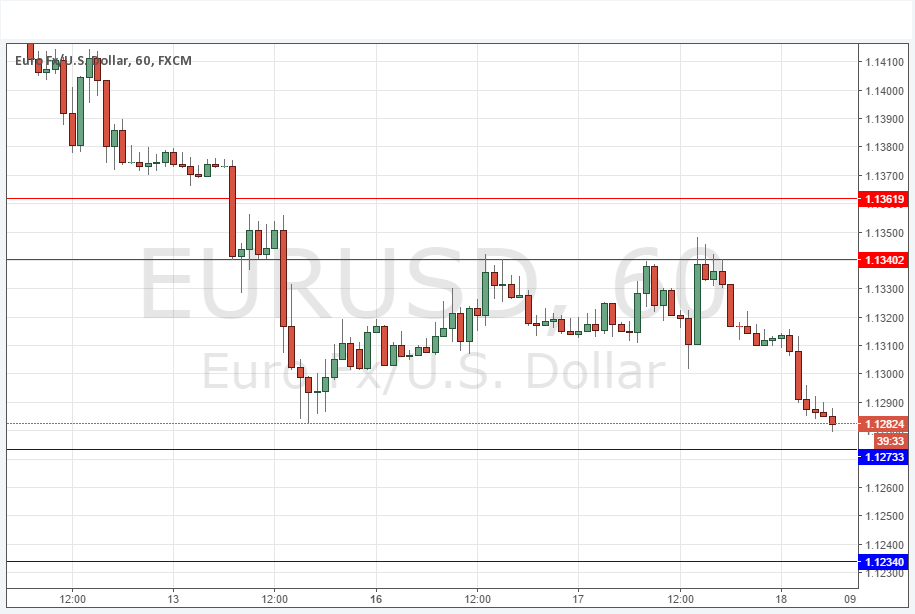

EUR/USD Signal Update

Yesterday’s signals gave a profitable short trade following the rejection of the resistance level at 1.1340. As the price at the time of writing is at a key previous swing low and also close to a key support level, it would make sense to take some more profit on any open trade from there.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be taken before 5pm London time today only.

Long Trades

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1273 or 1.1234.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Move 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Short Trades

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1340 or 1.1362

Put the stop loss 1 pip above the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

The action over the previous day has been bearish, although we are now close to a key support level. The USD has been strengthening ahead of the FOMC Meeting Minutes due later today. It would be logical to assume that the key support at 1.1273 will hold at least until the time of that release, unless the market is gripped by a strong rumour about the contents beforehand.

There are no high-impact events due today concerning the EUR. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm London time, followed later at 7pm by the FOMC Meeting Minutes.