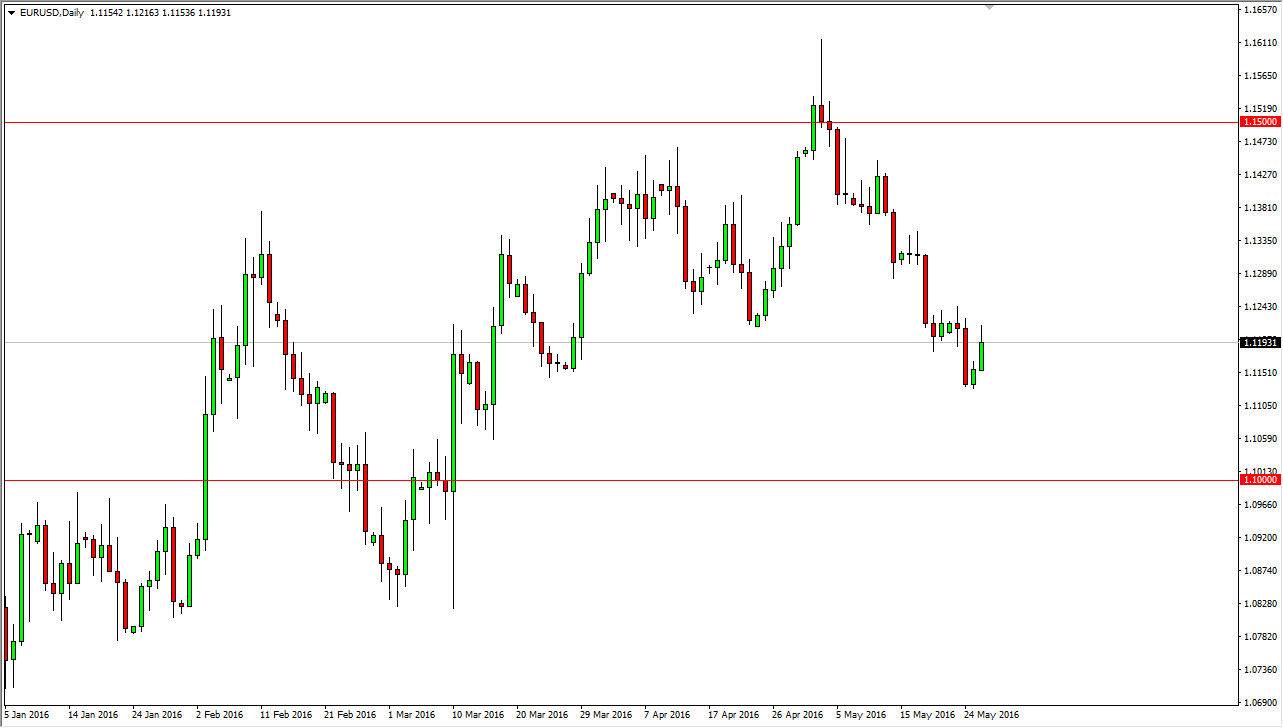

EUR/USD

The EUR/USD pair rose during the course of the day on Thursday, testing the 1.1250 level for resistance. You can see that the area had caused quite a bit of choppiness over the last several sessions. With this being the case, it’s not until we break above the 1.1250 level that I can consider buying. I think this is a market that will remain a short-term trader’s type of situation, and a short-term exhaustive candle could be reason enough to short this market for a small move lower. I think eventually we could go down to the 1.10 level, which is the bottom of the overall consolidation. On the other hand, if we can break above the 1.1250 level, we could then go to the 1.1350 level. Either way, I think that this market is going to be very volatile and choppy.

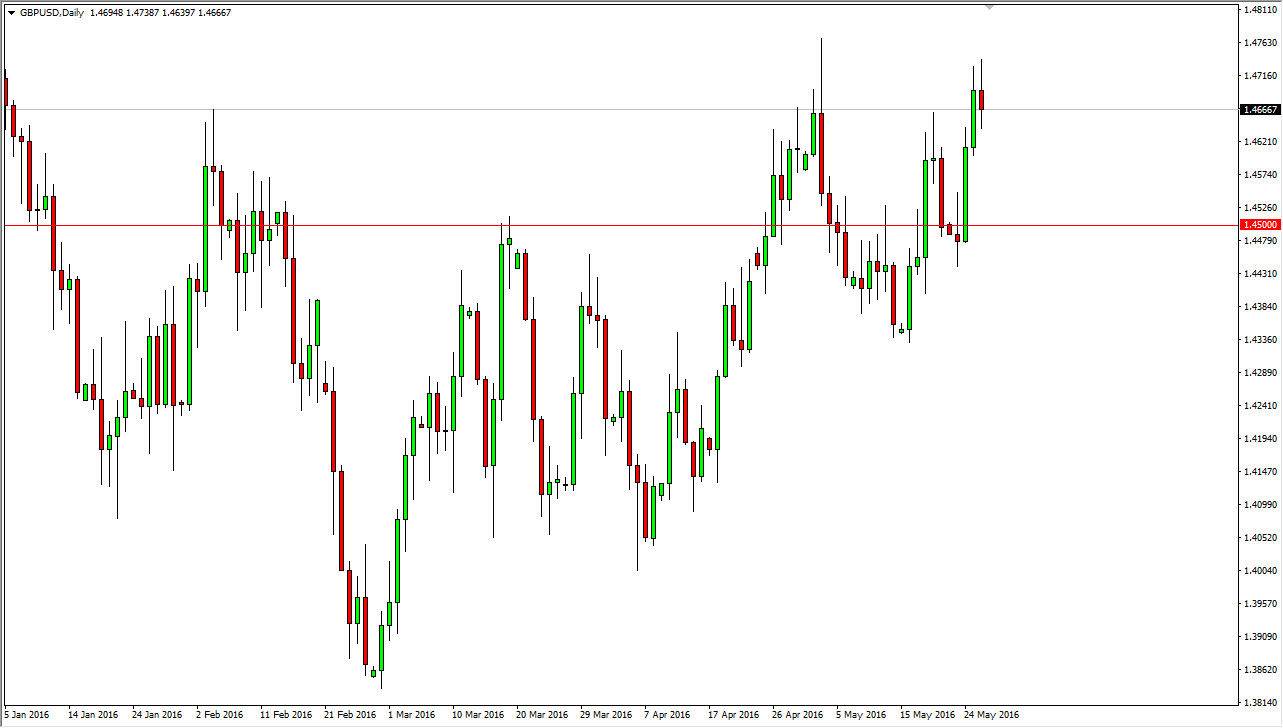

GBP/USD

The GBP/USD pair went back and forth during the course of the session on Thursday, as it shows quite a bit of hesitation to continue to go higher. If we break down below the bottom of the candle for the Thursday session, it is very likely that the market could reach down towards the 1.45 level. The 1.45 level below is massively supportive in my estimation, so having said that any fall from this level will be a short-term selling opportunity. A supportive candle below would be reason enough to go long again, just as a break above the top of the range for the session on Thursday would be. Either way, it’s going to be very volatile so I suspect that you’re going to have to be of the deal with quite a bit of back and forth action, regardless of where we go, up or down.

If we do break out to the upside, I suspect that the 1.48 level will allow the market then reach towards the 1.50 level given enough time. Ultimately, I think longer-term we go higher, but at this point in time we may have to pull back.