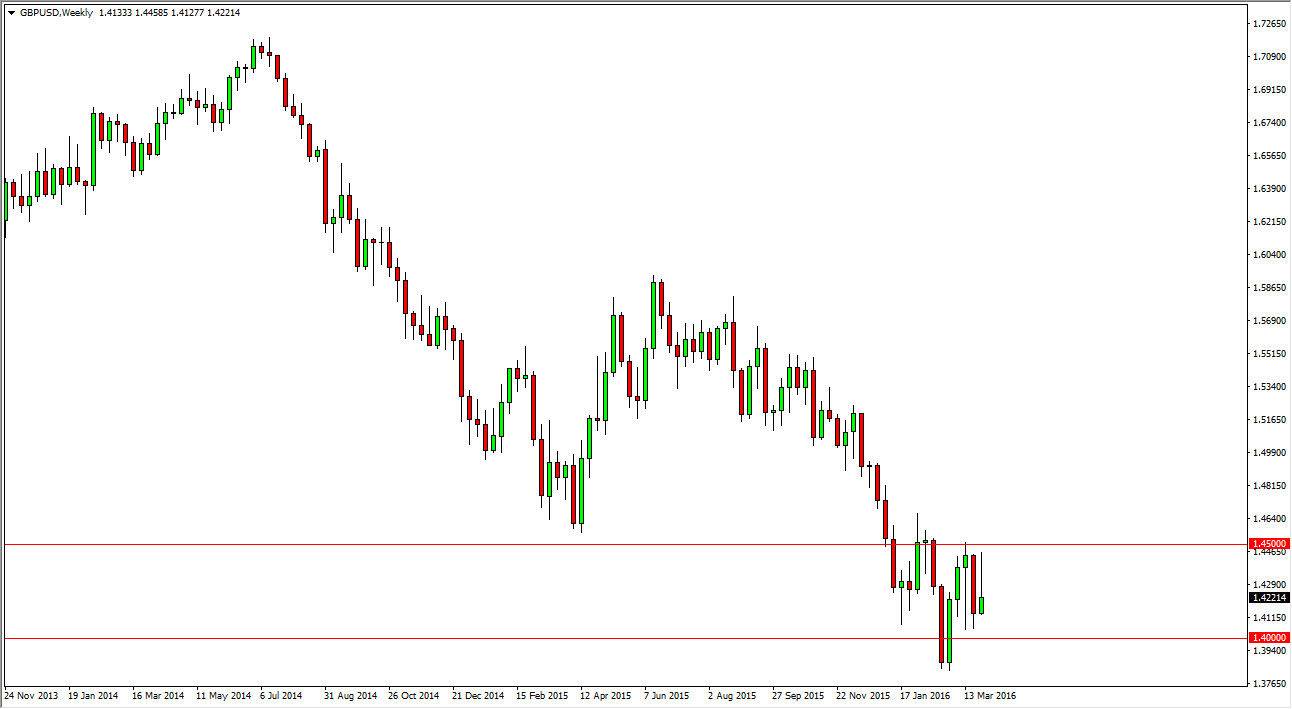

GBP/USD

The British pound initially tried to rally during the course of the week, but sold off drastically during the day on Friday. This resulted in a shooting star on the weekly chart, but I still believe that this market will continue to go back and forth overall, and consolidate between the 1.40 level on the bottom, and the 1.45 level on the top. This is mainly because the market has to worry about the British leaving the European Union, and the Federal Reserve stepping away from a couple of interest-rate hikes. Nonetheless though, I believe that short-term rallies should be sold for short-term trades. You could trade the other way, but I prefer the downward action at this point.

