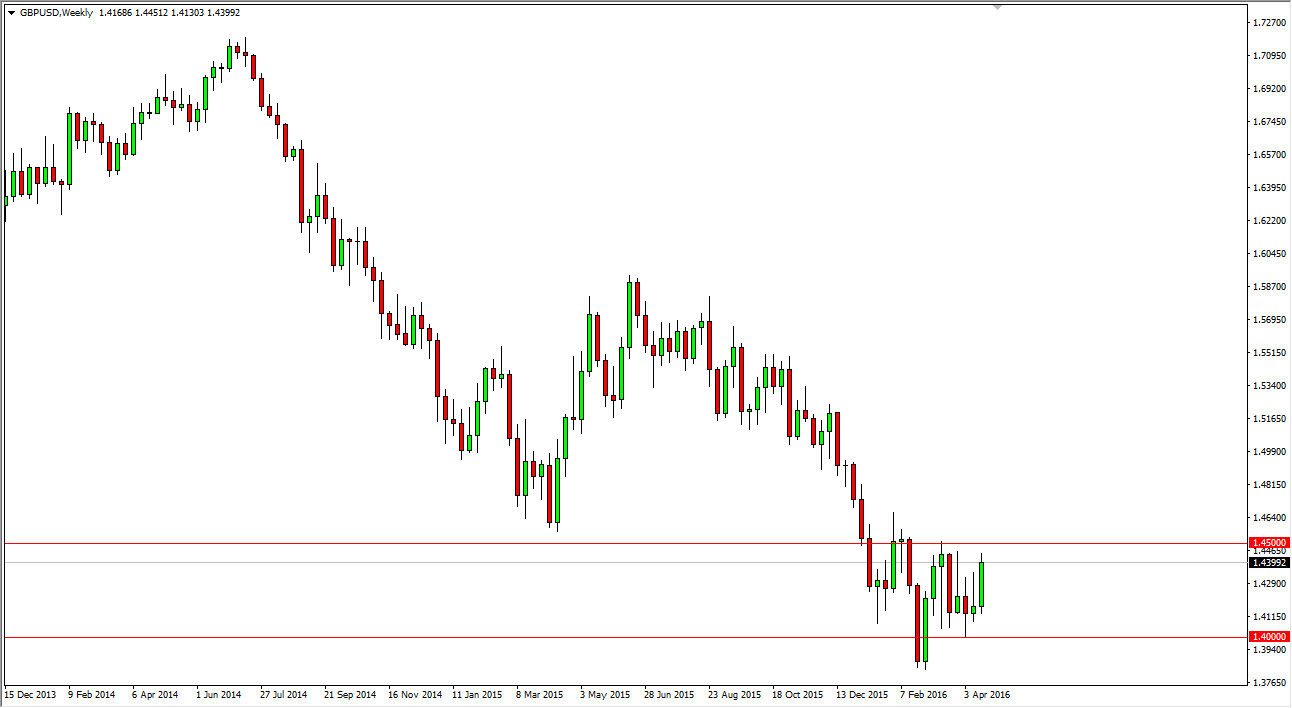

GBP/USD

The GBP/USD pair broke higher during the course of the weekend even broke above the top of the previous weeks shooting star. However, we are still very much in the consolidation area, so I’m looking to see whether or not we get some time been exhaustive candle between here and 1.45 in order to start selling again. If we break above the 1.45 level on a daily candle, then I can begin to start thinking about buying.

