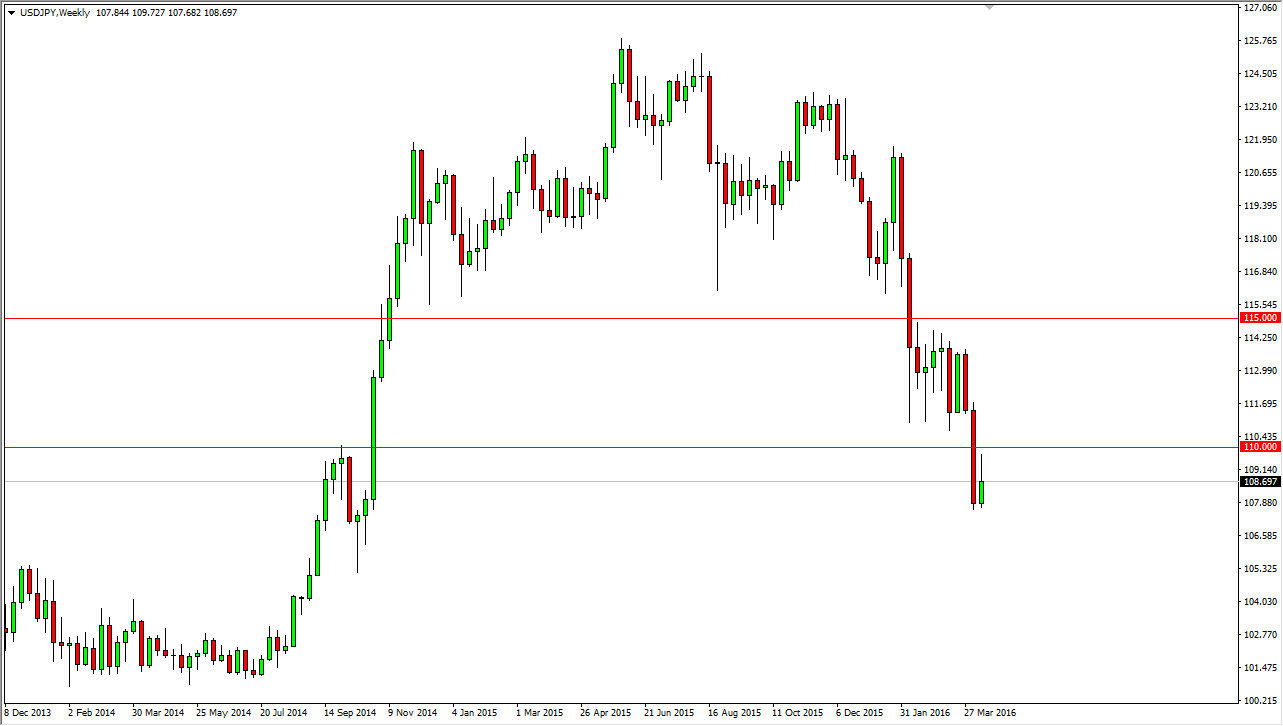

USD/JPY

The USD/JPY pair initially tried to rally during the course of the week, but turned right back around just below the 110 level. Because of that, it looks as if the market will more than likely continue to show quite a bit of resistance. Ultimately, it is not until we get above the 111 level that I’m comfortable buying.

