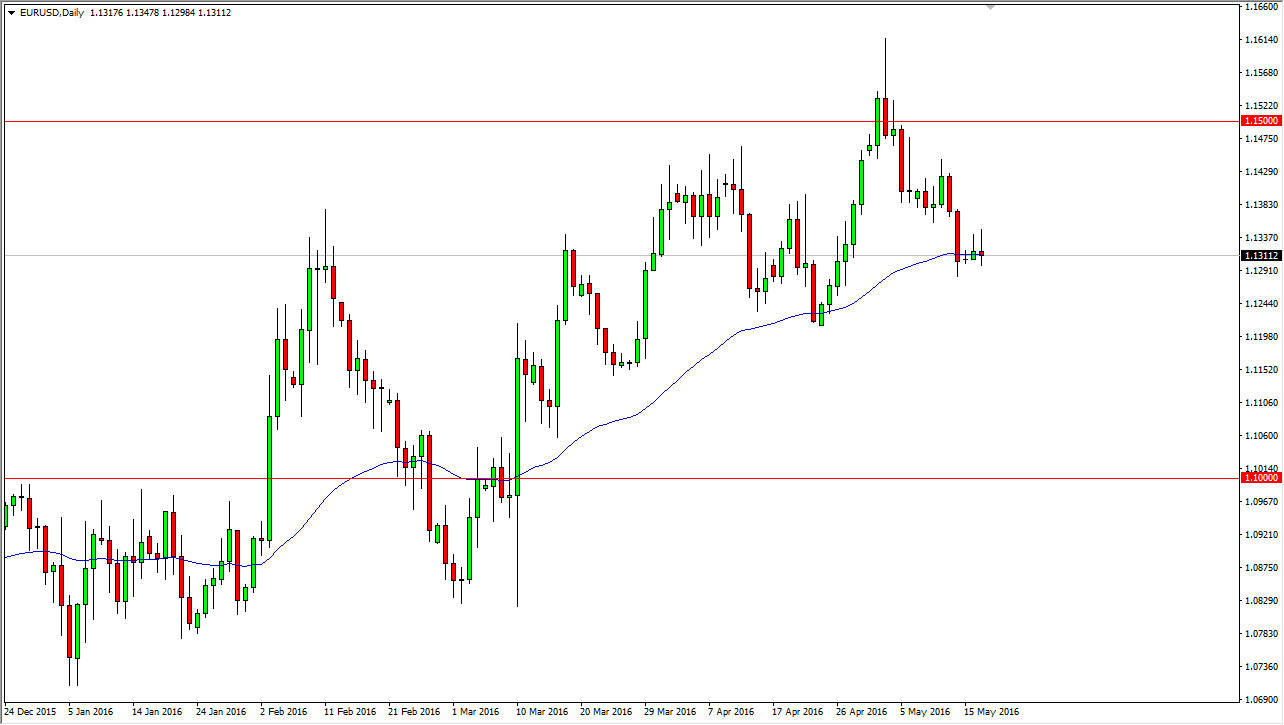

EUR/USD

The EUR/USD pair fell during the day on Wednesday, testing the 1.12 level for support. This is an area that I have felt the market would target, so now that we are down here we have to see what happens next. The fact that we are closing towards the bottom of the candle suggests to me that we are going to see more downward pressure, and with that being the case it’s likely that we will break down and perhaps even try to reach back to the 1.10 level. Ultimately, I believe that we will get a bounce again, as the market will continue to show quite a bit of volatility. Having said that though, I can see where we have broken below a significant amount of upward pressure, so in the short-term I believe that the sellers are going to have the upper hand.

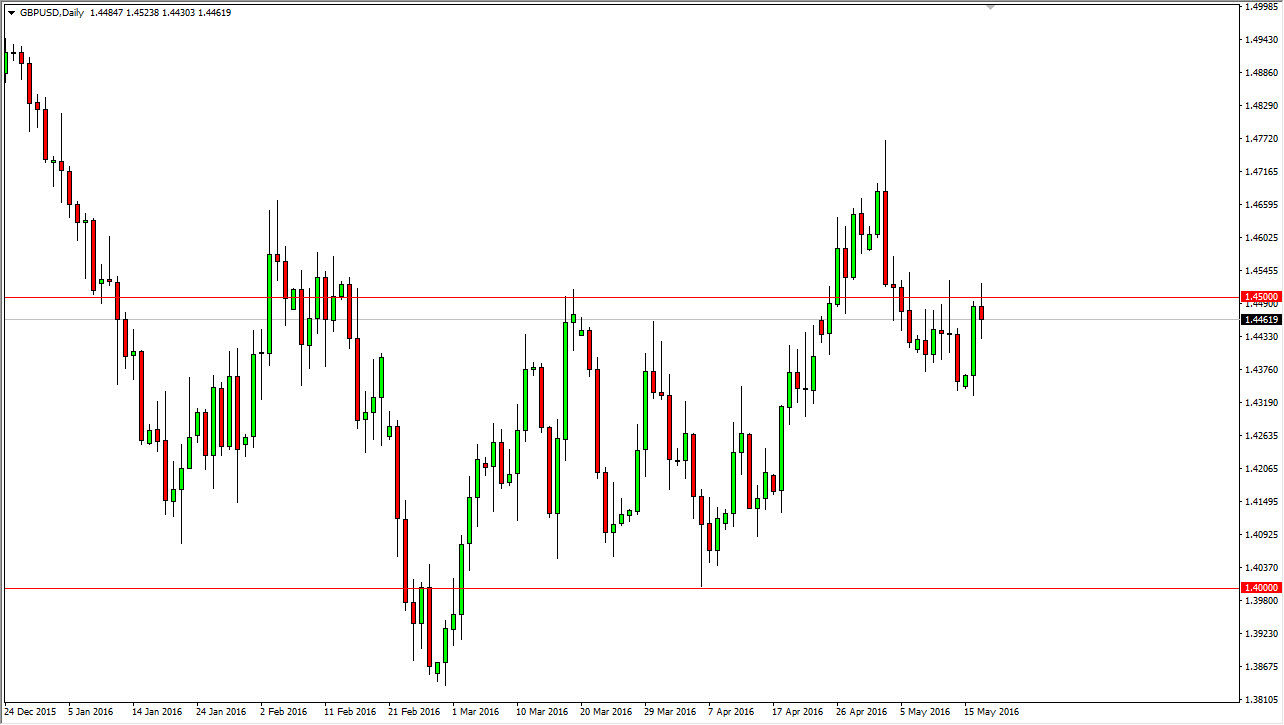

GBP/USD

The British pound broke above the 1.45 level during the course of the session on Wednesday, which of course was a psychologically significant barrier. More importantly though in my opinion is that we have broken above the top of the shooting star from Tuesday. Anytime you break above the top of the shooting star, it shows that momentum is starting to shift to the upside as we have not only seen a significant pushback by the sellers, but they have been blown past and we continue to go higher. We didn’t quite close of the top of the range, but close enough to make me interested in going long on short-term pullbacks.

Going forward, I anticipate that there will be a significant amount of resistance near the 1.48 level, which was the most recent high previous to the current trading action that we are now starting to see. I believe that we will probably not only touched that area, but perhaps try to break above it and reach towards the 1.50 level.