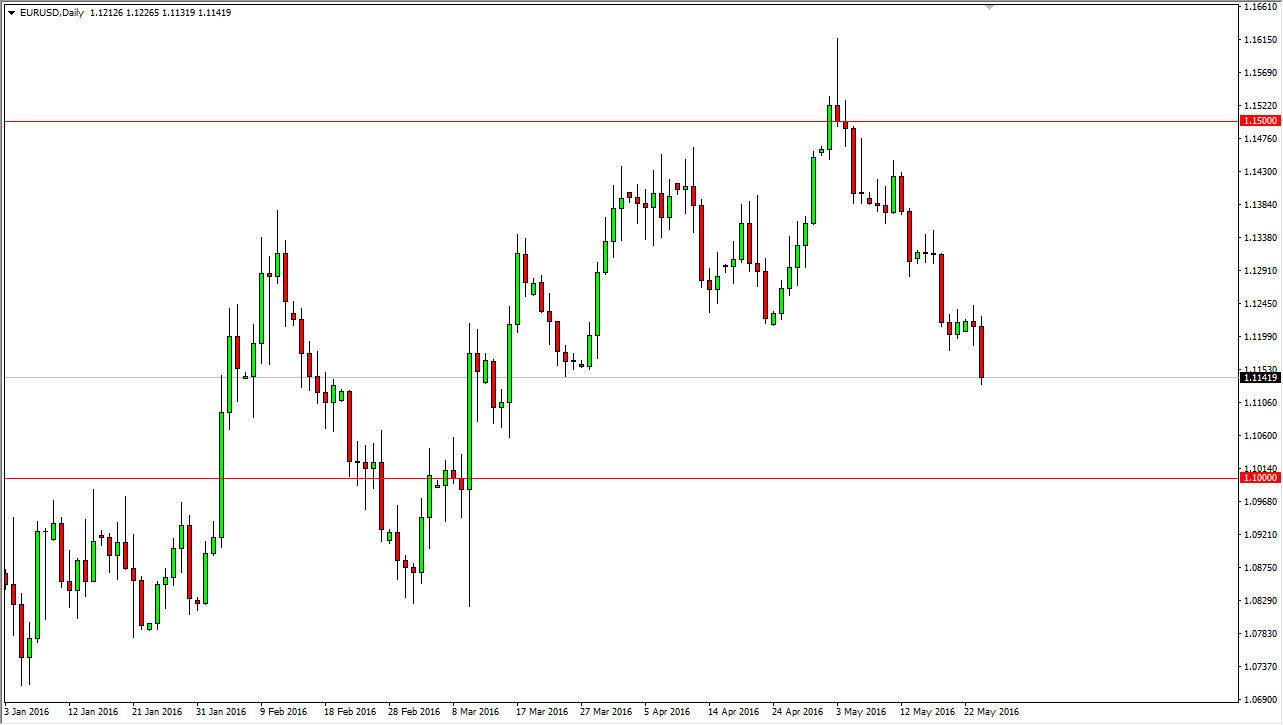

EUR/USD

The EUR/USD pair fell significantly during the course of the day on Tuesday, breaking below the 1.12 handle. Because of this, looks like we are going to continue going lower, perhaps try to reach towards the 1.10 level. At this point in time I think that any short-term rally will more than likely find enough resistance to turn the market back around and therefore I am looking for exhaustive candles on short-term charts in order to get involved. If we break down below the bottom of the candle during the course of the session on Tuesday, it’s likely that the market will sell off as well. It is not until we break above the 1.1250 level that I feel that this market can be bought as it would show a break above the consolidation area just beyond the market’s reach at the moment.

GBP/USD

The GBP/USD pair rallied during the course of the day on Tuesday, breaking above the top of the shooting star from the Monday session. That being the case, the market looks as if it is ready to go higher, and the fact that we close towards the top of this large candle suggests that we are going to continue to go even higher. However, there is a shooting star from a handful of sessions ago that we are just below the top of. If we can break the top of that shooting star, the market should very well then go to the 1.48 handle.

If we pullback from here, I think that the 1.45 level will continue to be supportive, and a supportive candle in that general vicinity we also be a buying opportunity. If we can break above the 1.48 level, I think the market could then go to the 1.50 level over the longer term as it is a large, round, psychologically significant number on the longer-term charts.