EUR/USD Signal Update

Yesterday’s signals were not triggered as there was no appropriate price action at any key level.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be entered before 5pm London time today.

Long Trades

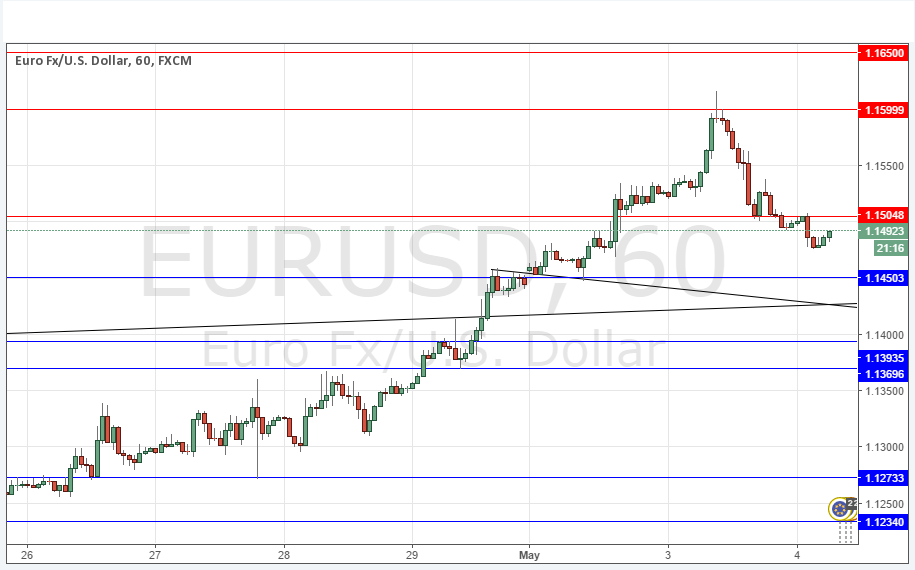

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1450.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Short Trades

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1505, 1.1600 or 1.1650.

Place the stop loss 1 pip above the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

Yesterday was a strange day as there was a sudden and very strong reversal of fortune for the U.S. Dollar that didn’t seem to have been triggered by anything at all. After rising very strongly and even briefly getting above 1.1600, the pair then fell just as strongly, although it may have bottomed out in late Asian session trading below 1.1500. These strong moves have invalidated key support and resistance levels, and suggested that new ones have been formed.

It can be dangerous to trade in such an unsettled environment so it might pay to be very careful. It looks as if the round numbers could be good resistance, which 1.1450 looks as if it remains good flipped resistance to support.

There are no high-impact events due today concerning the EUR. Regarding the USD, there will be a release of the ADP Non-Farm Employment Change at 1:15pm London time, followed by the ISM Non-Manufacturing PMI data at 3pm and Crude Oil Inventories at 3:30pm.