The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 1st May 2016

Last week I highlighted long AUD/USD and short USD/CAD as the best possible trades for this week. Unfortunately, each pair moved in the opposite direction by an average of 0.24% during this past week.

This week I see long EUR/USD and short USD/CAD and USD/JPY as the best possible trades.

Fundamental Analysis & Market Sentiment

Fundamental analysis is becoming less useful in Forex markets at the moment. Sentiment has been more of a driver.

The weakness of the U.S. Dollar is not really supported by economic data, but is rather a product of sentiment that the Federal Reserve is going to take a more cautious approach regarding any forthcoming rate rises.

The Canadian Dollar continues to strengthen on the back of the continuing recovery in the price of Crude Oil, as Canada is a major oil exporter.

Eurozone data has been improving somewhat.

The Japanese Yen is seen stronger as the Bank of Japan has signaled there will be no further stimulus measures in the near future, which would be seen by the market as a debasement of the currency, hence sentiment sees the Yen stronger.

Technical Analysis

USDX

The U.S. Dollar Index fell last week, printing a strongly bearish outside candle plunging into a key support zone between 11800 and 11600. Again, it closed at a price lower than the prices from both three months and six months ago, suggesting the greenback is in a downwards trend. This indicates that the best trend trades are likely to be against the U.S. Dollar in the near future. However the Index may find support at 11600, but the price action looks very bearish.

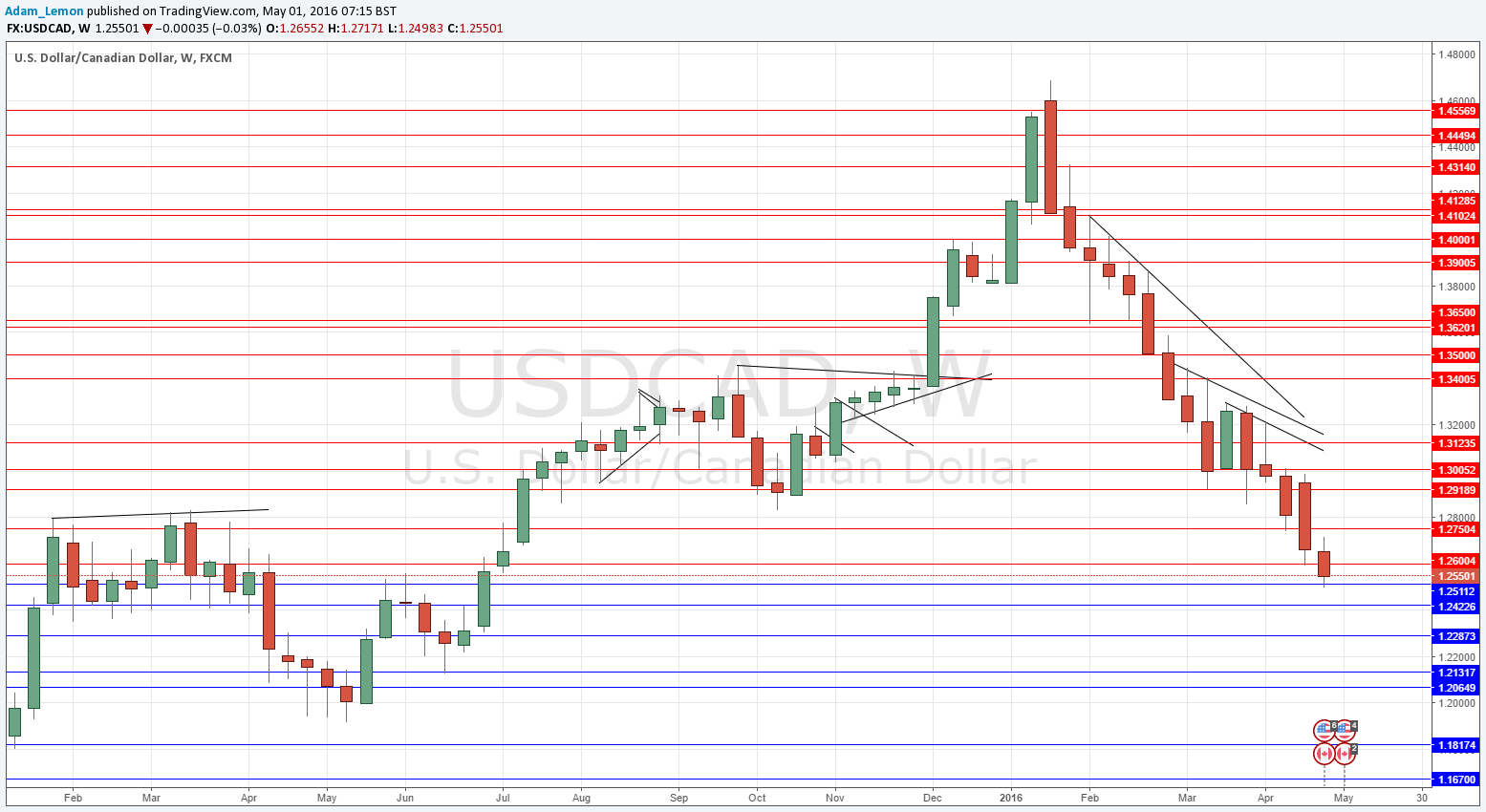

USD/CAD

This pair has continued falling very strongly, with only one week closing up in all the previous 15 weeks. The support at 1.2592 broke last week and has now been flipped to resistance at 1.2600. Below there is be support close to the key psychological level of 1.2500.

