The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 8th May 2016

Last week I highlighted long EUR/USD and short USD/CAD and USD/JPY as the best possible trades. Unfortunately, each pair moved in the opposite direction by an average of 1.34% during this past week.

This week is a difficult prediction as sentiment is currently mostly against long-term trends. I see short GBP/USD as the best possible trade.

Fundamental Analysis & Market Sentiment

Fundamental analysis is becoming less useful in Forex markets at the moment. Sentiment has been much more of a driver.

The U.S. Dollar has been the strongest currency this week, moving against its longer-term trend of weakness. Sentiment has turned bullish on the U.S. Dollar as two members of the Federal Reserve spoke out in favor of a rate hike next month, which has led the market to believe such a rate hike is now more likely.

The Australian Dollar is seen as much weaker following a rate cut by a quarter point by the Reserve Bank of Australia and a fairly dovish monthly report.

Technical Analysis

USDX

The U.S. Dollar Index rose last week, printing a strongly bullish candle rejecting into a key support zone between 11800 and 11600. However, it closed at a price lower than the prices from both three months and six months ago, suggesting the greenback remains in a downwards trend. Nevertheless the chart suggests some continuing short-term strength in the U.S. Dollar.

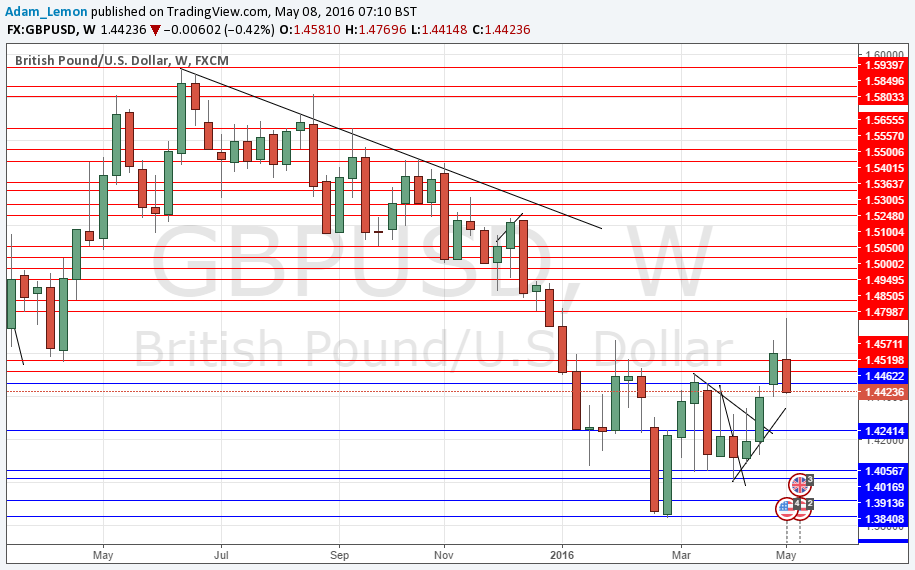

GBP/USD

This pair has turned around quite convincingly over the past week, and the GBP is the only currency in a long-term bearish trend against the U.S. Dollar, closing at levels below 3 months and 6 months ago. The weekly candle has a large upper wick, rejecting the key psychological level of 1.4750, and it is almost a bearish outside candle. It looks as if there is going to be some follow-through, with a further downwards move most likely over the coming week.

Conclusion

The market is currently driven by bullish sentiment on the USD and I do not see any obvious event scheduled over the coming week that is very likely to change this. Therefore although the USD is in a long-term bearish trend, I see the best odds over the coming week in trading in favor of the USD, using the GBP as the obviously bearish currency as counterparty.