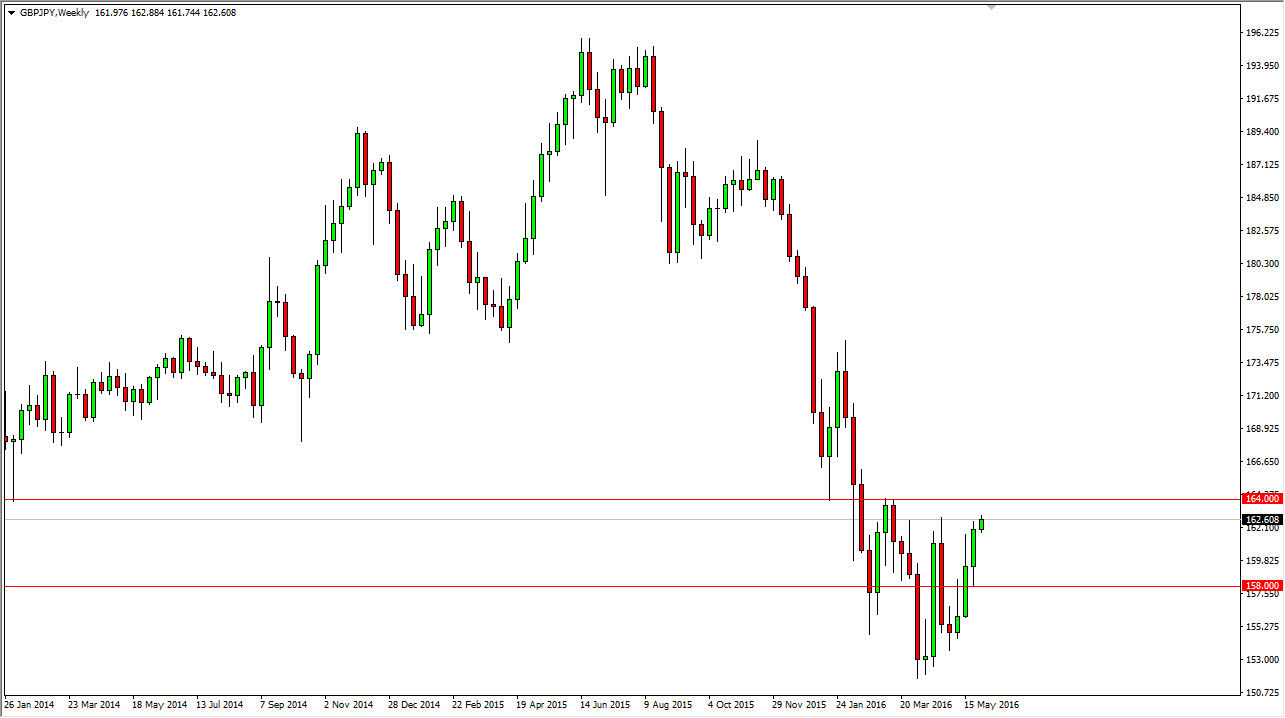

The GBP/JPY pair rose during the course of the last several weeks, and has exploded above the 158 level which had been so resistive in the past. However, on the chart you can see that the 164 level has offered resistance in the past. It is because of this that I need to see a move above that level in order to believe that the market has the ability to change the trend overall. Ultimately, it will be interesting to see what happens at the 164 level, and with that being the case this could be one of the most important months when it comes to the GBP/JPY pair for the longer term.

Highly volatile

This is a market that will be highly volatile regardless, because it always is. I believe that an exhaustive weekly candle near the 164 level would be reason enough to start selling, because quite frankly if we break above there it is a very strong sign of bullish pressure. That strong sign of bullish pressure would be of the longer term variety, so any loss that I take based upon trained to sell this market would be miniscule compared to what I would be aiming for as the market could then reach towards the 175 level, perhaps even the 185 level given enough time. Ranted, I don’t necessarily think that it will all happen during the month of June, just that we would be in a multi month move in my estimation.

If we do pullback though, I believe that the 158 level will of course be very supportive, and with that being the case we would have plenty of room to the downside to start selling for the foreseeable future, and as a result I think that this could be one of the more interesting pairs to trade during the month of June, and you also have to keep in mind that June tends to be a little less liquid than the rest of the months of the year, so we could get quick moves.