The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 15th May 2016

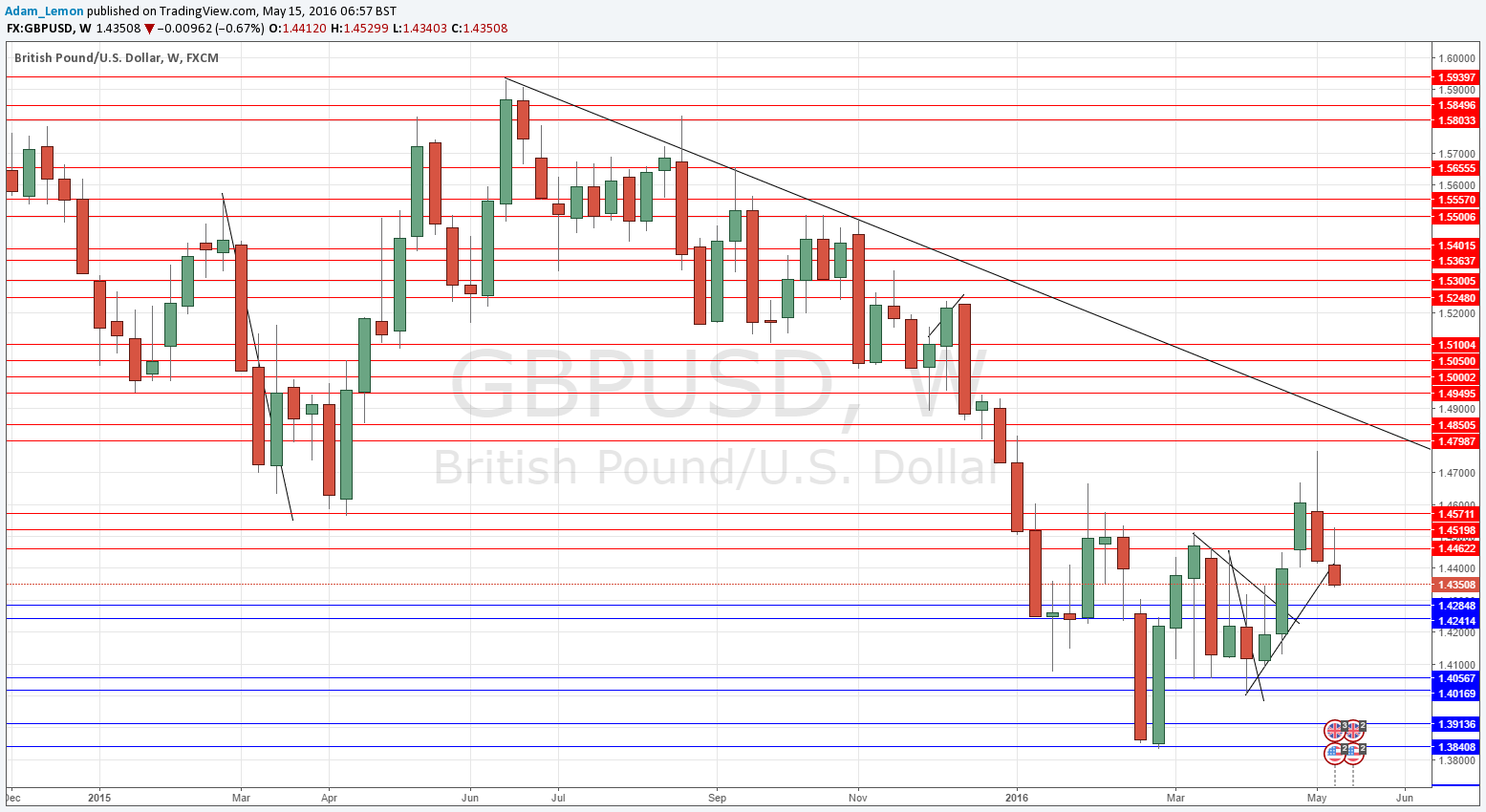

Last week I highlighted short GBP/USD as the best possible trade. This pair did indeed fall by 0.50% during this past week.

This week is again a difficult prediction as sentiment is currently mostly against long-term trends but the FOMC are releasing a statement. I still see short GBP/USD as the best possible trade.

Fundamental Analysis & Market Sentiment

Fundamental analysis is becoming less useful in Forex markets at the moment. Sentiment has been much more of a driver.

The U.S. Dollar has been the strongest currency this week, moving against its longer-term trend of weakness. Sentiment has turned bullish on the U.S. Dollar as two members of the Federal Reserve spoke out in favor of a rate hike next month, and Retail Sales data was stronger than expected.

The British Pound is affected by fears that the referendum due next month on a possible exit from the European Union may result in a vote to leave. Recent polls are showing voting intentions more or less equal.

Technical Analysis

USDX

The U.S. Dollar Index rose again last week, printing a strongly bullish candle as part of a movement rejecting into a key support zone between 11800 and 11600. However, it closed at a price lower than the prices from both three months and six months ago, indicating the greenback remains in a downwards trend. Nevertheless the chart suggests some continuing short-term strength in the U.S. Dollar.

GBP/USD

This pair has printed another very bearish candle over the past week, and the GBP is the only currency in a long-term bearish trend against the U.S. Dollar, closing at levels below 3 months and 6 months ago. The weekly candle has a large upper wick, breaking below a key short-term supportive trend line. It looks as if there is going to be some follow-through, with a further downwards move most likely over the coming week.

Conclusion

The market is currently driven by bullish sentiment on the USD, although the FOMC release due on Wednesday could change this sentiment completely. Therefore although the USD is in a long-term bearish trend, I see the best odds over the coming week in trading in favor of the USD, using the GBP as the obviously bearish currency as counterparty.