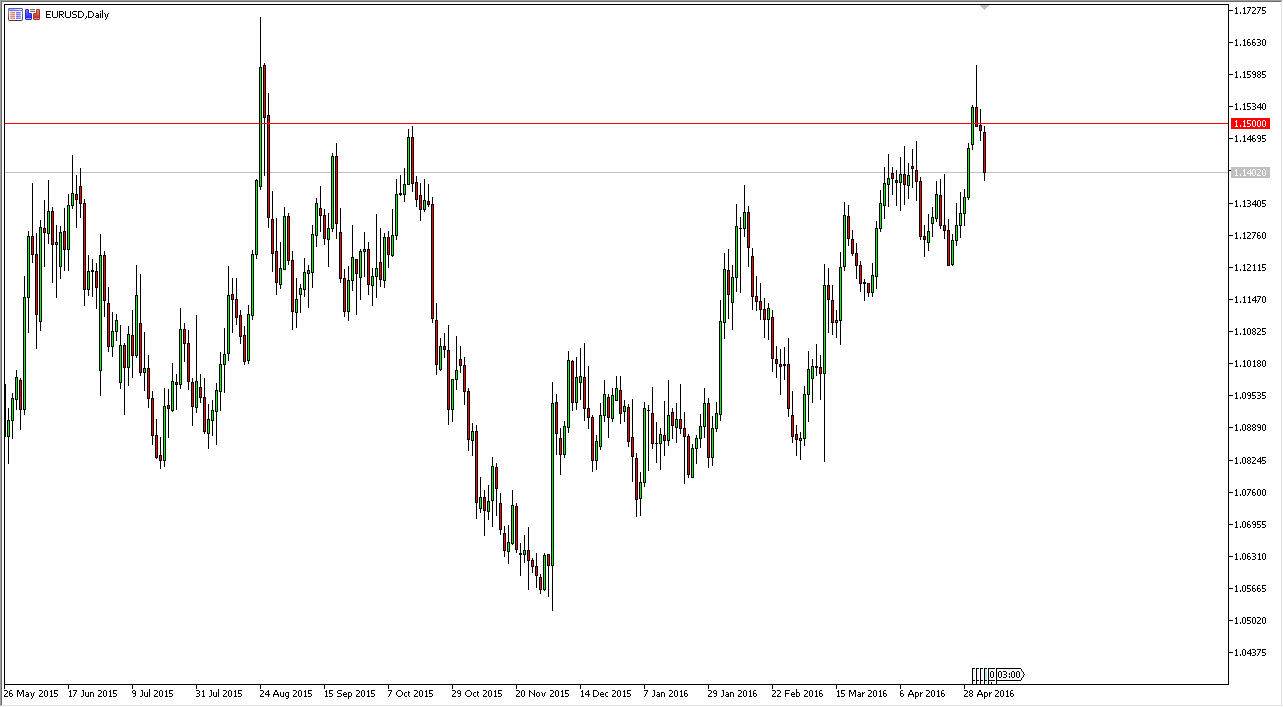

EUR/USD

The EUR/USD pair fell rather significantly during the course of the session on Thursday, crashing into the 1.14 handle. This was the bottom of the previous resistance barrier that we have just recently broke above. The shooting star during the day on Tuesday just above the 1.15 level is a bearish sign, but we do have quite a bit of bullish pressure underneath. Also, you have to keep in mind that today is Nonfarm Payroll Friday, so that of course will throw quite a bit of volatility into this market. I believe at this point though, there is still quite a bit of support below so I am waiting to see whether we get a bounce or a supportive candle in order to start going long. Once we do, I will not hesitate to do so but I do recognize that it is probably going to be a real fight.

GBP/USD

The British pound did very little during the day on Thursday, as we continue to bounce around just below the 1.45 level. The level offered a bit of resistance, and it looks as if we are going to continue see it here. This being the case, I would anticipate that we are going to have quite a bit of volatility today, especially considering that we have the Nonfarm Payroll Announcement. Because of this, it could very well be a very quiet session during the day until we get that announcement, so therefore it will more than likely be a knee-jerk reaction that we get, and that means that it will be a bit difficult to trade. Because of this, I am going to wait until we get a daily close in order to place my position on. One thing that I would bring to your attention is that we recently pulled back from the 200 day exponential moving average, so it is worth paying attention to. Perhaps we are going to break down, but at this point in time we will have to get through the Friday session in order to make that decision.