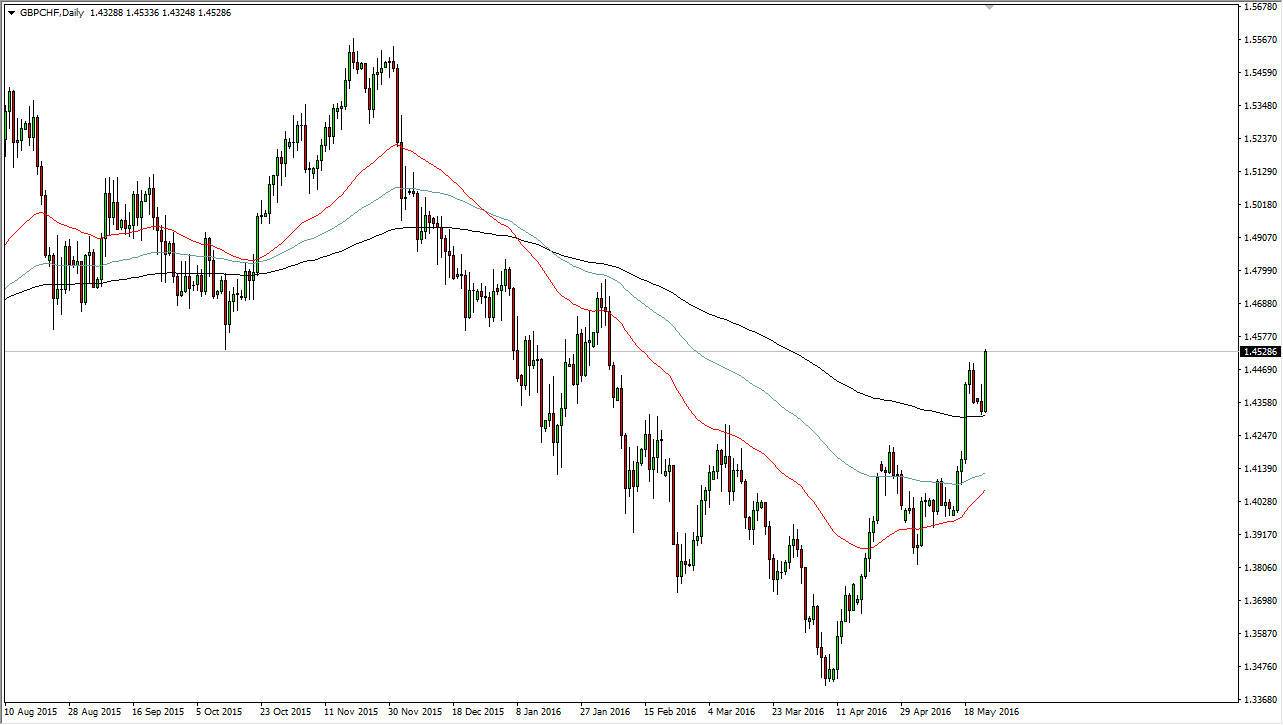

The GBP/CHF pair rallied significantly during the course of the session on Tuesday, showing real strength as we ended up forming a very large green candle. This of course is a very strong sign, and as a result it looks as if we are going to continue to go higher. What I find particularly interesting about this pair is that not only do we form a candle, but we broke above the top of the shooting star from the previous session. Any time we break above the top of the shooting star, that shows that the sellers are starting to run out of strength. That being the case, it’s likely that the market is ready to continue going higher. The market should continue to attract buyers on short-term pullbacks as there is more than enough interest in this market to continue to push it higher.

200 day moving average

The 200 day moving average on the chart is in sight, and you can see that we bounced directly off of that. With that being the case, it looks as if the momentum is starting to shift to the upside as long-term traders typically use the 200 day exponential moving average as a longer-term trend signal. If we can break above the top of the 200 day moving average, the theory is that we are starting to switch to the upside. We have definitely done that now, and as you look at the chart you will notice that the red 50 day moving average is about to cross over the blue-green 100 day moving average. That would be the first confirmation of this move higher, and as a result more and more traders will more than likely get involved.

Because of this, I believe that we are starting a longer-term “buy-and-hold” type of situation, but this pair does tend to be very volatile. Because of that, it’s likely that there will be opportunities to go long again and again, but I certainly have no interest in selling.