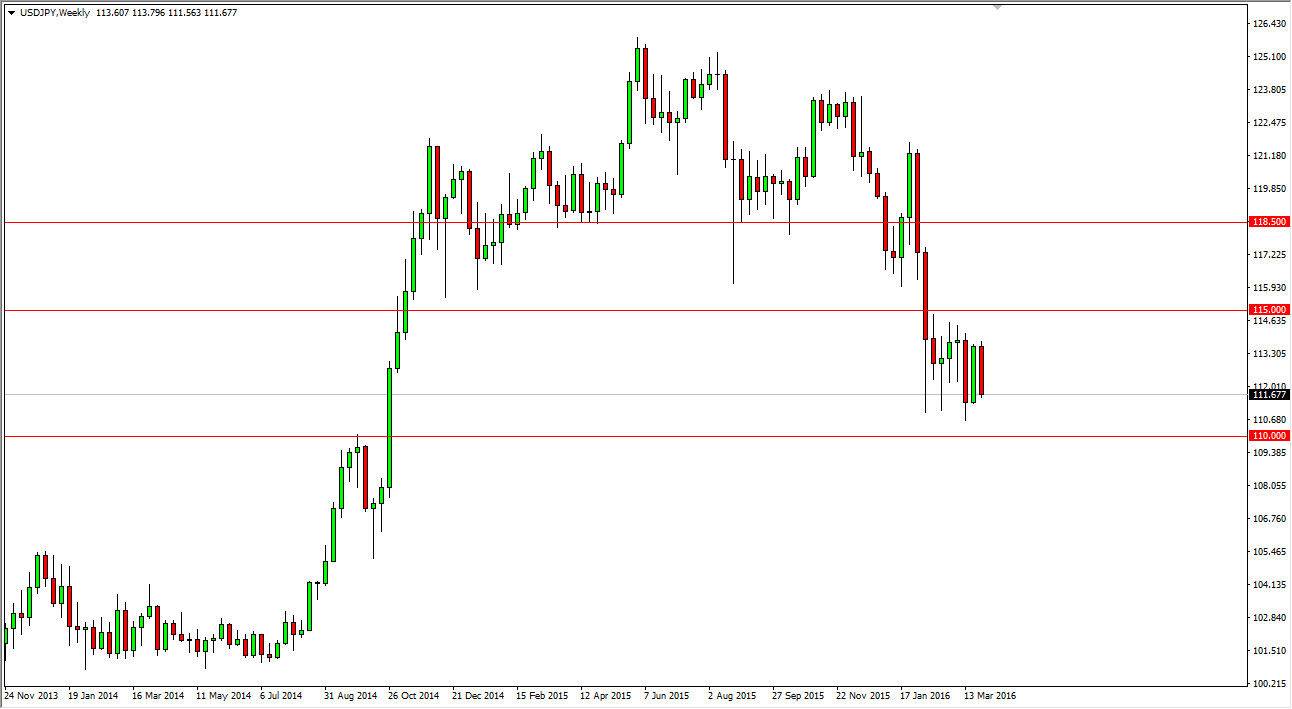

USD/JPY

The USD/JPY pair broke down during the course of the week, and looks as if it is trying to find the next major support level at the 110 handle. However, I believe that it will be a choppy affair, so short-term selling might be possible on short-term rallies, but I’m not looking for anything major out of this market this week.