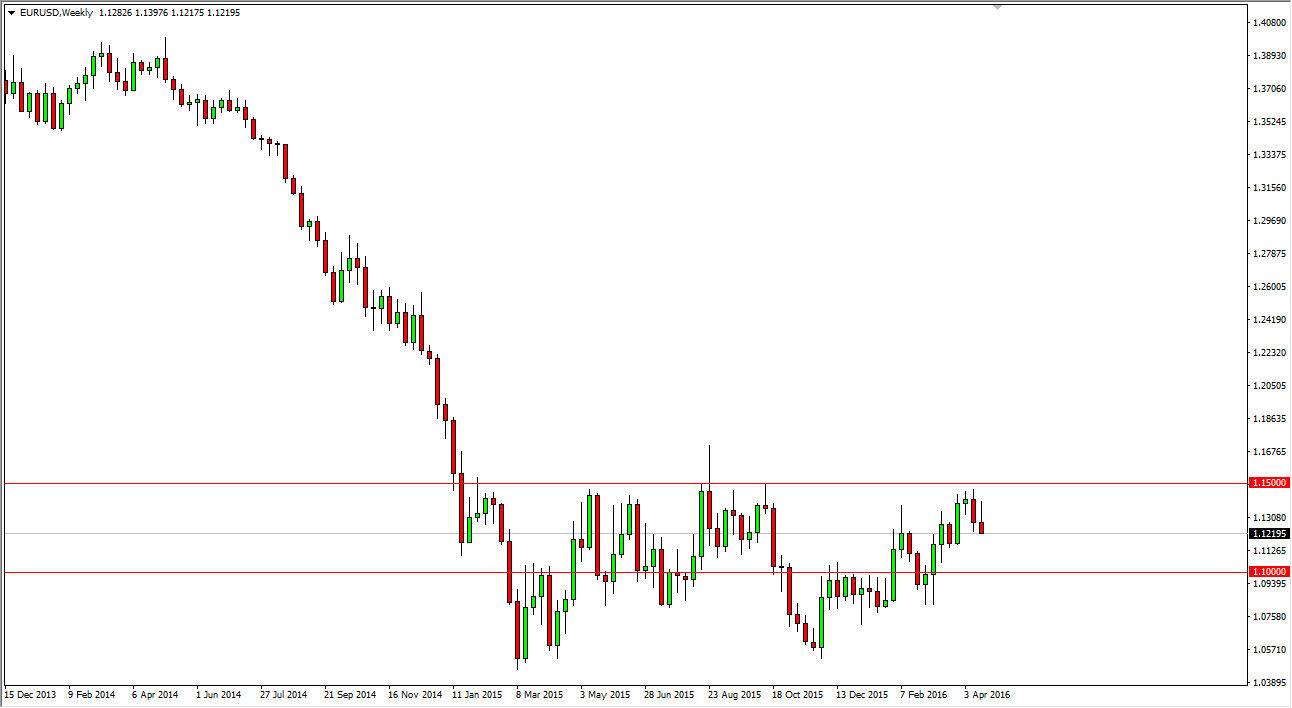

EUR/USD

The EUR/USD pair initially tried to rally during the week but turned right back around to form a shooting star. At this point in time, I believe that the market will try to break down, perhaps reaching back towards the 1.10 level. There is a bit of an overhang in this market, but at the end of the day I believe that we are essentially still stuck in the consolidation area.

