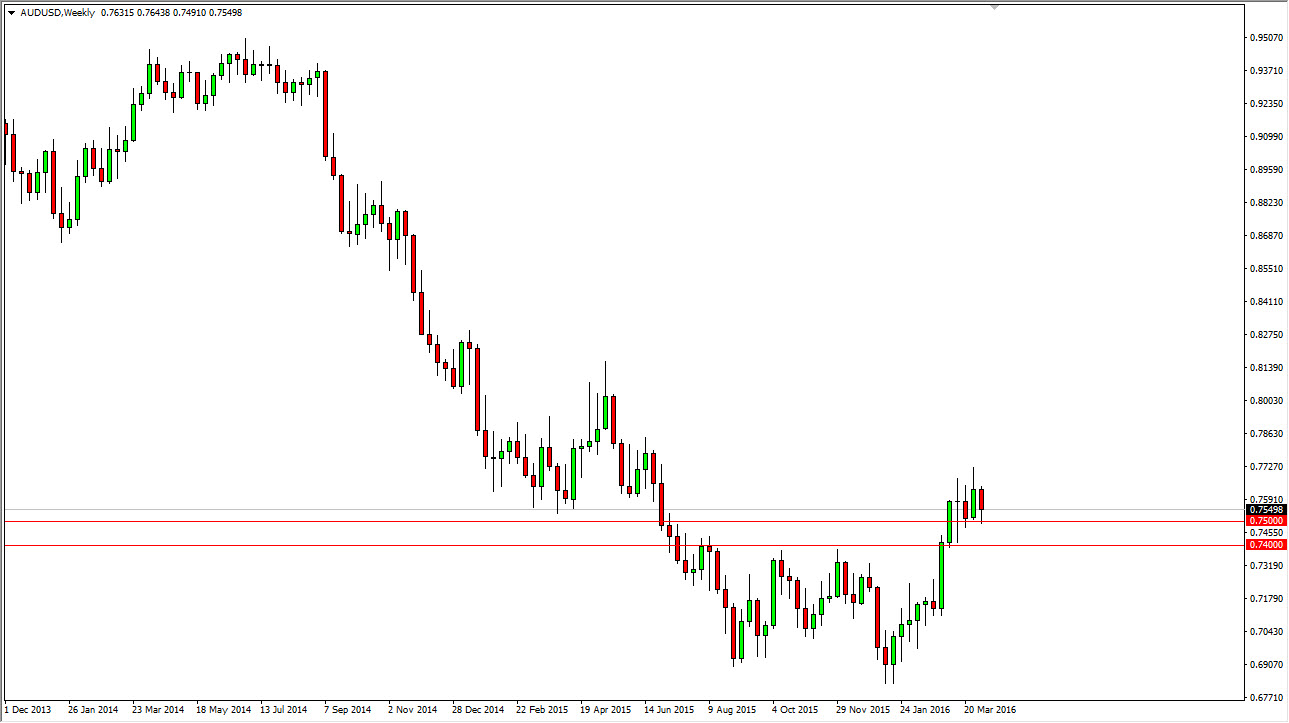

AUD/USD

The AUD/USD pair fell during the course of the week, testing the 0.75 level for support. We did bounce from there, so I believe that the Australian dollar will have a slightly positive week. I believe that we will probably continue to consolidate overall though, so I’m not expecting a move above the 0.77 handle this week, but I do expect short-term rallies from time to time.

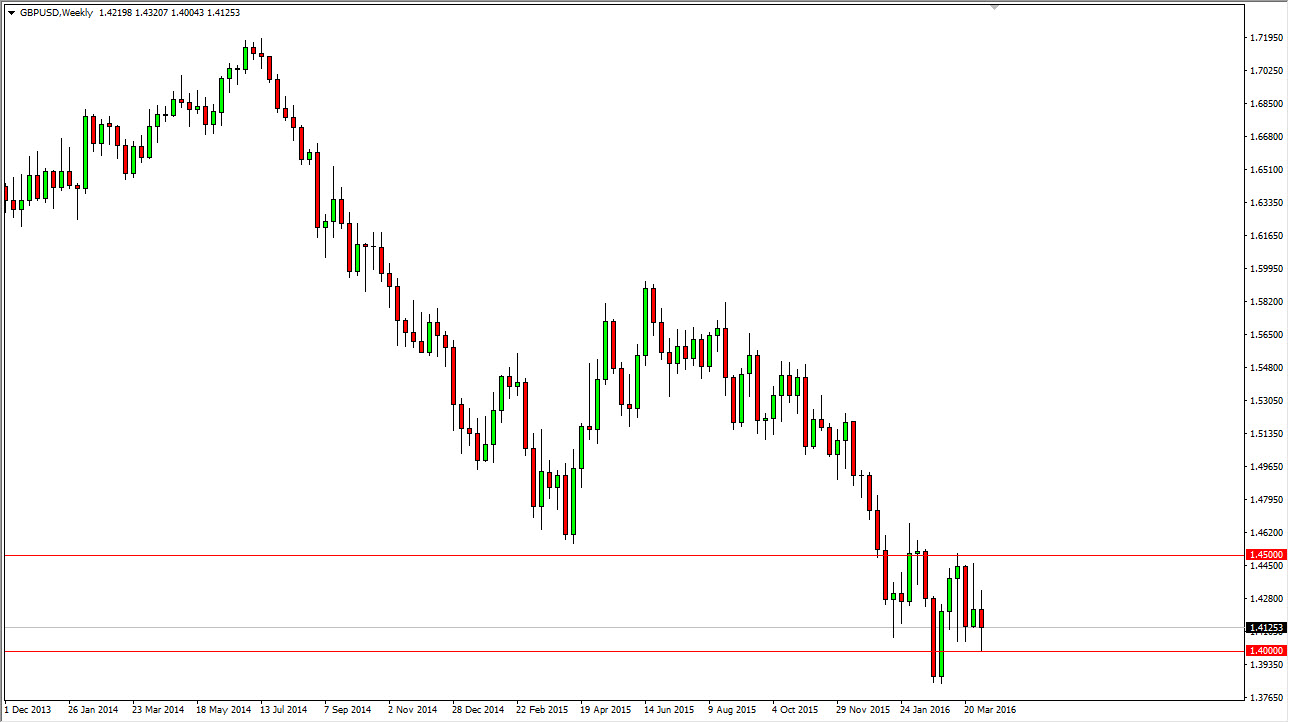

GBP/USD

The GBP/USD pair went back and forth during the course of the week, testing the 1.40 level for support. In fact, we ended up forming a hammer during the week, based upon that level. Ultimately, I believe that this market will continue to bounce back and forth between the 1.40 and the 1.45 level above. At this point though, I think that we are more likely to see buying pressure them selling, and with that being the case I think it’s only a matter of time before the British pound not only rallies, but turned right back around yet again.