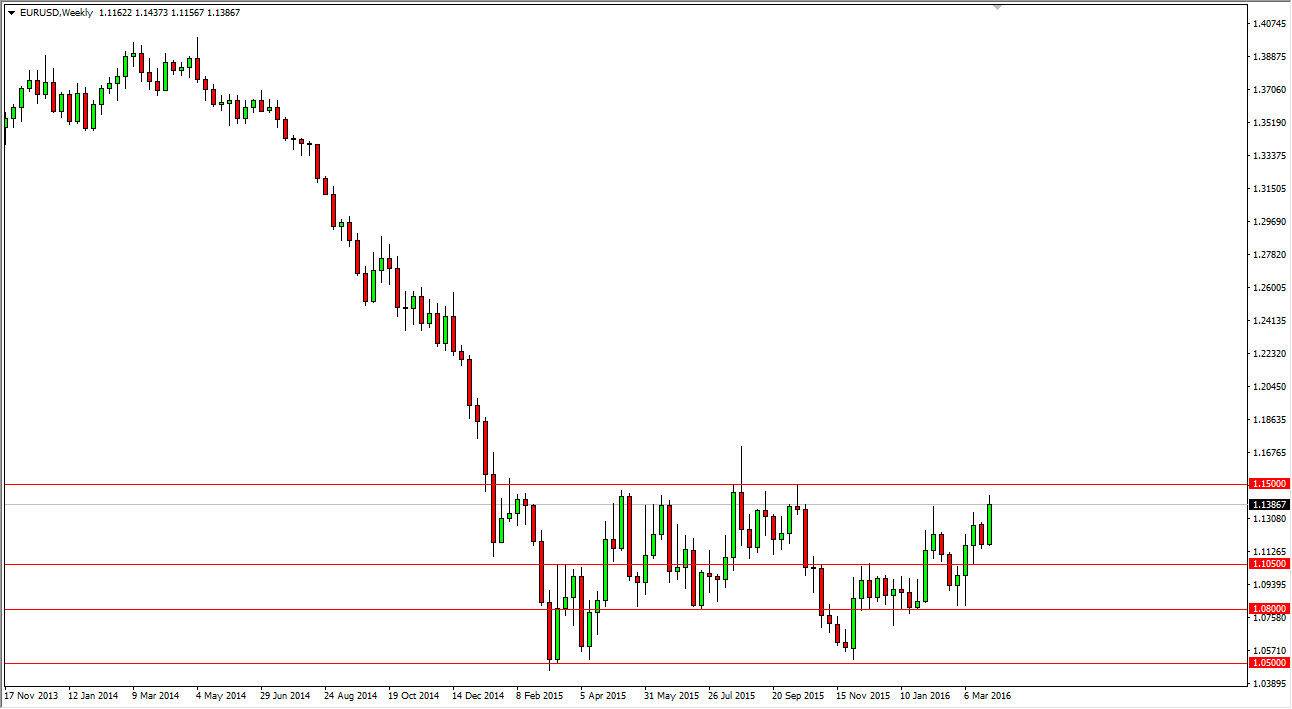

EUR/USD

The Euro rose during the course of the weekend and is testing a fairly significant barrier between 1.14 and the 1.15. With that being the case, I think we will pullback for short-term moves to the downside, but they should end up being attempts to break out. If we break above the 1.15 level, that would be massive in its implications.

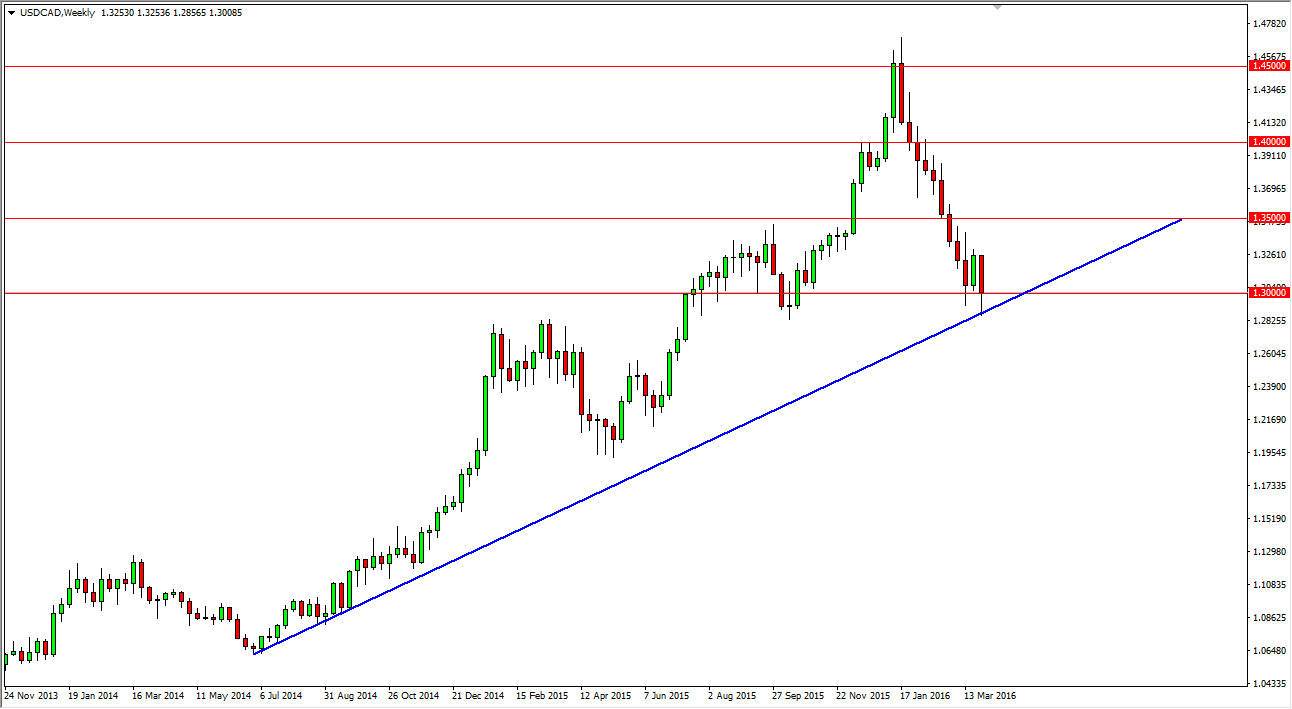

USD/CAD

The USD/CAD pair fell rather drastically during the course of the week but did bounce back to the 1.30 level. We are currently sitting on a massive uptrend line, so this point in time I think this particular we could be vital. If we can break above the top of the range for the week, this market will continue its longer-term uptrend move. On the other hand though, if we break down below the lows of the week, this could be disastrous for this market.