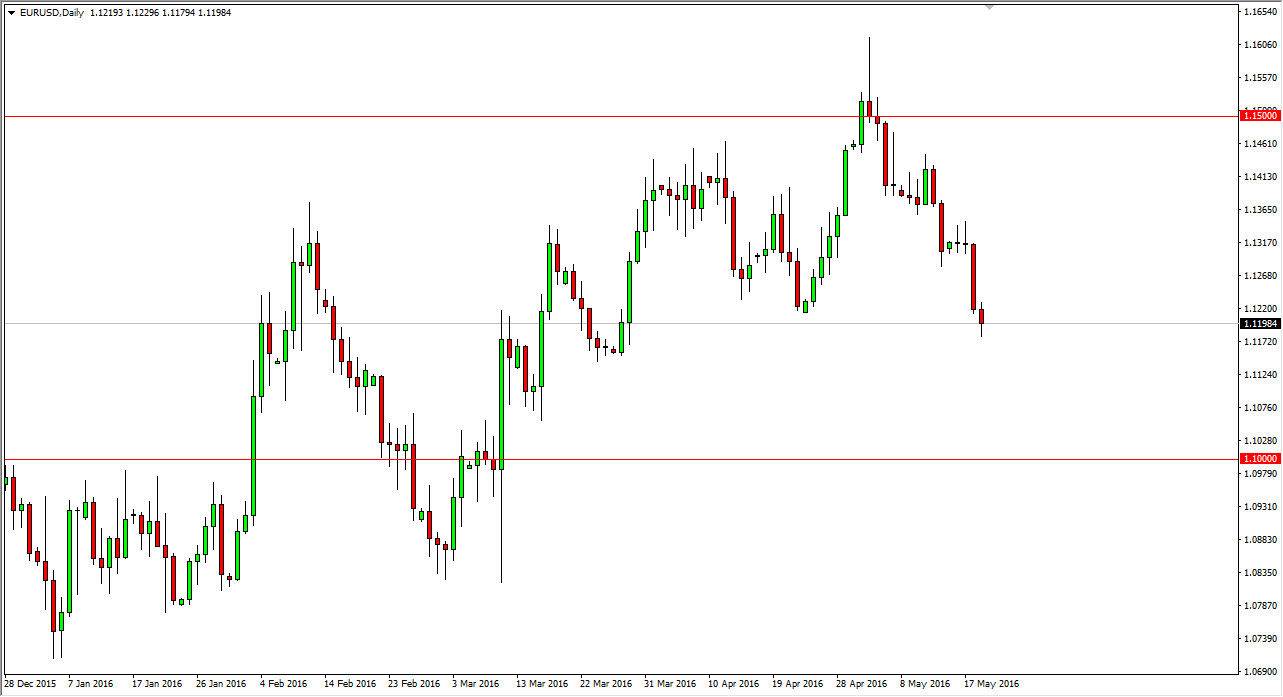

EUR/USD

The EUR/USD pair fell initially during the day on Thursday, but found enough support just below the 1.12 level to turn things around for a bit of a hammer. With this, the market should continue to go back and forth over the longer term in my opinion, so we can break above the top of the hammer. I believe that we will probably bounce towards the 1.1350 level next, and then possibly even the 1.15 level above that. On the other hand, if we break down below the bottom of the hammer, that is a very negative sign and could very well send this market down to the 1.10 level below. Either way, expect a lot of choppiness of volatility due to the current state of the Forex markets.

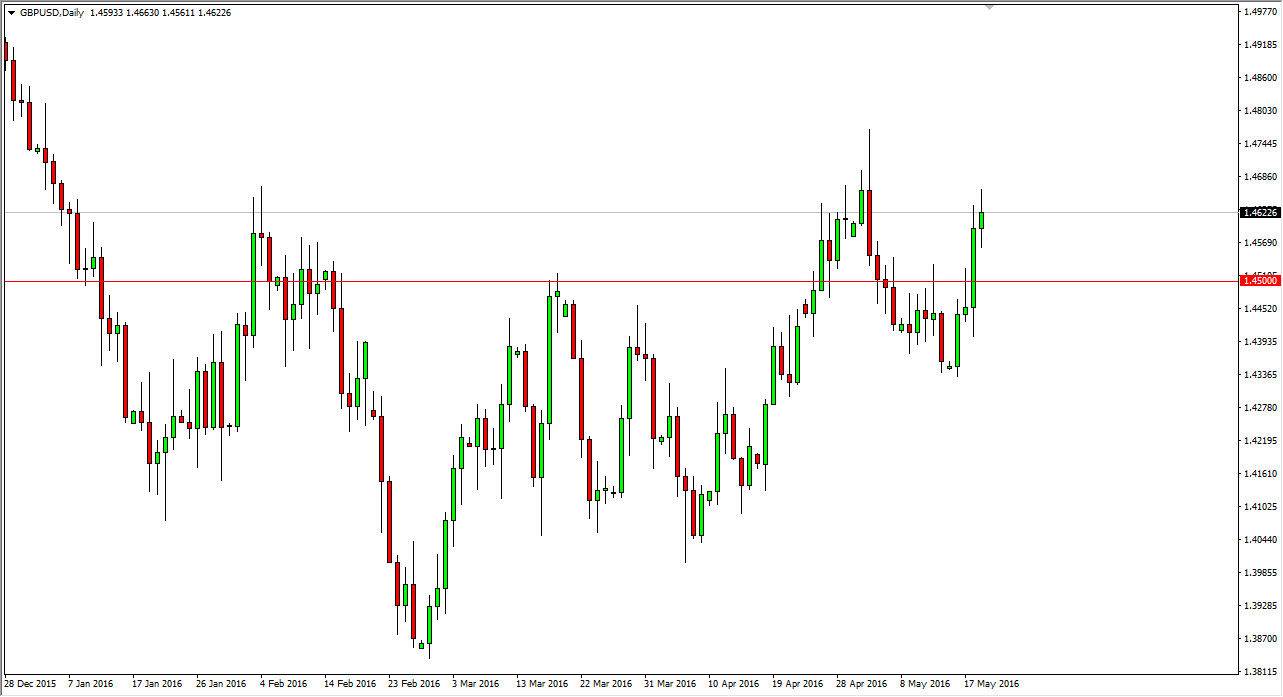

GBP/USD

The GBP/USD pair went back and forth during the course of the session on Thursday, as the market continues to show quite a bit of volatility after the move higher. The 1.450 level has been broken to the upside and is a very bullish sign, and with that being the case I have no interest in selling this market. If we pullback, I think that we would buying just above the 1.45 handle, as traders will continue to go higher. At this point in time, I believe that there should continue to be bullish pressure of a longer-term due to the fact that we have broken above the aforementioned 1.45 handle, and of course had such a massively green candle in doing so.

As far selling is concerned, I have no interest whatsoever in doing so, at least not until we break down below the 1.44 handle, and as a result I am looking for buying opportunities only at this point in time. Pullbacks should continue to find a lot of interest from people who have missed the move higher.