Gold prices fell for a second day and settled at $1279.33 per ounce, losing $6.76, as the recent recovery in the US dollar lured some investors away from the market. In economic news on Wednesday, the Institute for Supply Management's non-manufacturing index came in at 55.7, up from the previous month's 54.5 and above expectations for a reading of 54.9. The Commerce Department reported that new orders for factory goods jumped 1.1% last month but ADP private jobs data fell short of market expectations.

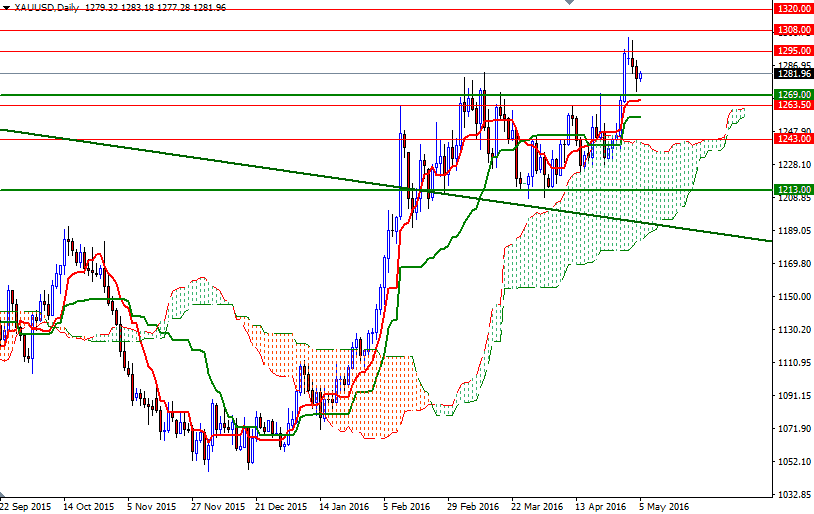

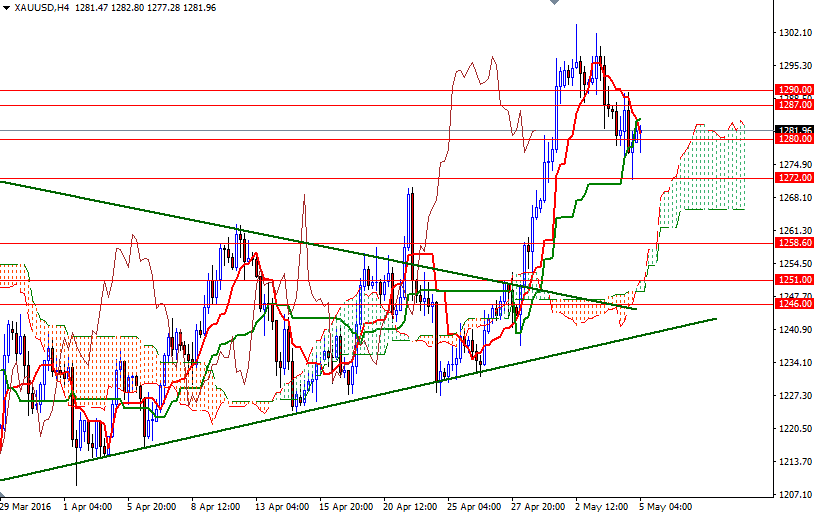

The XAU/USD pair initially tested the 1290/87 but failed to penetrate and as result headed back to 1272 after the 1280/78 support gave way. The market is likely to continue to benefit from the bullish medium-term outlook but keep in mind that short-term charts are still weak, with prices residing below the Ichimoku clouds on the 1-hour and 30-minute time frames.

The bulls have to defend their camp in the 1280/78 region and push prices beyond the 1290/87 resistance in order to gain more strength and proceed to 1297/5. Closing above 1297 on a daily basis would imply that the market will be aiming for 1308 afterwards. On the other hand, if the bulls run out of steam and prices drop through 1278, the market will probably head down to 1272/69. A break below 1269 would set the XAU/USD pair up for a test of the support at 1263.50.