EUR/USD

This pair has been consolidating bullishly for a long time, as can be seen in the weekly chart below. Recent weeks have been significant as there have been a few closes above 1.1300, and it seems now that the price is really starting to break above and challenge an area that has acted as effective resistance for a long time. This suggests that the price is heading up to the 1.1600 area at least and the trend is definitely bullish.

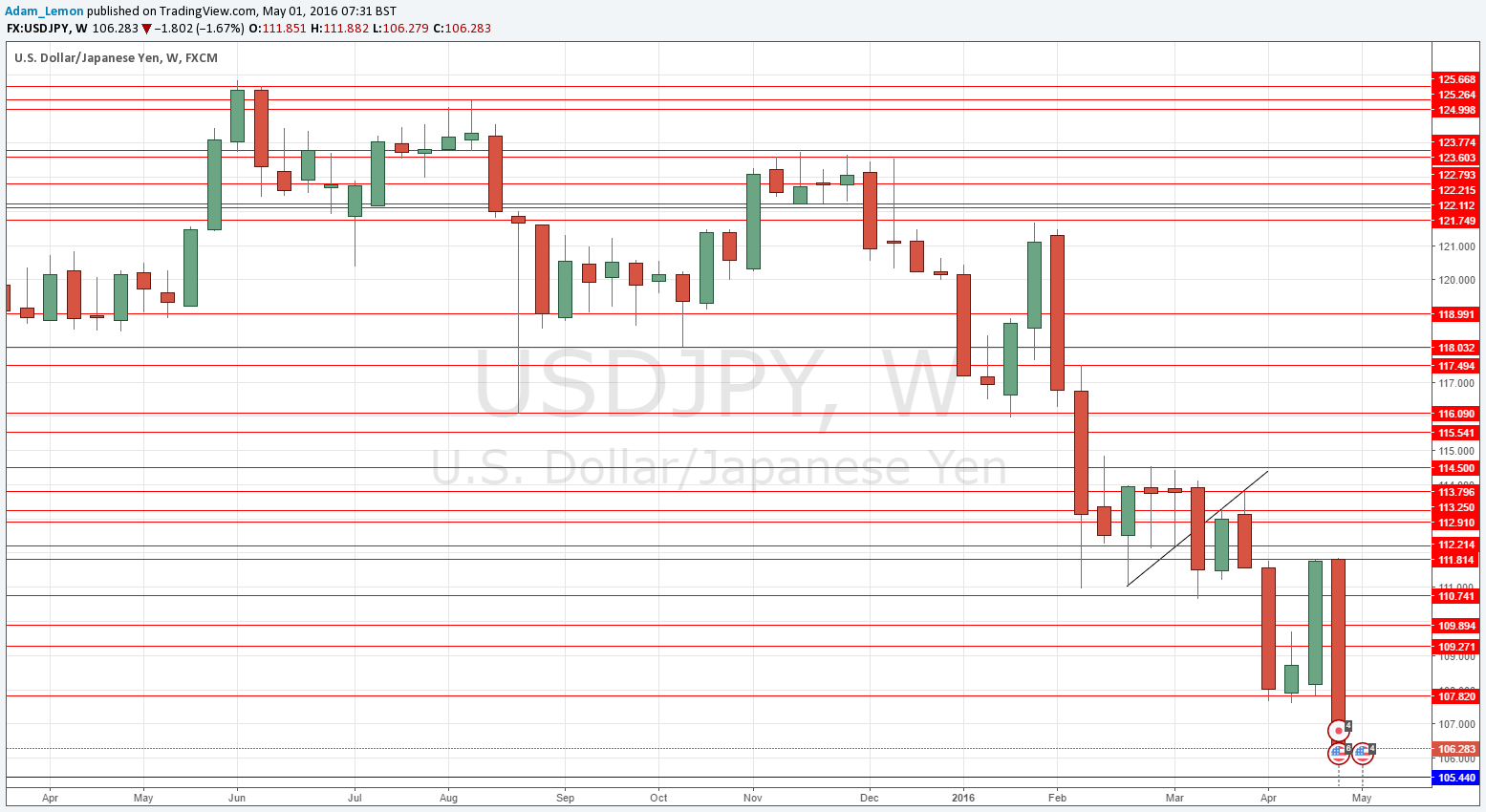

USD/JPY

We have a very strong trend here, as can be seen in the weekly chart below. The pair fell very sharply last week, by almost 5% in value, which is an unusually strong magnitude. It looks like there is a lot of bearish momentum here and there is no obvious support before 105.44. The pair is now making fresh 18 month lows.