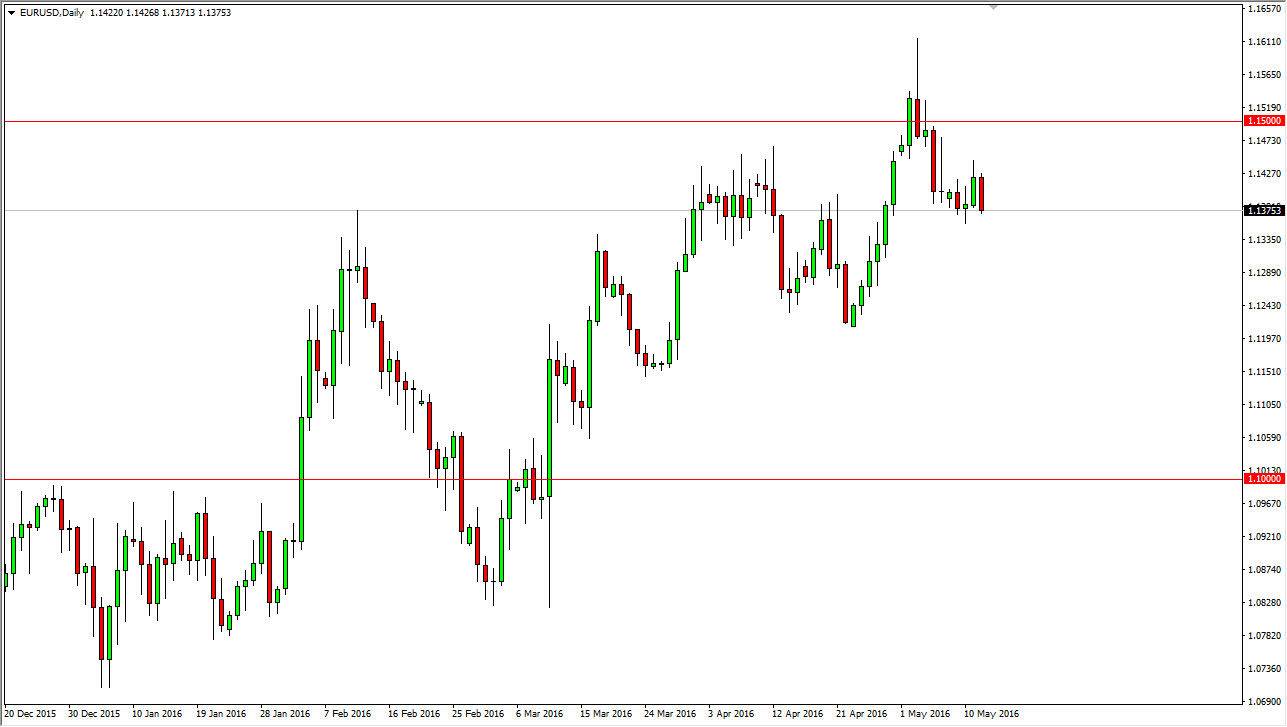

EUR/USD

The EUR/USD pair fell during the day on Thursday, as we continue to bounce around the 1.14 level. However, I think there is enough support just below to turn things back around and eventually we should reach towards the 1.15 level. After all, the Federal Reserve looks less likely to raise interest rates as quickly as one would have thought previously, and the market continues to come to grips with that. If we can break above the 1.15 level, we should continue to go even higher, perhaps reaching towards the 1.16 level. Every time we pullback from here, we should see supportive action and eventually a supportive candle in order to start going long. I don’t believe in shorting this market, as I believe there is a massive amount of noise between here and the 1.12 level.

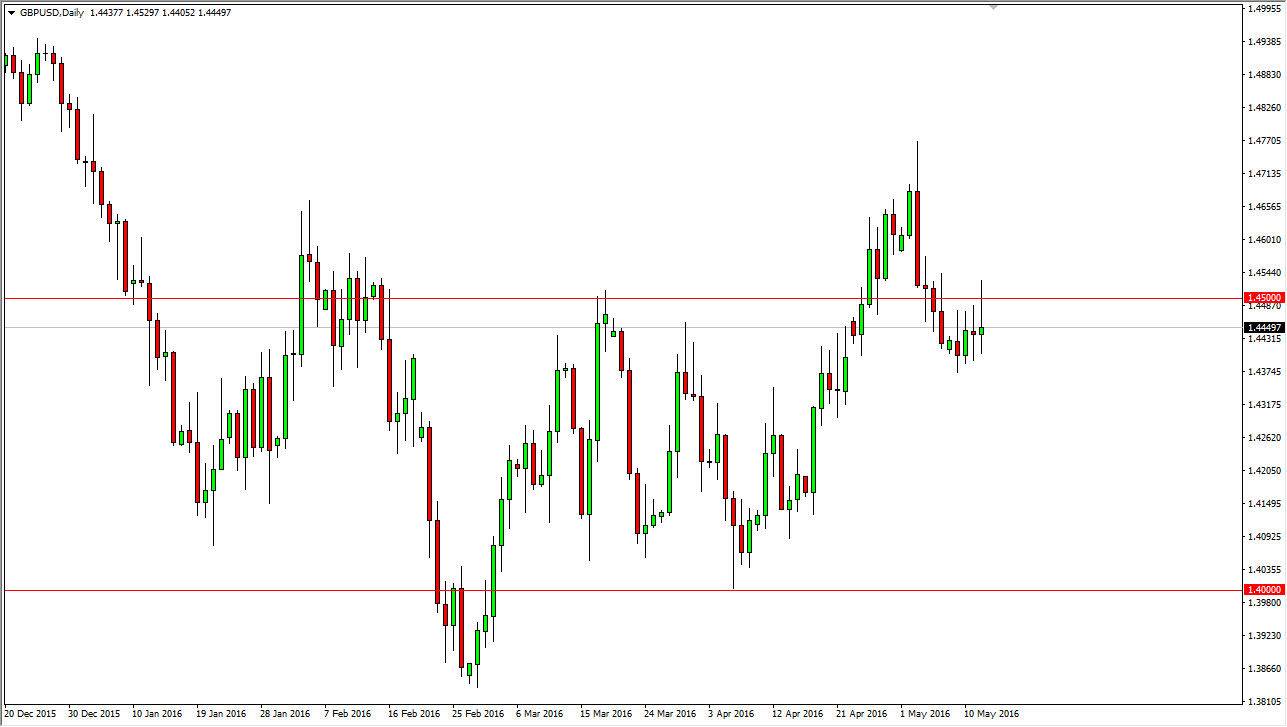

GBP/USD

The GBP/USD pair initially rallied during the day on Thursday but found enough resistance of the 1.45 level to turn things around and form a shooting star. The shooting star of course is a very negative sign, and as a result it is a sign that we could fall from here. If we can break down below the 1.44 level, I feel that the market could go to the 1.41 level but there is going to be a lot of noise between here and there. On the way, if we can break above the top of the shooting star, we could very well find ourselves going to the 1.4750 level. Needless to say, currency markets are going to be concerned about the possibility of the United Kingdom leaving the European Union, so that of course continues to weigh upon the British pound in general. Nonetheless, I believe that sooner or later we are going to continue to go higher given enough time. With this, a selling opportunity can present itself but I believe that short-term at best.