GBP/USD Signals Update

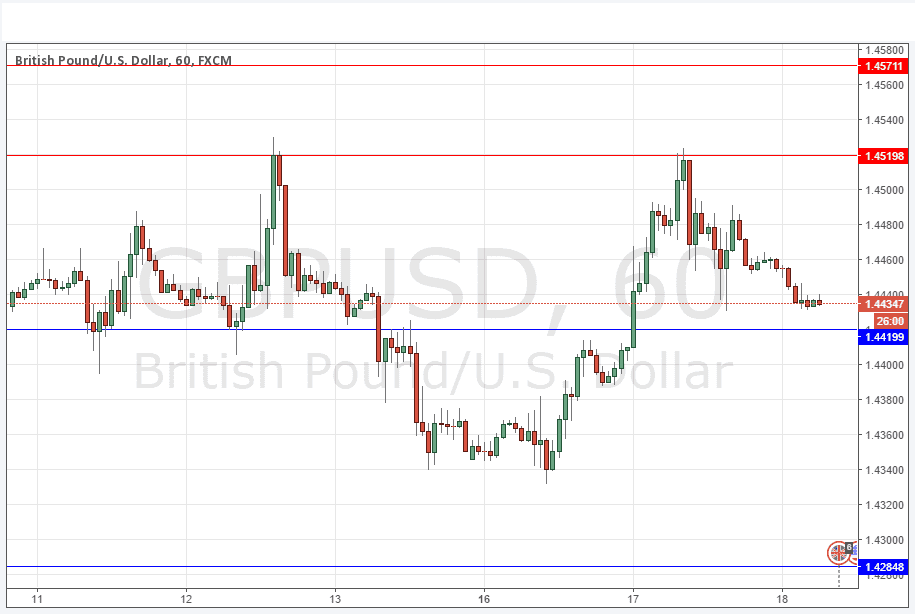

Yesterday’s signals gave a profitable short trade following the rejection of the resistance level at 1.4520. As the price at the time of writing is at a key previous swing low and also close to a key support level, it would make sense to take some more profit on any open trade from there.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered before 5pm London time today.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4420.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Short Trades

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4520, or 1.4571.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

One day ago the downwards trend was in question, but the USD has reasserted itself with the resistance level at 1.4520 holding very cleanly, and giving a great opportunity for a short trade. We are now close to key support at 1.4420 which may be a significant level, and it might well hold as we now approach the FOMC release due later today. However there is some news due for the GBP during the early part of the London session that could push the price beyond there.

If the USD continues to strengthen, this is likely to be a good pair to use to take advantage of that, as the GBP is relatively weak.

Concerning the GBP, there will be a release of Average Earnings Index and Claimant Count Change data at 9:30am London time. Regarding the USD, there will be a release of Crude Oil Inventories data at 3:30pm, followed later at 7pm by the FOMC Meeting Minutes.