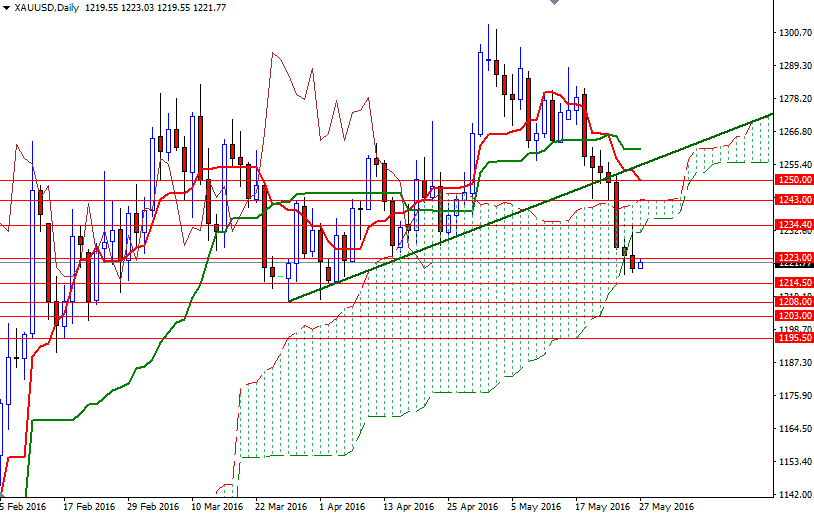

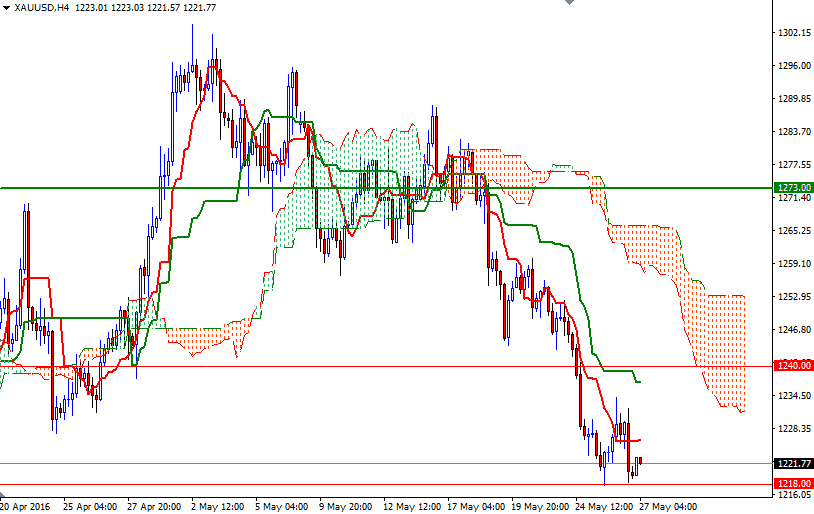

Gold prices ended Thursday's session down $4.36, to settle at $1219.66 an ounce as investors focused on positive economic data backed the case for the Federal Reserve to continue raising interest rates this year. The XAU/USD pair initially rose during yesterday's session but we encountered selling pressure at $1234.40 level where the daily and hourly Ichimoku clouds overlapped. Data from the Commerce Department showed that demand for durable goods increased 3.4% in April and the Labor Department reported that the number of Americans filing first-time claims for unemployment insurance payments decreased by 10K to 268K.

Attention will now turn to Fed Chair Janet Yellen, who is due to speak at an event hosted by the Harvard University. The XAU/USD pair is trying to hold above the 1218 level at the moment but lack of momentum and the fact that the market is trading below the Ichimoku could on the daily and 4-hour time frames makes me a bit skeptical. Down below, there are more significant supports such as 1213 and 1208 so unless the market breaks through 1226/3, prices may pay a visit to these levels before we see an upwards move.

If XAU/USD dips below the support level at 1208, then 1203 will probably be the next stop. A breakdown below that level could see a further fall the way down to 1194. On the other hand, if prices can confidently break above 1126/3, it is quite likely that the market will proceed to 1234.40-1231 area. The bulls will have to overcome this barrier in order to set sail for 1243/0.