EUR/USD

The EUR/USD pair tried to rally initially during the day on Tuesday but turned right back around as we continue to see quite a bit of choppiness in this market. It appears that we are essentially hugging the 50 day exponential moving average as we have formed a bit of a neutral candle right on that indicator. I also think that the 1.13 level will continue to be an area of interest. The market has been steadily climbing over the longer term, but it has been choppy to say the least. Because of this, it would not surprise me at all to see the market continue to go higher, but it is not going to be easy to trade. We may very well be entering the “summertime” when it comes to trading and volatility absolutely disappears. Having said that though, we do get the FOMC Meeting Minutes today.

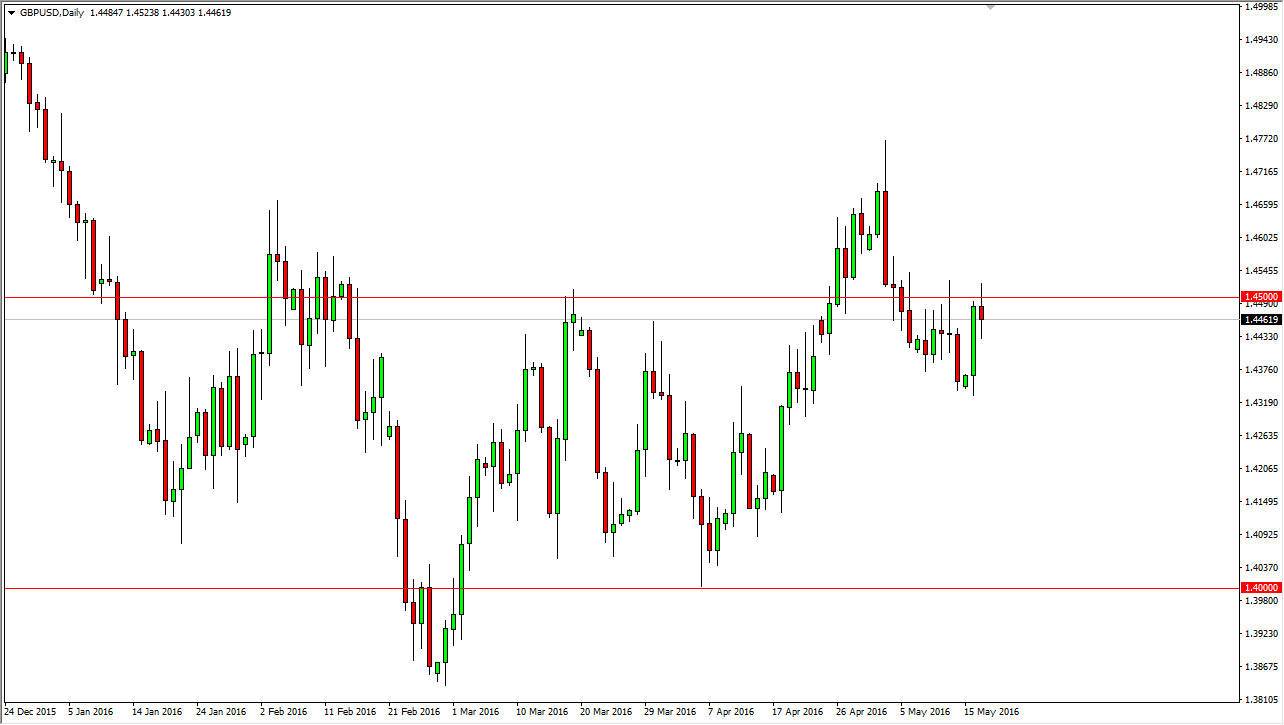

GBP/USD

The GBP/USD pair broke above the 1.45 level during the day but then dropped lower. This shows just how important this level is going to be as far as resistance is concerned, and as a result it would not surprise me at all to see this market continue to struggle to get above it for any real length of time. However, pullbacks from here will more than likely just be another attempt at bringing momentum back into the marketplace of the week and at least attempt to go higher. I think choppy conditions will be the norm, and quite frankly I’m just not interested in risking any money in this market at the moment as I see the risk of losing far too great for what little gains may show up in my account. With that being said, and impulsive move higher is what I’m actually looking for in order to start buying, but I would only do so after a daily close that was very green, and very impressive.