EUR/USD

The EUR/USD pair initially tried to rally during the day on Wednesday but found the area above the 1.15 level to be far too resistive. By doing so, we ended up turning back around and forming a bit of a shooting star, which of course was preceded by a shooting star on Tuesday. Because of that, the market looks as if it is ready to pull back, but that more than likely would just be a buying opportunity in my opinion. After all, we did break significantly above the 1.15 level, and touched to the 1.16 level couple of sessions ago. I think that we have broken through some stop losses, and now will drop lower in order to pick up more buyers so of the momentum to continue to the upside.

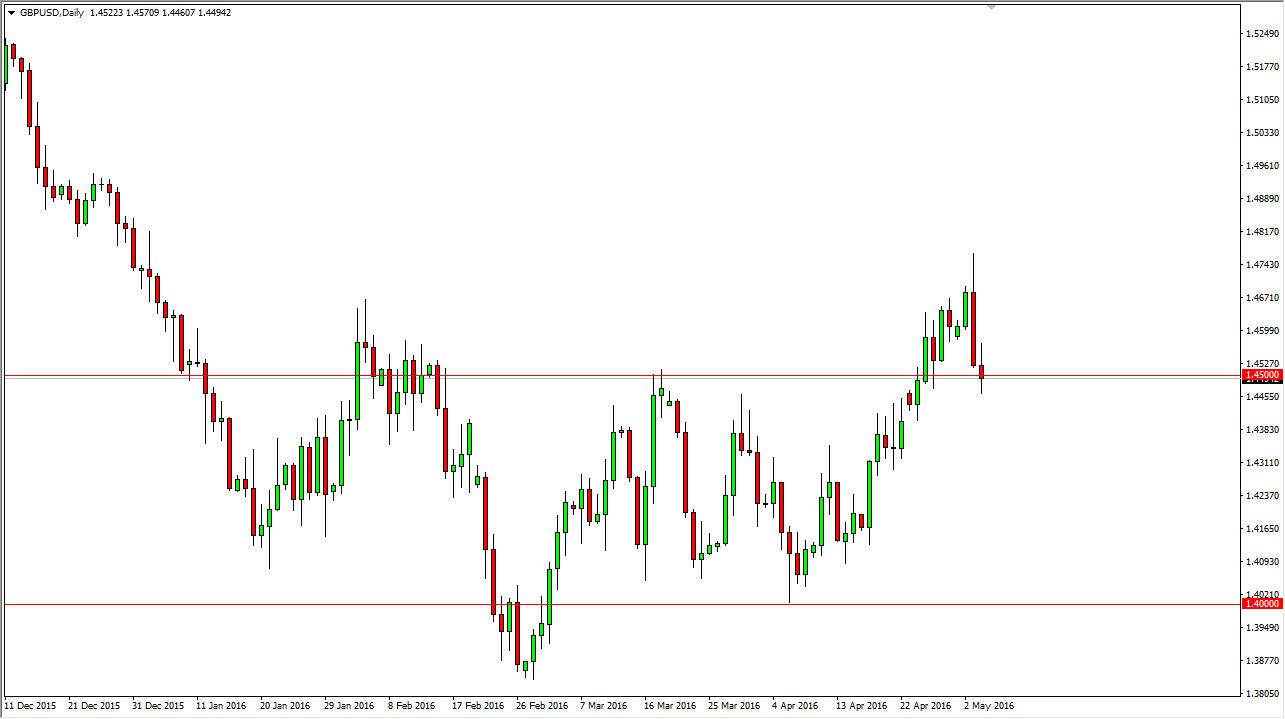

GBP/USD

The GBP/USD pair initially rallied during the session on Wednesday, bouncing off of the 1.45 level. However, we ended up turning right back around and breaking below that level, and found the buyers there as well. Ultimately, we ended up forming a neutral candle with a red body, which suggests that we are ready to do anything major, but we do have a bit of negative bias in this market.

For the longest time, the British pound was being punished for the idea of the United Kingdom leaving the European Union, or at least the possibility of it. Because of that, it’s likely that the selling is all but done at this point. After all, you have to ask questions sooner or later “who is left to sell?”

Because of this, looking for some type of supportive candle between here and the 1.44 level, which I see is the bottom of this support zone. On the other hand, if we can break above the top of the range for the session on Wednesday, I would also be a buyer there as it shows an increase in momentum.