GBP/USD Signals Update

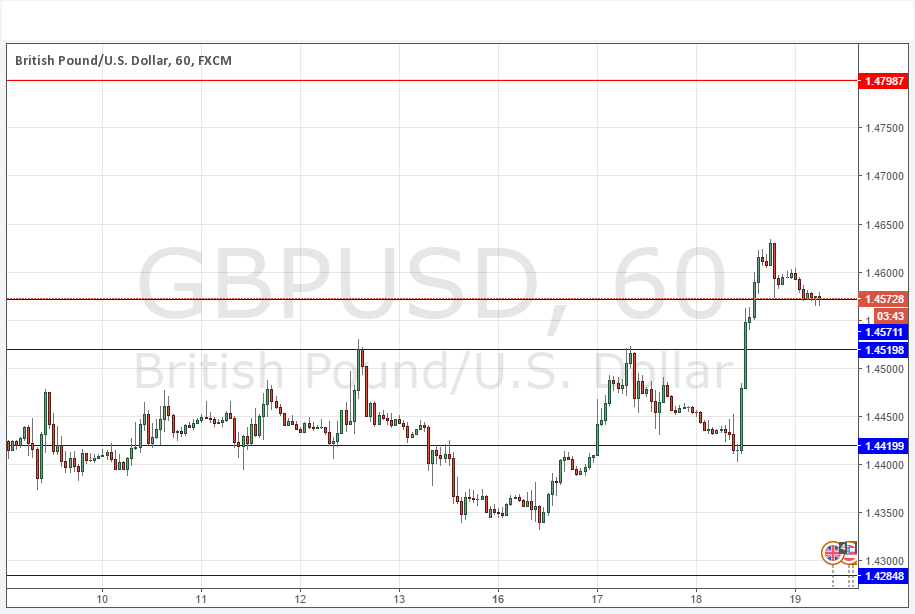

Yesterday’s signals were technically not triggered, although my identification of support at 1.4420 was just a few pips from the launching of the extremely strong upwards move that we saw in this pair yesterday.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today only.

Long Trades

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4570, 1.4521 or 1.4420.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4799.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

The price fell a little early during yesterday’s London session, before forming a pin/doji candle just around the anticipated support level, and beginning to turn around and rise. At this point a new opinion poll was released showing that British voters seemed much more likely to vote to remain within the European Union in next month’s schedule referendum. This sent the GBP shooting upwards against every other currency very strongly, so we had a very strong rise up past two former resistance levels, both of which now look to have become support.

Even though we have had a strong USD generally, and especially since last night’s FOMC release, the GBP is holding up well, so it would seem that this pair will be best placed to take advantage of any USD weakness that may emerge.

Concerning the GBP, there will be a release of Retail Sales data at 9:30am London time. Regarding the USD, there will be a release of Unemployment Claims and Philly Fed Manufacturing Index data at 1:30pm.