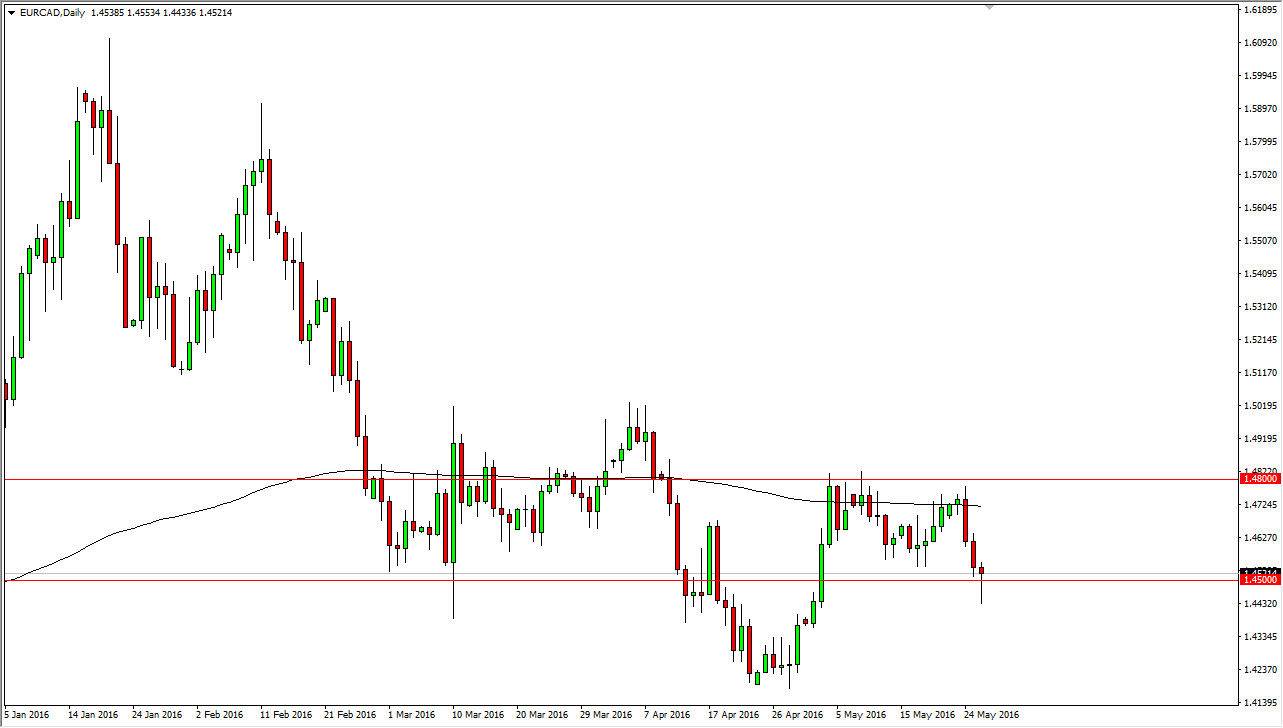

The EUR/CAD pair initially fell during the day on Thursday, breaking well below the 1.45 level. This of course is a large, round, psychologically significant number and an area that we’ve seen support and previously, so having said that it makes sense that we did find enough buying pressure there to turn the market back around and ended up forming a hammer. On the chart, I have the 200 day exponential moving average strong, which is fairly flat and sitting above so I think that we may have a bit of a “reversion to the mean” when it comes to this pair. On top of that, we have a hammer that suggests that we could get a bit of a bounce anyway. With this being the case I believe that this to be an interesting market to trade during the session.

Oil

We have to watch the oil markets as well, because obviously crude oil has a fairly significant effect on the value the Canadian dollar. The oil markets, both WTI and Brent, formed a shooting star during the day on Thursday, suggesting that the market is going to perhaps pullback. That should bring down the value of the Canadian dollar, and could very well make this market go higher. If we can break above the top of the hammer and if it coincides with the falling of the oil market, it makes a lot of sense that we would at least try to go back towards the top of the consolidation area which goes all the way up to the 1.48 level, which is slightly above the 200 day exponential moving average. With this, I would be willing to take profits somewhere closer to the 200 day exponential moving average.

Alternately, if we broke down below the bottom of the hammer, I believe that would be a very negative sign and it could send the market reaching down towards the 1.41 level, which was where we had bounced from in the month of April.