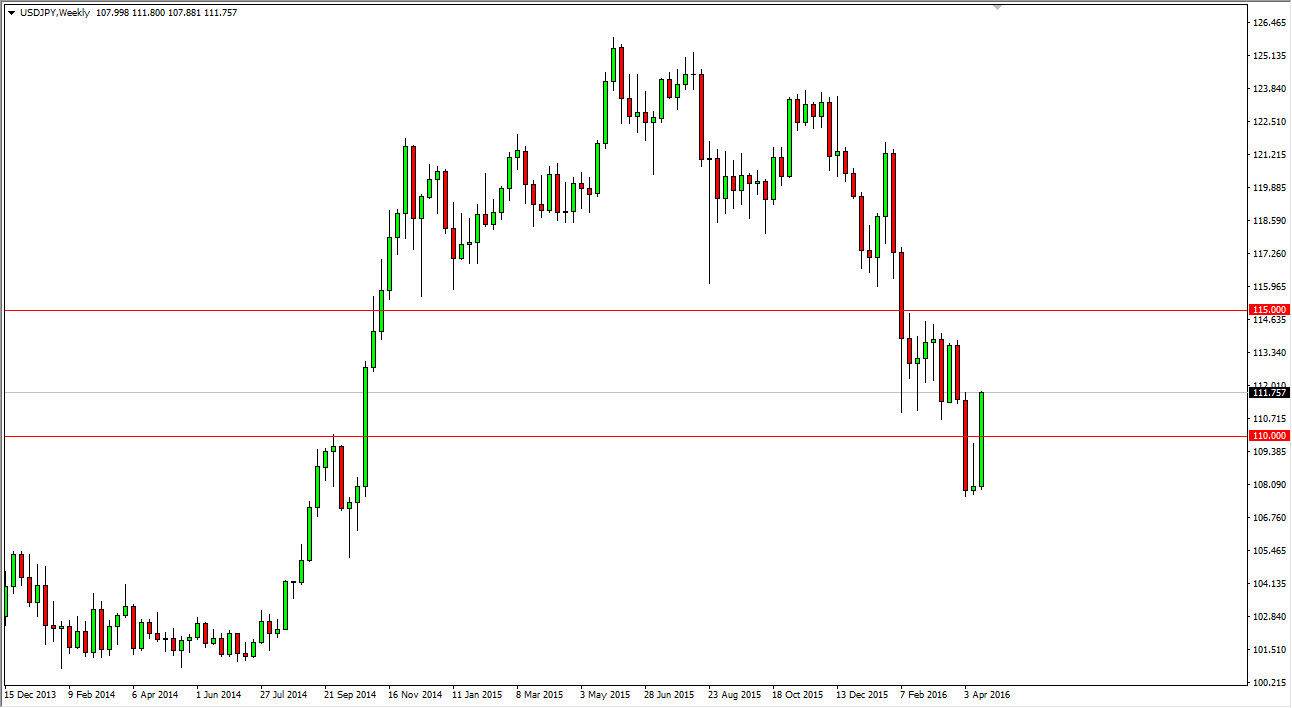

USD/JPY

The USD/JPY pair had an explosive move on Friday, and we have completely broken above the top of the shooting star from the previous week. Because of this, it looks like the market will continue to go higher and that pullbacks will more than likely be buying opportunities. I have no interest in selling this market now although I do recognize that we are starting to head towards pretty significant resistance.

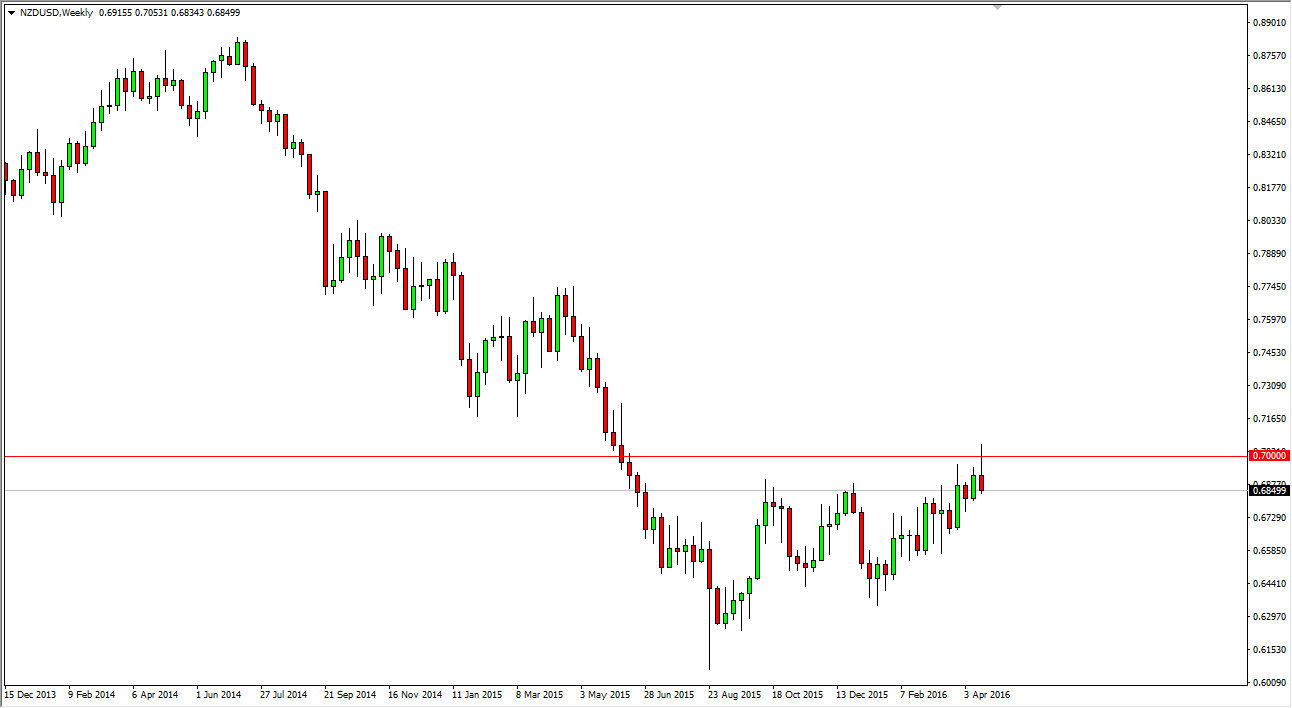

NZD/USD

This is one of the more important and interesting charts as far as I can see. We have formed a shooting star at the 0.70 level and of course that is a perfect place to see one. However, if we break down below the bottom of the shooting star I think that there is enough noise below that we will simply consolidate. If we break above the top of the shooting star for the week, we could go much higher. The one thing you can count on is that it is going to be volatile.