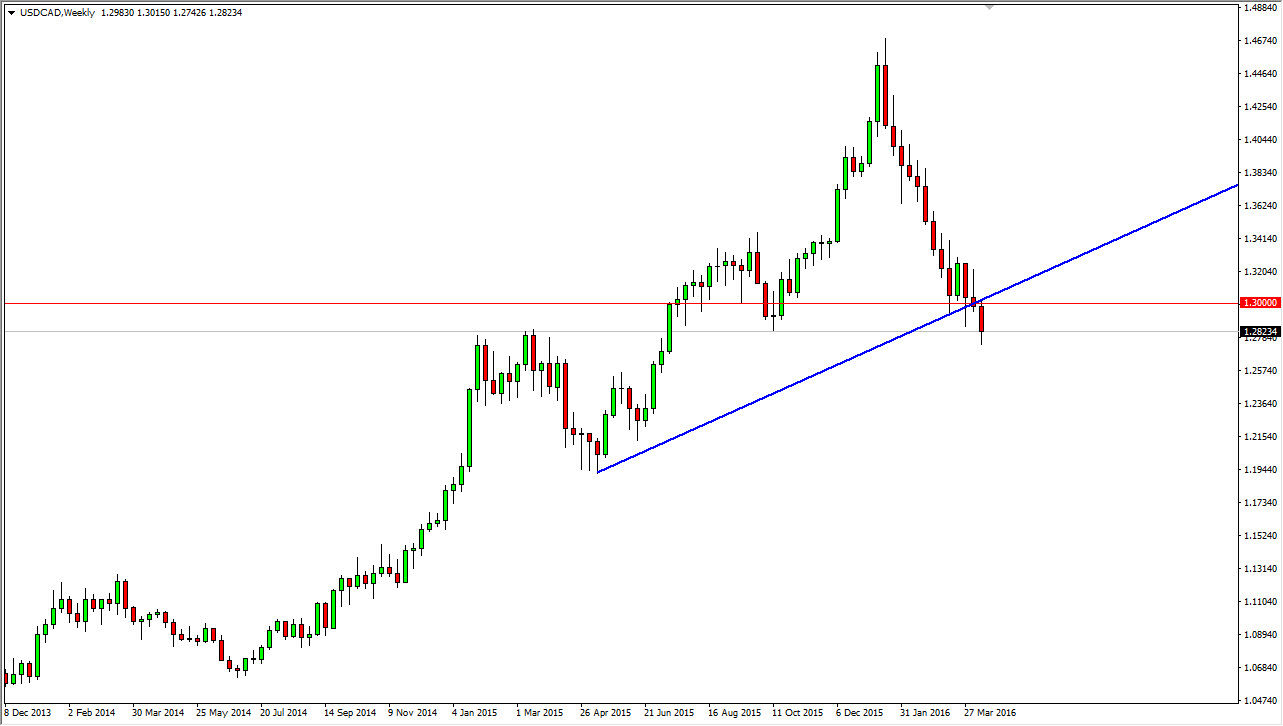

USD/CAD

The Canadian dollar continued to show quite a bit of strength over the course of the week, breaking towards the 1.28 handle. If we rally from here, it is not until we are well above the 1.30 level that I’m comfortable buying. At this point in time, I believe that rallies will continue to be sold off on shorter-term time frames. Keep in mind that the oil meeting on Sunday will have a massive influence on oil markets, which of course means that it will have a major influence on the Canadian dollar.

EUR/JPY

The EUR/JPY pair initially rose during the course of the session’s that made up this previous week, but we ended up turning back around and forming a shooting star on the weekly chart. A break down below the bottom of the shooting star, or even better yet the recent low, should send this market down to the 120 handle. Rallies will more than likely selloff as we are in a massive downtrend.

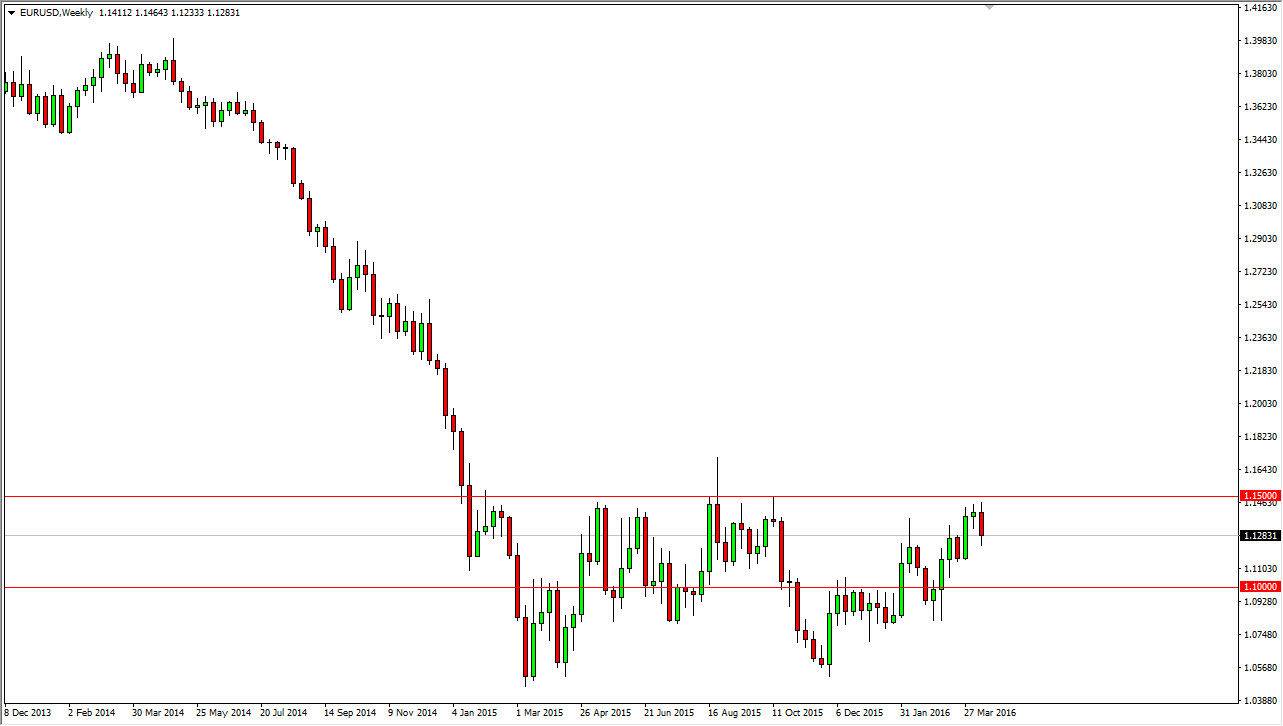

EUR/USD

The EUR/USD pair fell rather significantly during the course of the week, after initially trying to break above the 1.15 handle. However, there is a lot of noise underneath so I believe that although we may have a negative candle, it’s only a matter time before the buyers reenter this market in my estimation.